Are stock and forex markets interlinked?

THE recent appreciation of the rupee and the consequent swings in stock exchanges brings interesting observations for businesses and stockbrokers.

In volatile and less integrated financial markets in developing countries, the important question is: whether there exists a volatility transmission between the stock and foreign exchange markets.

This article aims at examining the dynamics of volatility transmission between the stock and foreign exchange markets in Pakistan, because the interdependence between exchange rates and stock prices has important implications.

For example, increase in stock prices would attract capital, which increases the demand for domestic currency and causes the exchange rate to appreciate.

In particular, this study addresses the nature of volatility spillover between the two markets with reference to Pakistan.

We use data that covers three important market events that influenced the dynamics of stock and foreign exchange markets: the nuclear tests of May 1998, the terrorist attacks of September 11, 2001, and the global financial crisis sparked by the US sub-prime market failure in the middle of 2007.

Such market events can influence the underlying dynamic relationship between the equity and forex markets. This study empirically examines the short-run dynamic relationship between stock prices and exchange rate, which is useful for financial managers in making informed investment decisions.

Like many other developing economies, Pakistan has gone through a series of institutional and financial reforms since 1990 to reduce financial imbalances, enhance efficiency and depth of financial markets, and modernise the domestic financial sector.

The liberalisation of stock markets resulted in a sharp increase in inflow of portfolio investment, which not only helped in raising the investable funds, but also produced wild swings in stock market indices.

Despite the ongoing political crisis and a credit rating downgrade by Moody’s, Pakistan stood out as the best performing Asian Market in July 2012, as measured by the Morgan Stanley Capital International (MSCI) index.

Similarly, the foreign exchange market has also showed a high degree of volatility since 1998. For example, the rupee depreciated against the dollar from Rs43.19 in 1998 to Rs61.41 in 2001-02, and to Rs94.10 a dollar in August 2012. Currently, the rupee-dollar parity stands at about 99.

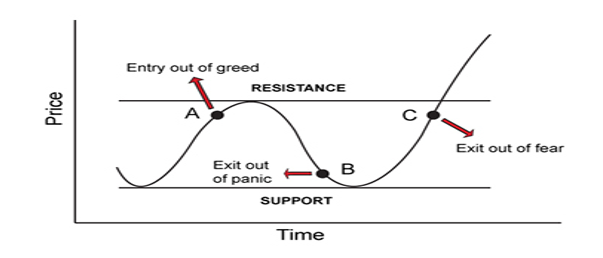

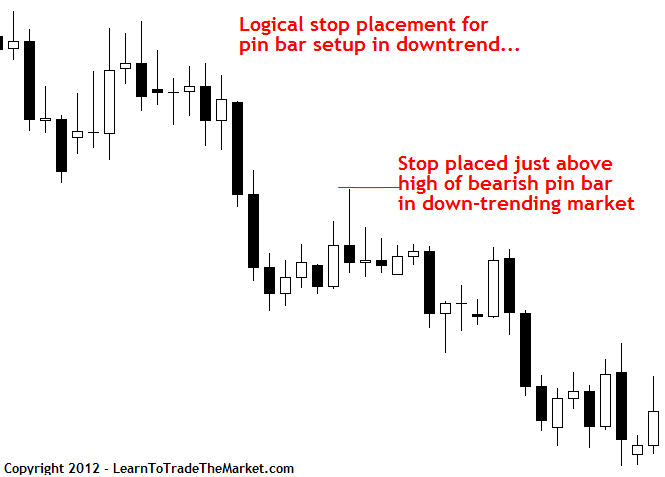

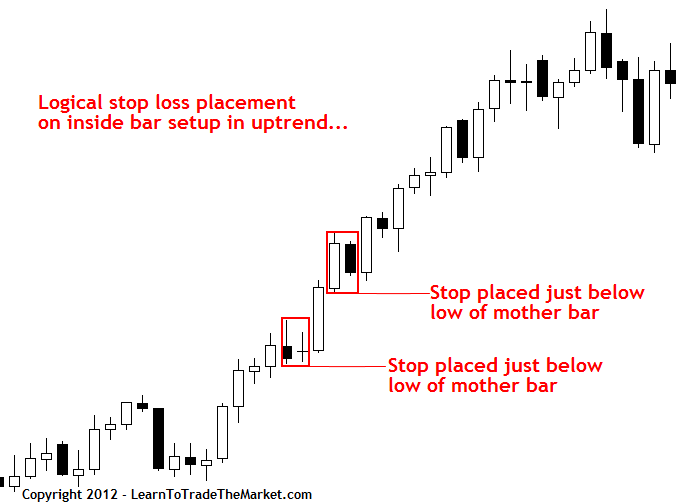

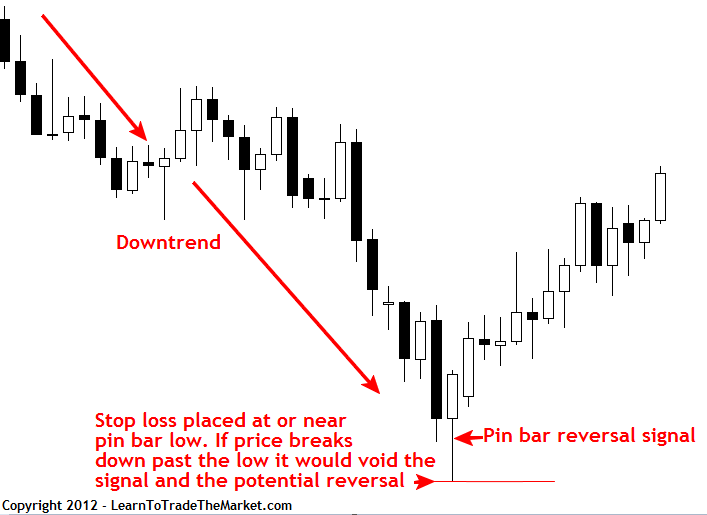

Exchange rate uncertainty may likely transmit shocks to stock markets. Therefore, awareness about inter-market volatility transmission is critical for the pricing of securities within and across markets for trading, hedging strategies and formulation of regulatory policies and portfolio management.

Furthermore, the link between stock and foreign exchange markets could be used to predict the future path of exchange rates, which provide could guidance to multinational corporations to manage their exposures with respect to risk that exchange rate fluctuations generate.

The results of empirical analysis suggest that exchange rate return produces no significant impact on stock return, whereas stock return exerts significant negative effects on exchange rate changes. Our results also depicted that 9/11 and the global financial crisis had little influence on Pakistan’s foreign exchange market. In contrast, the stability of the stock market was significantly influenced by the May 1998 nuclear tests.

The results support the existence of bidirectional volatility spillovers and asymmetric effect from stock returns to exchange rate changes.

Overall, these results show a significant information flow between the two markets, and that these markets are interdependent. This interdependence employs and confirms the volatility transmission between these two markets, as well as the recent appreciation in the rupee and its impact on the stock market. This is also confirmed with empirical results.

It appears from the analysis that structural shifts on the global and domestic fronts increases volatility of stock and foreign exchange markets. Therefore, there is a need to enhance the shock absorptive capacity of financial markets, especially during periods of crisis. To this end, the authorities may take appropriate measures to broaden the financial markets because Pakistan’s financial markets lack connectivity in terms of returns.

For example, reduction in capital gain tax may weaken the monopoly power of big investors and provide investment prospects, like in small and medium enterprises, mutual funds and IPOs to small investors to participate in stock market activities.

The authorities could also develop a framework for bringing down transaction time for settlement of securities, increase liquidity and market capitalisation, establish equity funds, encourage diversification of equity portfolios and adopt modern ways of transacting.

On the foreign exchange market front, authorities may take appropriate measures against those commercial banks (i.e. authorised forex dealers) responsible for unnecessary rupee depreciation against the dollar and other foreign currencies, and restore the exchange rate as well as financial stability.

The SBP may monitor the impact of stock price fluctuations on foreign exchange market, because investment earnings and the behaviour of international investors heavily depend on forex market trends.

An evidence of bidirectional volatility spillover across the markets indicates some degree of market inefficiency and uncertainty, which may shake investors’ confidence. It is, therefore, imperative to regulate and monitor both markets in order to minimise the adverse effect of volatility on investment decisions.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks