Date 27th June 2023.

Market Update – June 27 – Stocks buoyed after yesterday’s drift.

Trading Leveraged Products is risky

Risk appetite started to improve and a 2% bounce in the Hang Seng led Asian markets higher overnight. China Premier warned that economic barriers will lead to confrontation, while he promised the roll out of more effective measures to boost demand. China meanwhile set its daily reference rate for the managed currency at a higher level which for a second day helped the offshore yuan to advance. European and US futures are also finding buyers, after the US100 suffered again yesterday with markets preparing for a Fed hike in July. The 2-year finished fractionally lower at 4.680% after a well bid auction. It was as rich as 4.635% earlier. The 10-year was off 1.5 bps at 3.719%. The curve was at -102 bps.

Along with concerns over events in Russia, a plunge in German Ifo business confidence added to angst over the bearish impacts of central bank tightening, while more signs of a flagging Chinese economy added to risk-off flows.

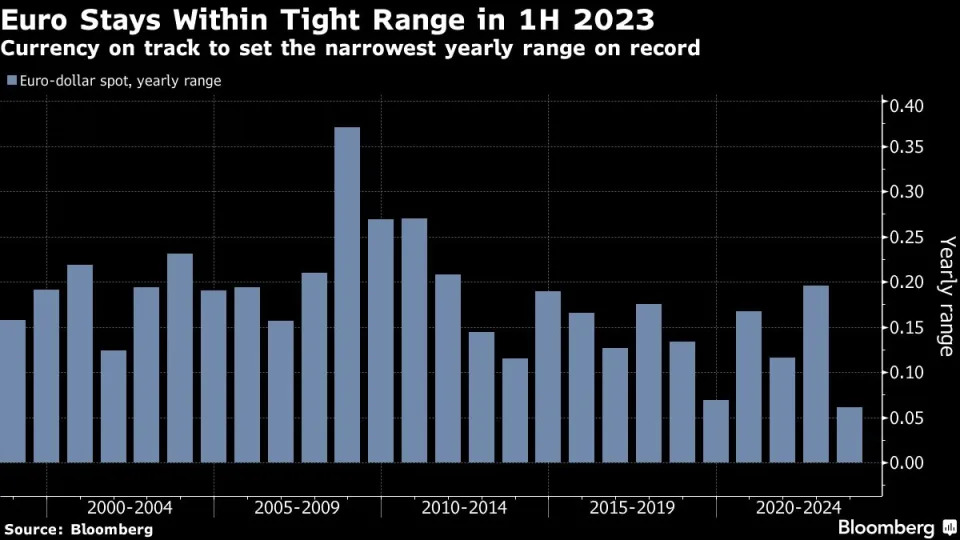

*FX – The USDIndex to 102.14, EUR at 1.0935, Pound retests at 1.274. USDJPY at 143.45, which will keep intervention talk alive, especially after Japan extended the term of its top currency official for another year, which will be taken as a sign that officials remain determined to stem the weakness of the currency.

*Stocks – Nikkei underperformed but China bourses were buoyed. Wall Street settled in the red with the US100 and US500 at the day’s lows. The US100 tumbled -1.16% and the US500 was off -0.45%. The US30 was down -0.04%.

*Commodities – USOil higher due to Russian turmoil and currently at $70 per barrel.

Gold slightly higher as markets lower but steady at $1922.13. Iron and Copper jump as China stimulus optimism.

Today – The ECB’s conference on central banking in Sintra really gets underway today and comments from Lagarde will be watched carefully.

Biggest FX Mover @ (06:30 GMT) EURAUD (-0.68%) dipped to 1.6256. Fast MAs aligned rebounded in the last hour indicating the potential end of the decline.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

a

a

Bookmarks