Date : 1st September 2022.

Market Update – September 1 – New Month Same Story – Dollar Bid.

Trading Leveraged Products is risky

*USDIndex – holds at 109.00 highs from a test of 108.50 support. Yields rallied again, Dollar on the frontfoot ahead of NFP & Labor Day Holiday, ADP (following revisions to calculation) big miss 132k vs 300k). Chengdu (120 million) in new lockdown.

*EUR – Record Inflation (9.1%) pressures ECB action (40% chance of 75bp rise next week) – EUR holds at 1.0018.

*JPY rallies again (new 24 yr highs) eyes key 140.00 & trades; 139.50 BOJ holding accommodative policy line.

*GBP new pandemic era lows under 1.1600 now, to 1.1568 lows.

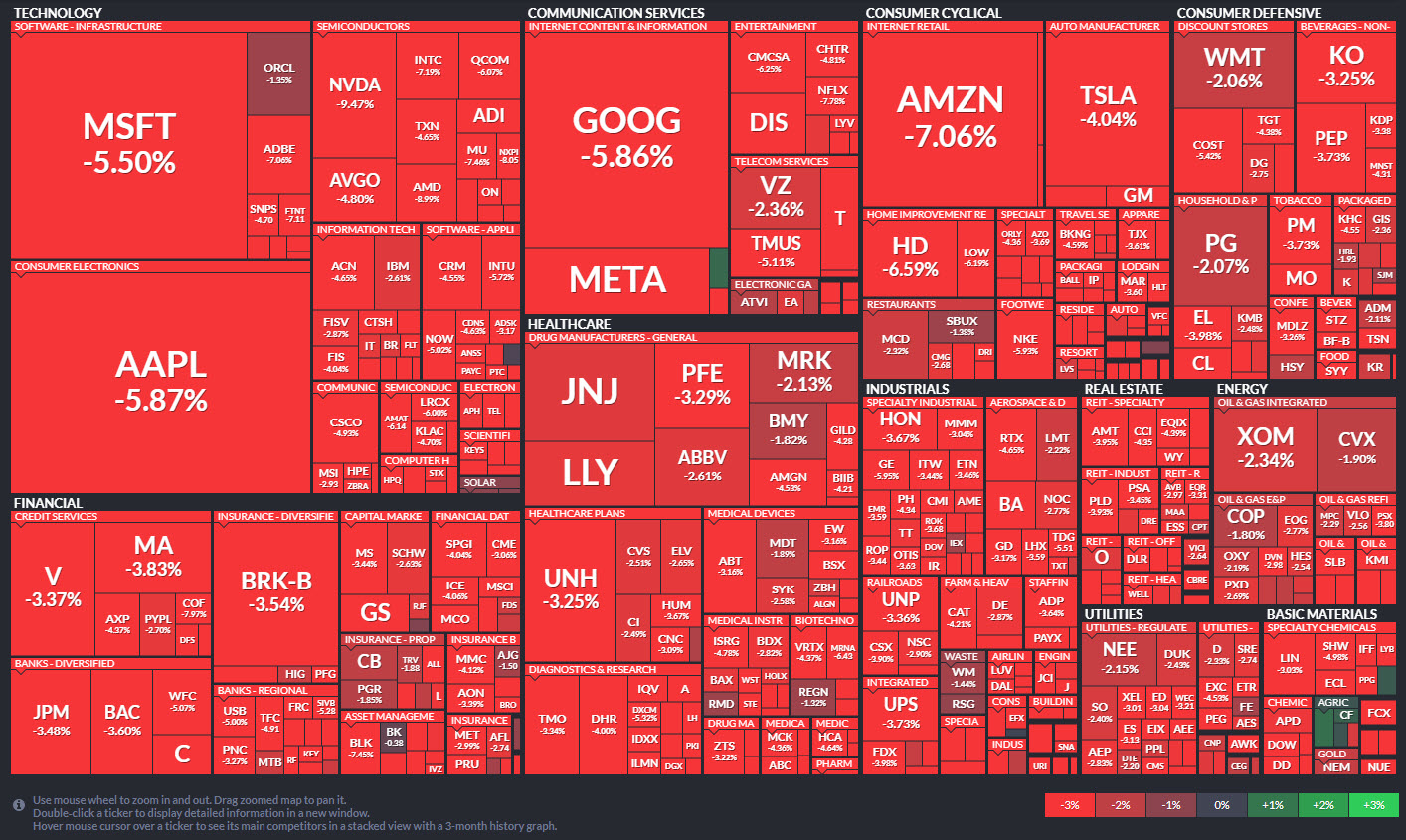

*Stocks US stocks weak again (S&P500 -31.00pts (-0.78%) 3955). Energy & Tech stocks led the decline again as weak news from Nvidia, Tencent & AMD weighed. Futs. -1% at 3930 now.

*Oil down again on weake outlook, under $90.00 and trades at $88.90 now.

*Gold – also down and within $1.50 of $1700 earlier, trades at $1707 now.

*BTC – under 20k again today.

Overnight – CNY Manufacturing PMI data missed (49.5) and returns to contraction. German Retail Sales better than expected (1.9% vs. 0.0%).

Today – EZ, UK & US Manufacturing PMIs, German Retail Sales, Swiss CPI, EZ Unemployment, US ISM Manufacturing, Construction Spending, Speech from Fed’s Bostic.

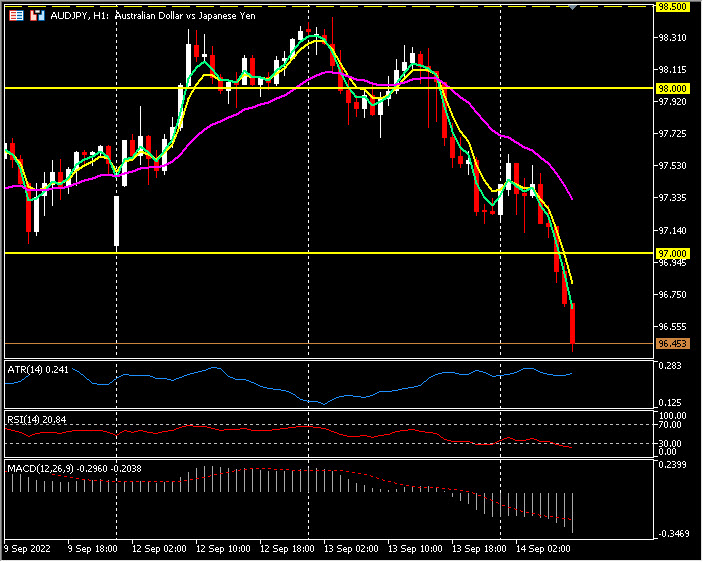

Biggest FX Mover (06:30 GMT) EURCHF (-0.48%). Rejected 0.9830 today following 5-day rally from 0.9559, trades at 0.9786. MAs aligning higher, MACD histogram positive but signal line falling, RSI 43.00, H1 ATR 0.00132, Daily ATR 0.000723.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks