Weekly Forex Market Price Action Outlook August 4th 8th, 2014

by

, 08-05-2014 at 02:20 AM (2096 Views)

Weekly Forex Market Price Action Outlook August 4th 8th, 2014

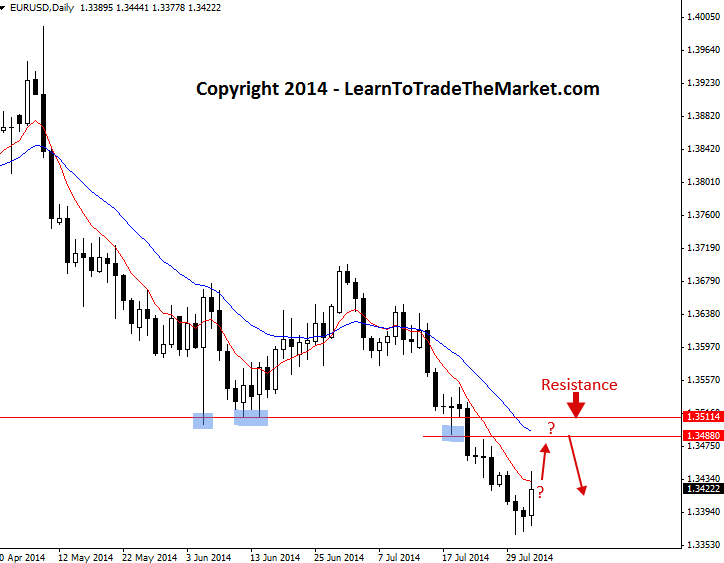

EURUSD Euro/dollar downtrend intact

On Friday, the EURUSD found some buying interest finally, and made a run back up to the 8 day EMA dynamic resistance level. The trend is still down in this market, and our recent bearish bias has not changed; we are still looking to sell on a rally back to resistance. If the market moves back up to the 1.3480 1.3510 area, we will watch closely for a price action sell signal to trade back in-line with the downtrend.

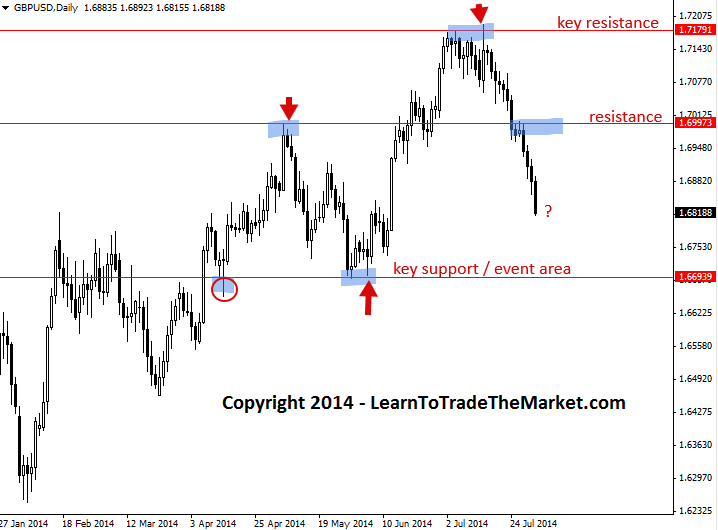

GBPUSD Sterling/dollar sell-off accelerates

The GBPUSD lost a lot of ground last week as bearish momentum took hold of the market. Our near-term bias on this market is now bearish and we will watch any rallies to resistance for sell signals. Theres some resistance coming in up near 1.7000, if the market retraces back to there we can watch for a sell signal. Theres also a key support / price action event area coming in down near 1.6690, and if the market falls down to that level in the coming days, we can watch for a price action buy signal as well, as that would be a high-probability area to look for buying opportunities.

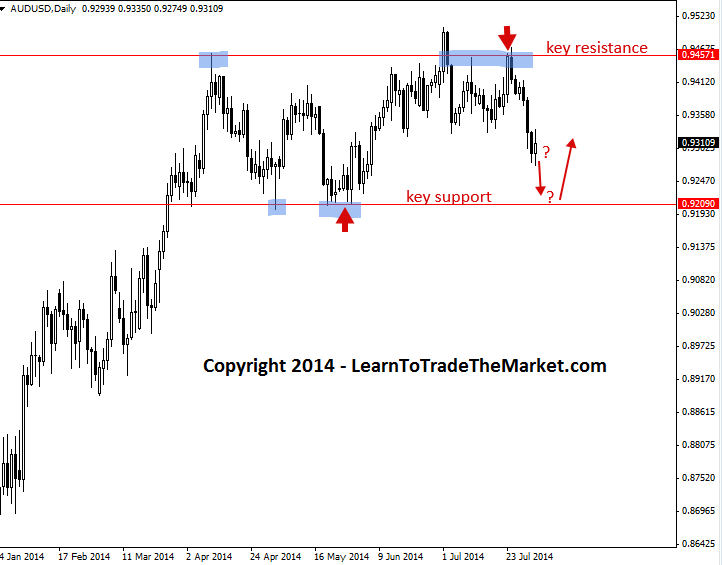

AUDUSD Aussie/dollar still within confines of trading range

The AUDUSD did break down through support near 0.9320 last week, but its still confined within a large trading range between 0.9450 resistance and key support level down near 0.9200. If price continues falling and tests that key 0.9200 support, we will watch for price action buying opportunities from there, to trade back up toward the range resistance.

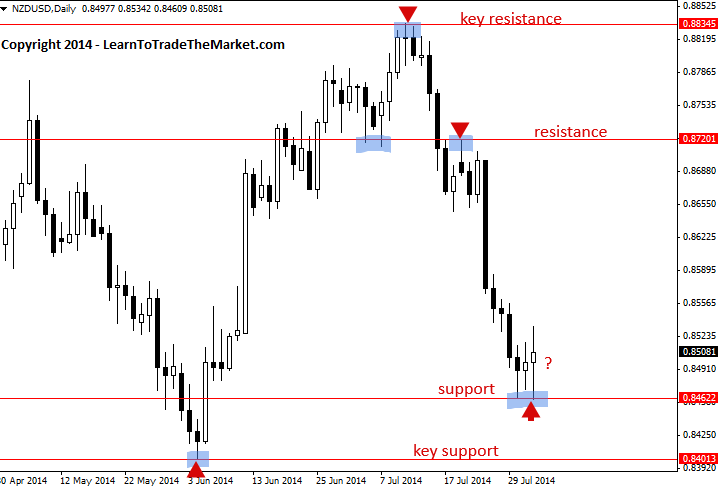

NZDUSD Kiwi/dollar showing signs of firming up near support

The NZDUSD found some buyers toward the end of last week as the market pushed slightly higher on Thursday and Friday. Price has fallen down close to the key support near 0.8400, but isnt quite there yet. We could wait for a buy signal from that key 0.8400 support level or wait for the market to retrace higher and watch for a price action sell signal from resistance to trade back in-line with this recent bearish momentum.

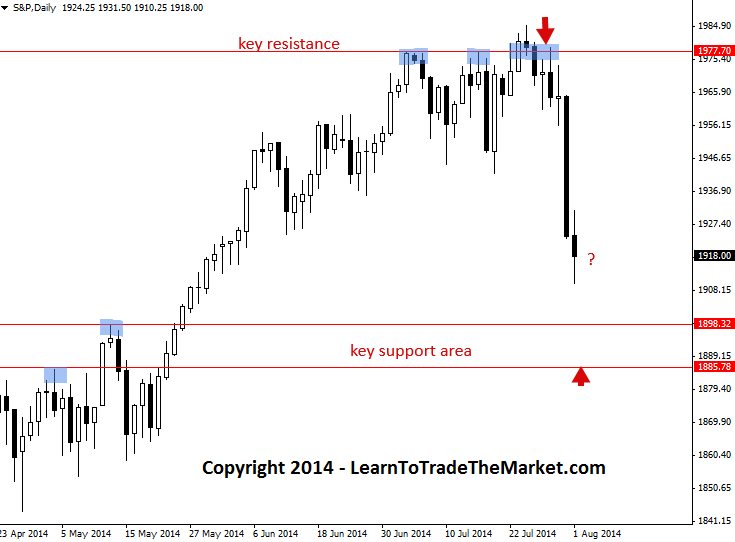

S&P 500 Bearish momentum pounds U.S. stocks

The S&P 500 has fallen significantly lower recently, following multiple failed attempts for the market to move higher. We can look to play both sides of the market at this point; watching for price action buy signals from key support and then looking for price action sell signals if the market pushes back up to key resistance levels.

Email Blog Entry

Email Blog Entry