Talking Points:

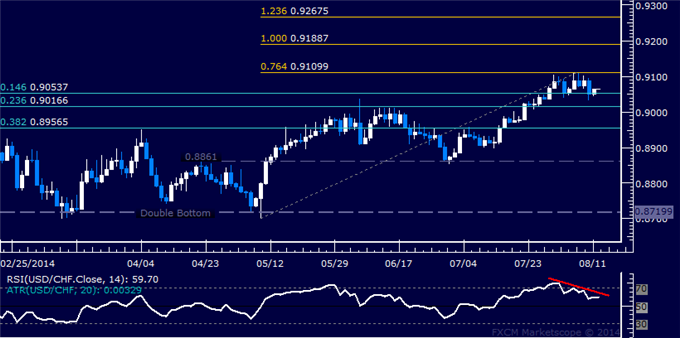

- USD/CHF Technical Strategy: Flat

- Support:0.9054, 0.9017, 0.8957

- Resistance: 0.9110, 0.9189, 0.9268

The US Dollar is digesting recent gains below the 0.91 figure against the Swiss Franc, with negative RSI divergence warning a corrective pullback may be ahead. Near-term support is at 0.9054, the 14.6% Fibonacci retracement. A break below that on a daily closing basis exposes the 23.6% level at 0.9017. Alternatively, a reversal above the 76.4% Fib expansion at 0.9110 clears the way for a challenge of the 100% threshold at 0.9189.

Risk/reward considerations argue against entering short with prices trading in close proximity to support. On the other hand, the absence of a defined bullish reversal signal suggests taking up the long side is premature. We will remain flat for now.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks