Date : 12th January 2022.

Market Update January 12 Inflation Day.

Trading Leveraged Products is risky

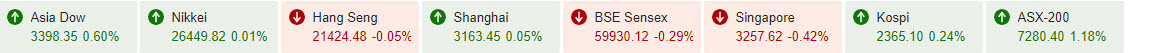

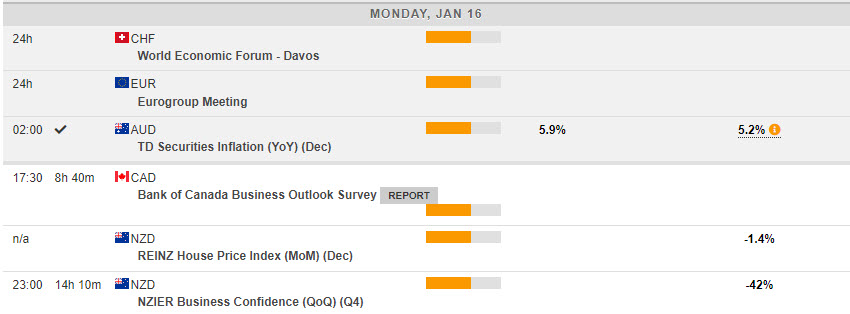

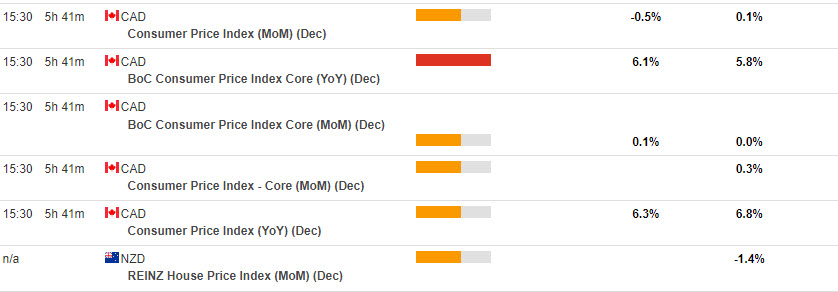

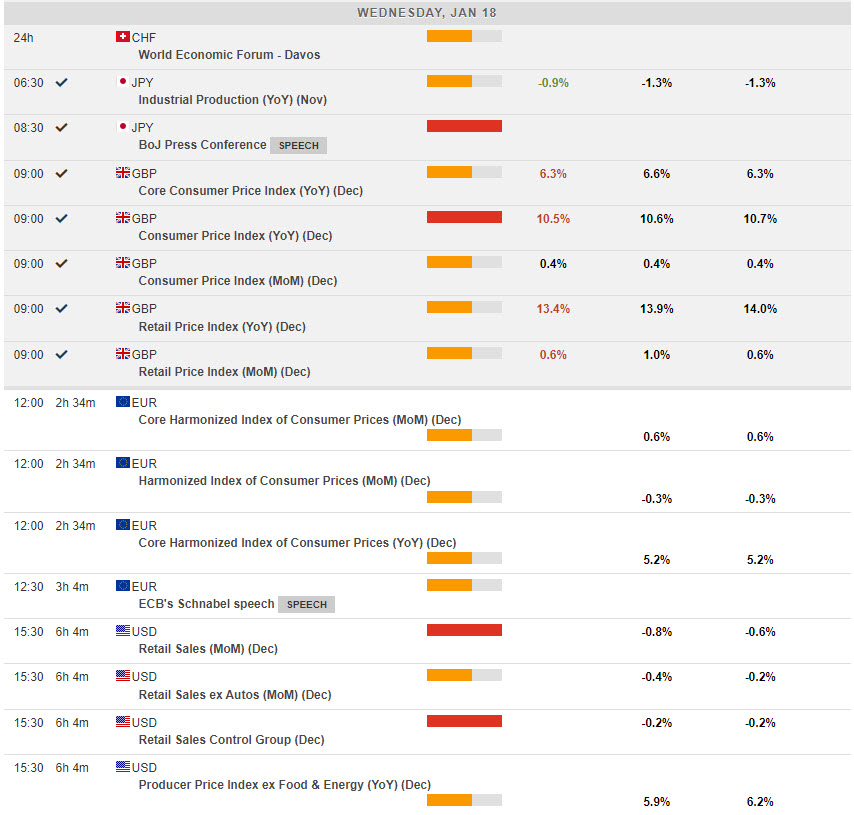

Stock market sentiment remains supported ahead of the US inflation report, with markets starting to look past the current wave of tightening moves and buying into hopes that final rates will be reached sooner rather than later this year. Yields have come down and stocks are benefiting. Australia and New Zealand bonds bounced today with yields stabilizing after being pushed up by stronger than expected local inflation data yesterday.

*The USDIndex is tumbling, between 102.60-103.20 for a 3rd consecutive day.

*EUR rallied to 7-month low to 1.0777.

*JPY got a boost today on speculation about a BOJ stimulus tweak heading into next weeks policy meeting. Currently traded at 131.80 amid wider strength in the Yen.

*GBP reversed from 1.2170.

*Stocks US indices are up since yesterday amid bets that a mitigation in the pace of US consumer price gains will allow the Federal Reserve to dial back the pace of its rate hikes. The US100 spiked to 11489, breaking 50 DMA, US30 to 34134 and US500 to 3994. GER40 and UK100 futures are posting gains of 0.2% and 0.3% respectively.

*USOil its been a rollercoaster for oil, having climbed over $77 on optimism on Chinas reopening. It then fell to below $76 on the huge build in inventories, but then managed to extend gains above $78. That is the third large weekly increase on record (dating back to 1982), and a big miss from analyst expectations for a small decline.

*Gold steady below $1885.

Today US Inflation release.

Biggest FX Mover@ (07:30 GMT) ETHUSD (+4.62%). Spiked to 1417.35, breaking W-pattern neckline at 1353. Fast MAs & RSI flattened but MACD histogram & signal lines remain positive. H1 ATR 13.75, Daily ATR 37.86.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

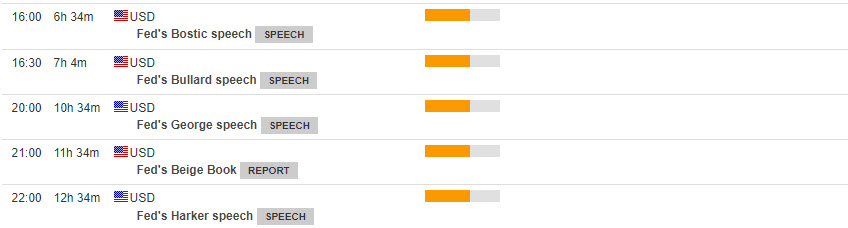

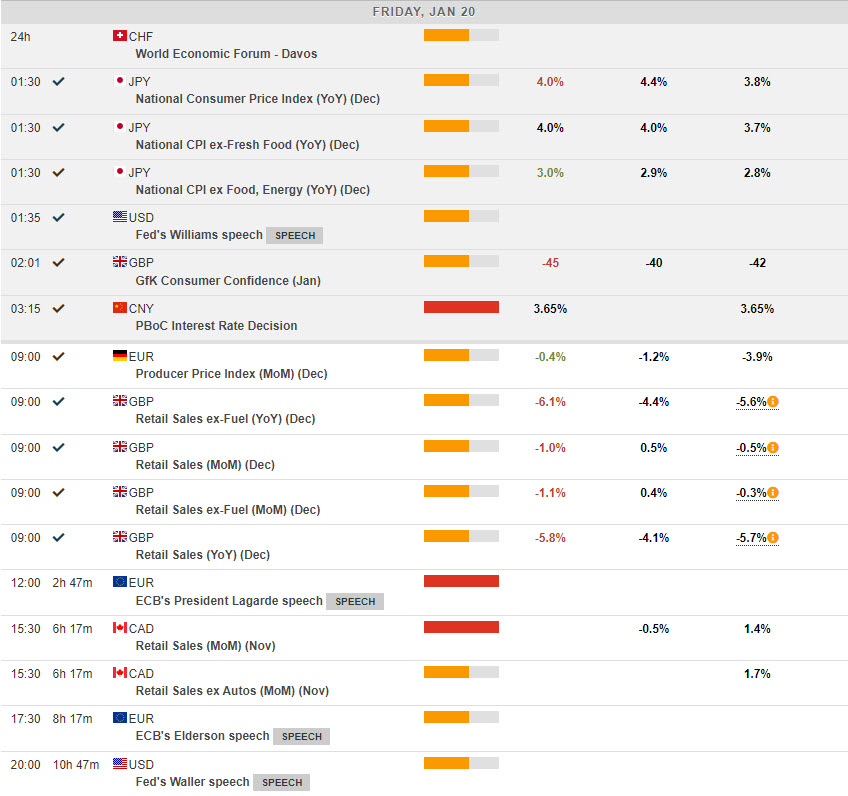

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks