Date : 14th February 2023.

Market Update – February 14 – Pivotal Day.

Trading Leveraged Products is risky

Markets have prepped for today’s CPI report over the last several sessions, while also pricing in a more hawkish FOMC stance going into Q2.

*Stocks high, Treasuries mixed and US Dollar sagged. Shorter dated Treasuries underperformed and were in the red most of the day as a “higher for longer” Fed stance was more fully priced in.

*Gains in Microsoft, Apple, and Meta helped boost tech Nasdaq. Microsoft +3.12%, pushing its market cap over $2 trillion, Meta +3.03% after the Financial Times reported that Meta is planning another round of layoffs. Tesla -1.14%.

*FX – USDIndex sagged – slumped to 102.93 today, from an overnight high of 103.83, helped by a rebound in USDJPY.

*EUR & GBP – extend losses against USD – 1.0737 & 1.2170 respectively. UK ILO unemployment held steady but employment rose in the three months to December. The tight labour market and wide spread strike action is forcing companies to up wage offers and regular pay in order to keep hold of skilled staff.

*JPY – just a breath below 133 before pullback to 132 again. The Yen recouped losses as Japan nominated a new central bank governor in a closely watched decision & as Japan’s Q4 GDP growth lags below expectations.

*The US100 led the way with a 1.48% bounce, followed by the US500’s 1.14% advance, while the US30 was up 1.11%.

*USOil – down at 79 area again but stands above 20-DMA. It fell after the US unveiled a plan to release supplies from its strategic reserves, offsetting price pressures triggered by rising demand in China and Russia’s plan to cut output. (Reuters)

*Gold – sideways for a 3rd day at $1856-1867.

*Cryptocurrencies – BTC – at $21.7k.

Today – All eyes are on US Inflation. EU prelim GDP is also on tap.

Biggest FX Mover @ (07:30 GMT) NZDJPY (-0.65%). Holds at 20 DMA. MAs flattened, MACD lines are at 0, RSI 44 presenting that pullback has run out of steam. H1 ATR 0.146, Daily ATR 0.883.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

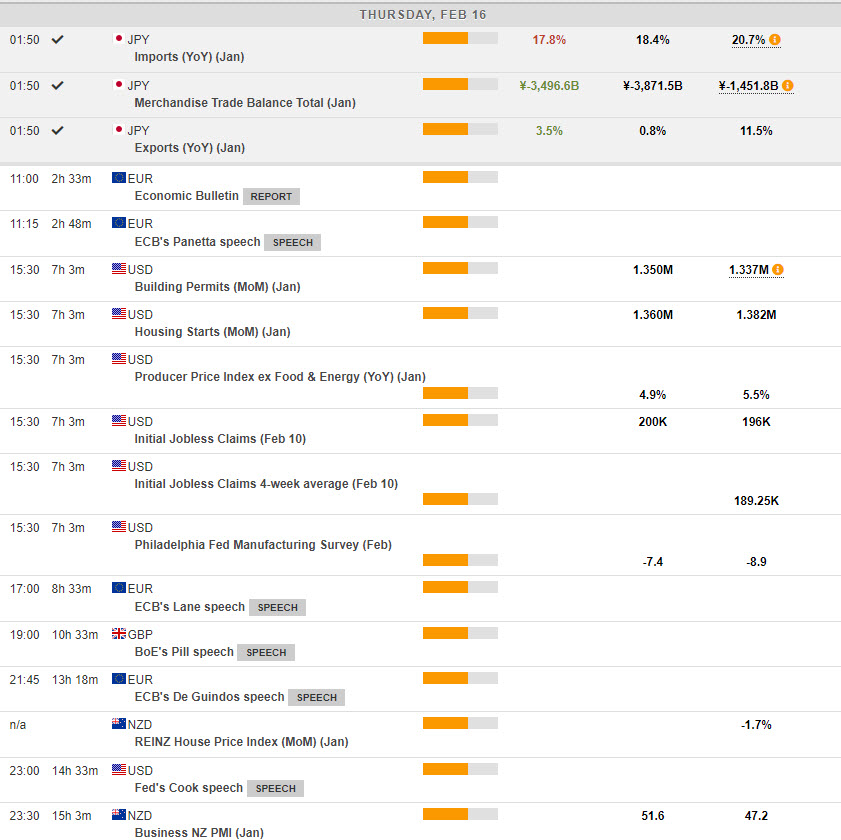

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks