Date 12th July 2023.

Market Update – July 12 – Dollar slumps further ahead of US CPI!.

The US Dollar sagged to a 2-month low and stock markets traded mixed overnight as markets wait for the key US inflation report. Wall Street had a modest bid, supported by hopes for a bounce from China from more stimulus, as well as by a surge in Activision Blizzard (+10.02%) after a ruling that will allow Microsoft’s $69 bln takeover to go through. Japan’s household inflation expectations rose, keeping pressure on the BOJ. RBNZ left rates on hold, as expected. New Zealand’s central bank kept the Official Cash Rate unchanged at 5.5% but suggested that rates are sufficiently restrictive to bring inflation back to target by the second half of next year. The RBA announced changes to its meeting schedule from next year but remains on course for additional tightening. The Bank of England stated today that the UK economy was proving resilient to the risks posed by higher interest rates, although it would take time for the full impact to feed through.

*FX – The USDIndex slipped to 101. USDJPY broke 50-DMA and drifted to 139.30 indicating a potential downtrend. GBP breached 15-month resistance at 1.2968 and EUR at 1.1036.

*Stocks – The US500 was up 0.24% and the US100 was up 0.18%. ASX lifted 0.4%, Hang Seng lifted 0.9%, and CSI300 corrected -0.5% overnight. Tencent’s shares gained 1.8% and Alibaba’s shares jumped 1.86% in the Hong Kong market. China’s state planner on Wednesday praised Tencent and Alibaba in a statement detailing a study it had done on platform firms, in the latest sign authorities are warming up to the technology sector after a nearly three-year crackdown. Activision Blizzard +10.02%.

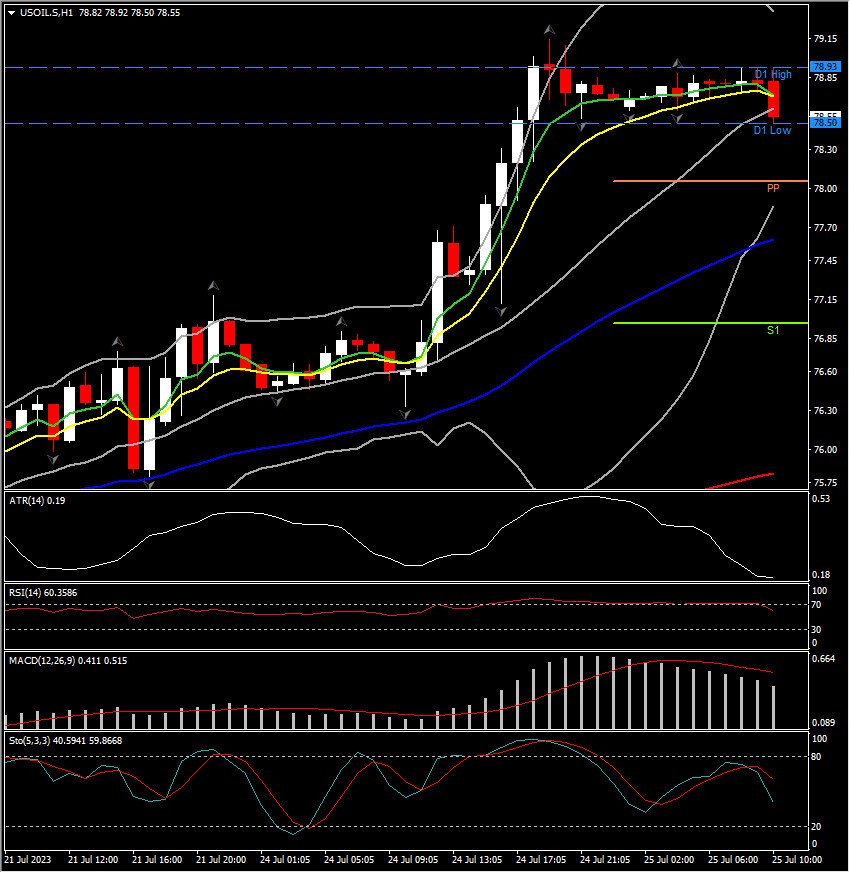

*Commodities – USOil remains supported as supply restrictions start to bite, at $74.96.

*Gold – broke 2-month down channel and extended to $1941.

Today – US Inflation, BOC Rate decision and Conference, and lots of Fedspeeches.

Biggest FX Mover @ (06:30 GMT) USDJPY (-0.54%) dipped to 139.30. Fast MAs flattened but MACD lines are negatively configured with RSI at 35.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks