Price Pattern Technical Analysis: S&P 500 May Be in the Process of Forming a Double Top, Crude Oil Rallies Most in 2 Months, Gold Prices Stalling

by

, 12-29-2014 at 11:45 AM (1346 Views)

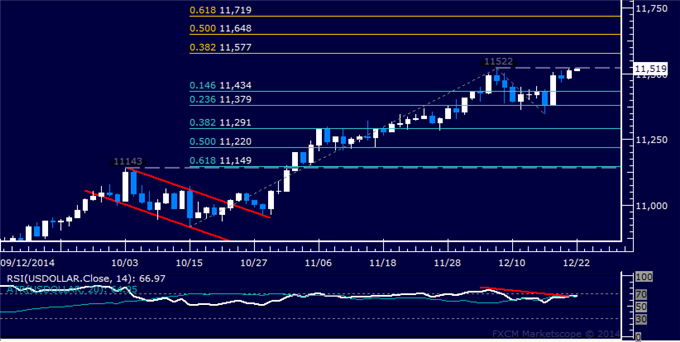

US DOLLAR TECHNICAL ANALYSIS – Prices arestruggling to breach December’s high, with negative RSI divergence warning a double top may be forming. A daily close below the 14.6% Fibonacci retracementat 11489 exposes the 23.6% level at 11379. Alternatively, a reversal above the December 8 high at 11522opens the door for a challenge of the 38.2% Fib expansion at 11577.

S&P 500 TECHNICAL ANALYSIS – Prices are testing resistance in the 2067.90-79.60 area marked by the 38.2% Fibonacci expansion and the December 5 high. A daily close above this barrier exposes the 50% level at 2098.60. Negative RSI divergence warns of ebbing upside momentum however and hints a reversal lower may be in the cards. A move below the 23.6% Fib at 2029.80 targets the 14.6% expansion at 2006.40.

GOLD TECHNICAL ANALYSIS – Prices are struggling with downside follow-through after breaking support at the bottom of a rising channel set from early November. A break below the 23.6% Fibonacci expansion at 1187.39 exposes the 38.2% level at 1156.00. Alternatively, a turn above the 1205.26-1206.74 area marked by channel floor support-turned-resistance and the 14.6% Fib targets the December 9 high at 1238.13.

CRUDE OIL TECHNICAL ANALYSIS – Prices put in the largest daily advance in two months, reclaiming a foothold above the 62.00 figure. A break above the 23.6% Fibonacci retracement at 63.94 exposes the 38.2% level at 67.31. Alternatively, a reversal below the 14.6% Fib at 61.86 targets the December 16 low at 58.49.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

Email Blog Entry

Email Blog Entry