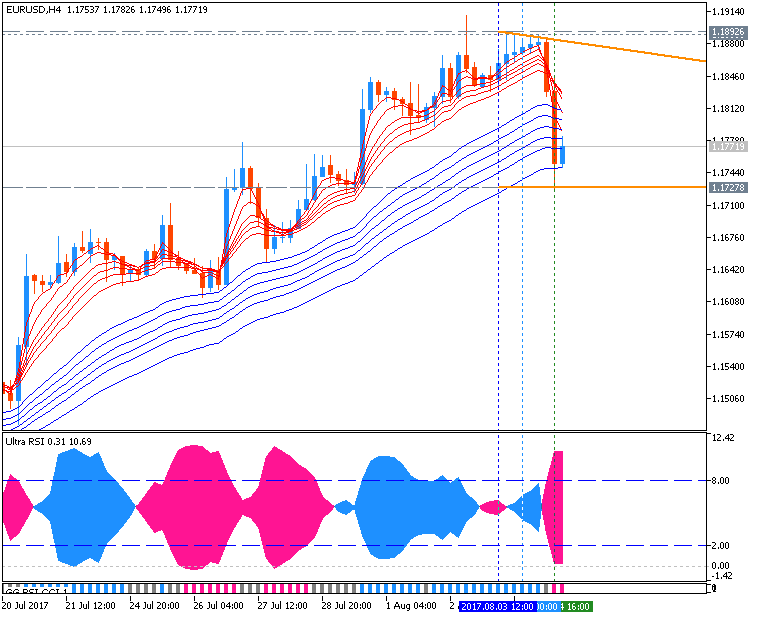

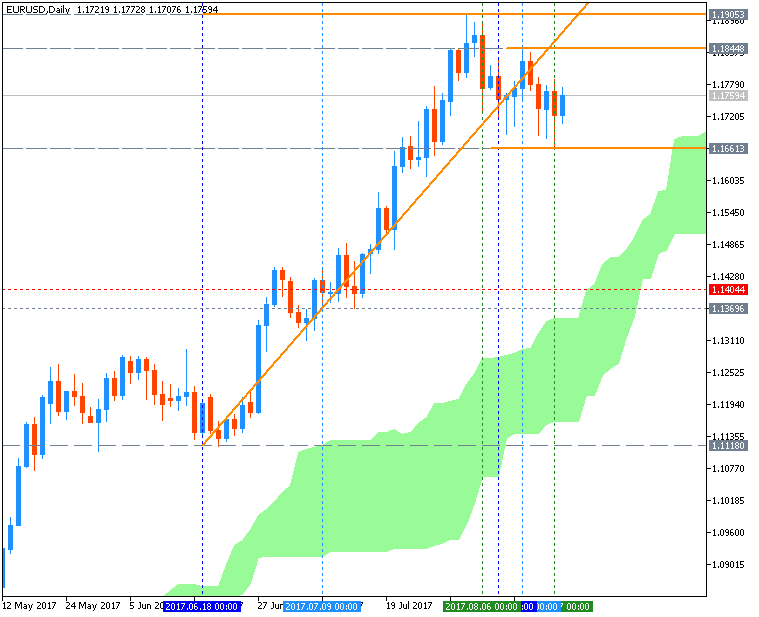

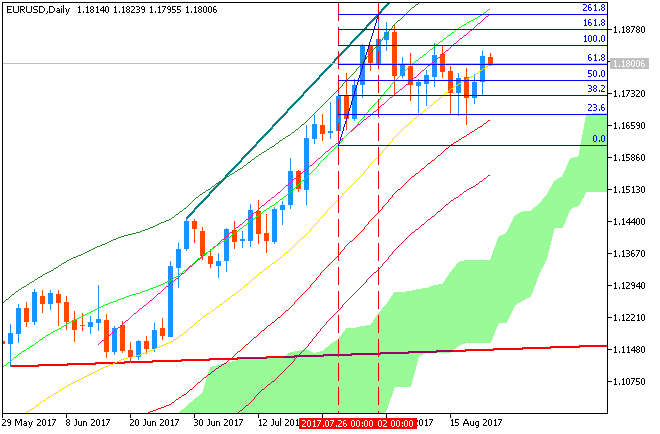

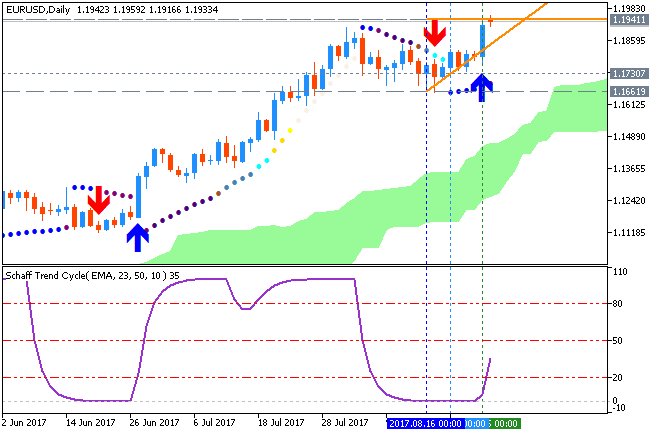

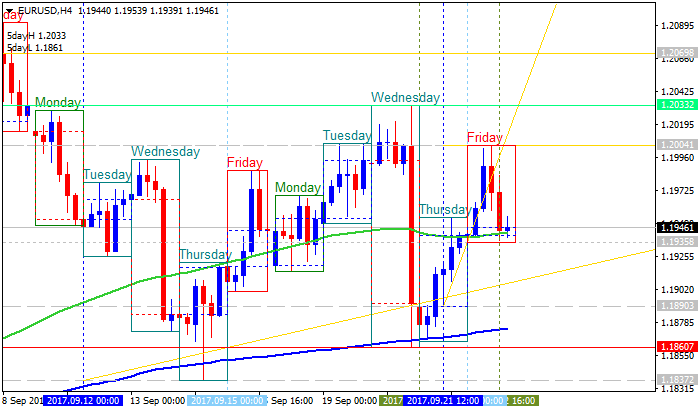

Last week, EURUSD started out on a strong note by briefly pushing through the 2010 low at 11876 on two different days, but each day it was unable to sustain above. Leading into the U.S. jobs report on Friday the euro was putting in a rising wedge on the 4-hr timeframe which provided a warning that we could soon see a downdraft if the underside of the pattern was broken. The all-around solid jobs report gave the US dollar a shot in the arm across the board.

Not only was the bearish rising wedge triggered, but for the first time since June we saw a lower-low develop on the 4-hr. This puts us on alert for a bearish sequence to begin developing marked by a failure to rally and develop a lower high and then subsequent lower lows. The first area to look for the euro to struggle is roughly where it closed the week near the vicinity of 11775/800, and even if it can rise above this first level of resistance if the trend is to turn lower it shouldn’t be able to gain traction above 11850.

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks