Date 14th August 2023.

Market Update – August 14- CNH, CHINA50 slide, JPY nears 2022’s intervention zone, PPI ticks up.

Trading Leveraged Products is risky

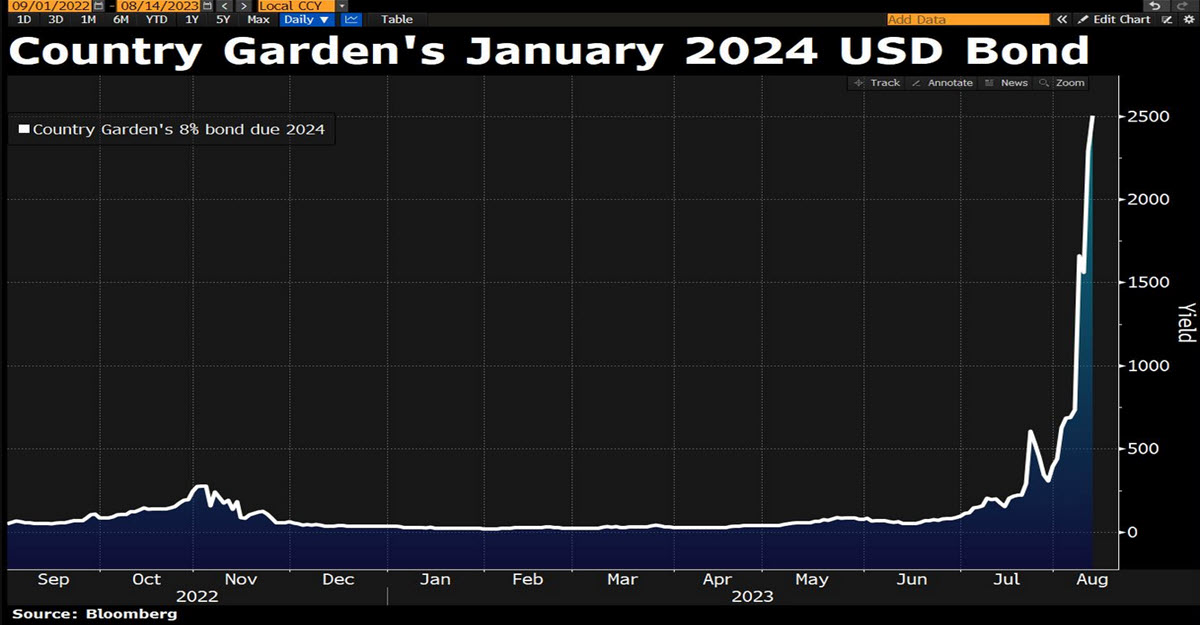

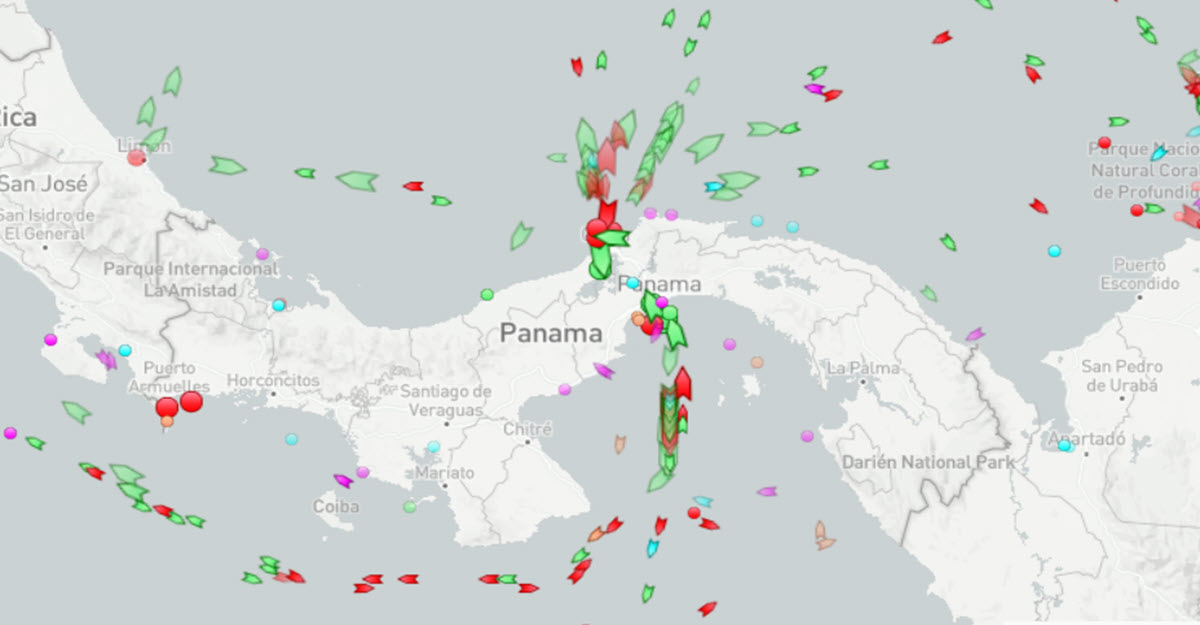

Asia is in dire straits: CHINA50 and HK are down more than 2% as problems with developer Country Garden intensify and the stock is down almost -15% at its lows after suspending trading on 11 onshore bonds. Its issuance dated 01/2024 has fallen as low as 9 cents, indicating a yield of 2500%: a bankruptcy now seems inevitable, it remains to be seen how much the system will be able to sterilise it. The USDCNH currently trades at 7.2757, what would be the highest settlement of the year. But it is not the only one: the USDJPY touched 145.20, a new one-year low for the yen. Last year above 146, the BOJ’s monetary defence with open market interventions had begun and many traders expect something similar this year.

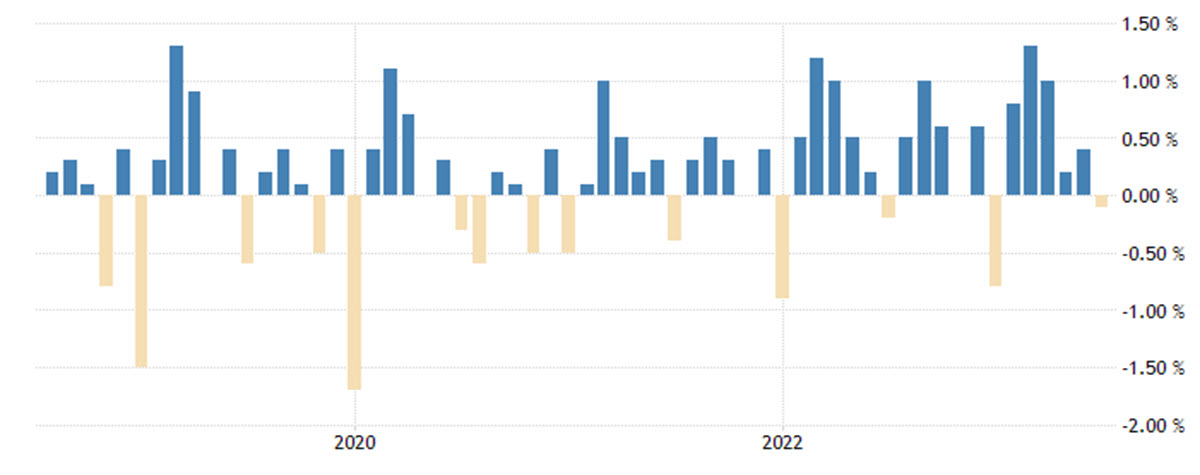

Back in the West, a higher-than-expected PPI figure favoured another red day for the US indices from which only the US30 was saved: that’s two weeks in a row of declines for both the US500 and US100. Remember that producer prices move ahead of consumer ones. Meanwhile, the USD continues to rise for the fourth week in a row and so does the Crude, up for 7 weeks in a row: the energy sector is now the best performer and has largely overtaken technology in short-term performance. Rates are on the rise again with the 2y at 4.90% and the 10y at 4.17%.

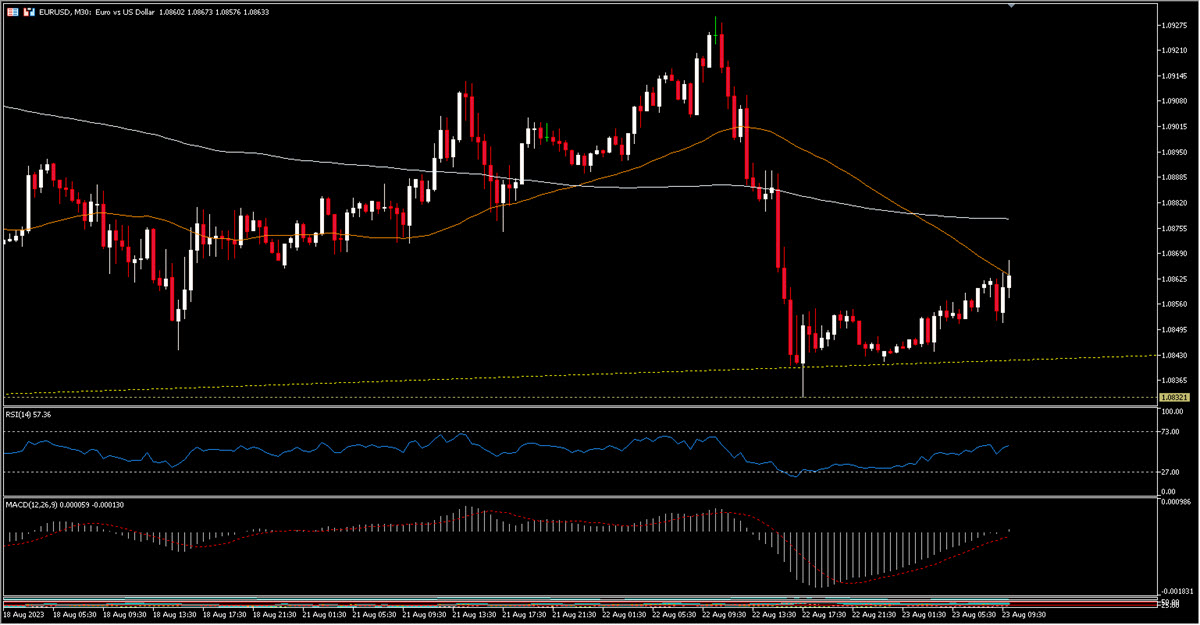

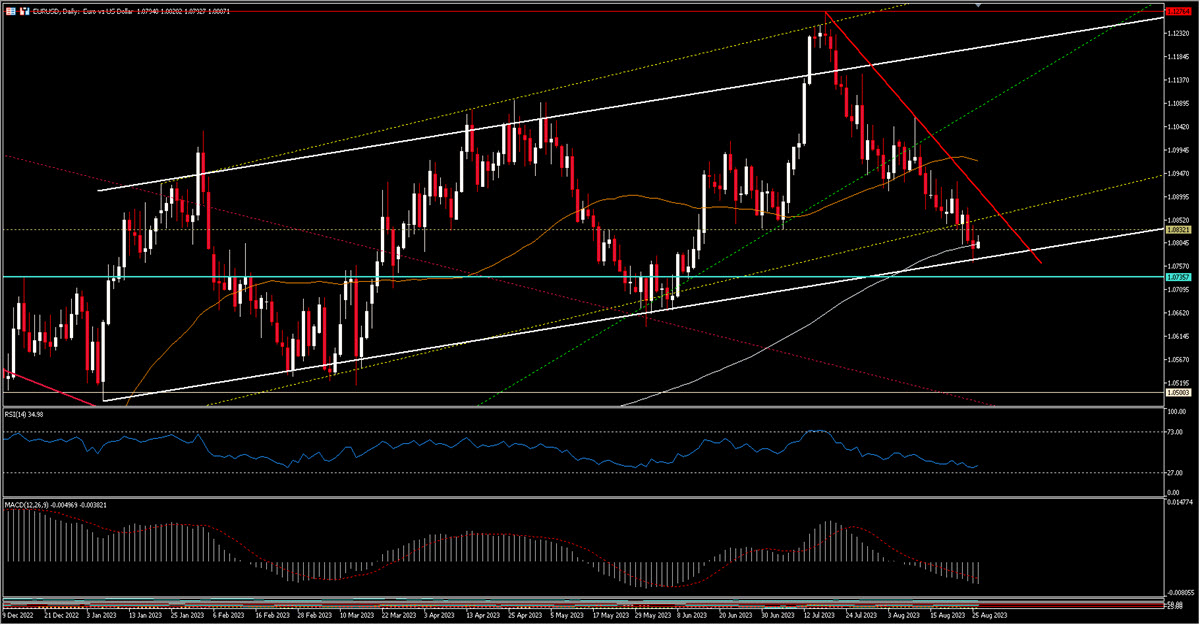

*FX – USDIndex up for weeks in a row trading at 102.80 now, approaching the channel down and the 200MA; both EURUSD and CABLE are -0.10% (1.0938, 1.2681) and seem to be close to break down their 10 months long uptrends.

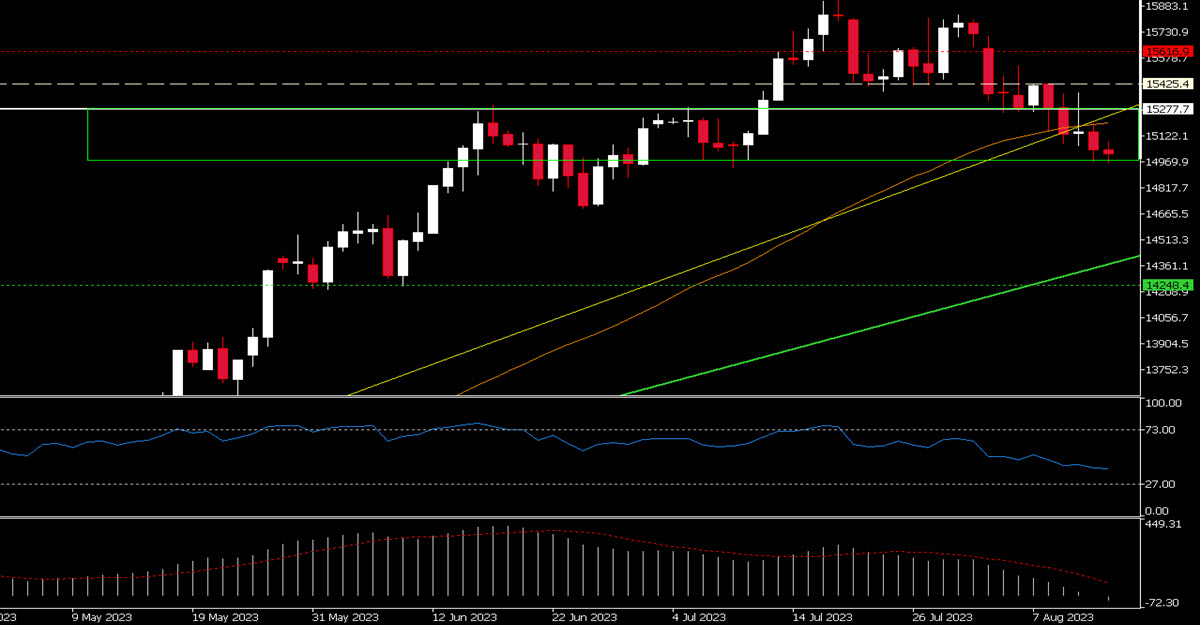

*Stocks – US futures are -0.2% this morning, JPN225 -1.44%, AUS200 -0.87%, DAX -0.4% and clearly trading below its 50MA (as US100 is).

*Commodities –USOil -0.96% at $82.24, UKOil -0.93% at $85.58, another red day for Copper ($370).

*Gold – Down at $1913 as yield are rising.

Today: No data till tonight when Japanese GDP, RBA minutes and Chinese Retail Sales + Industrial Production will hit the tape.

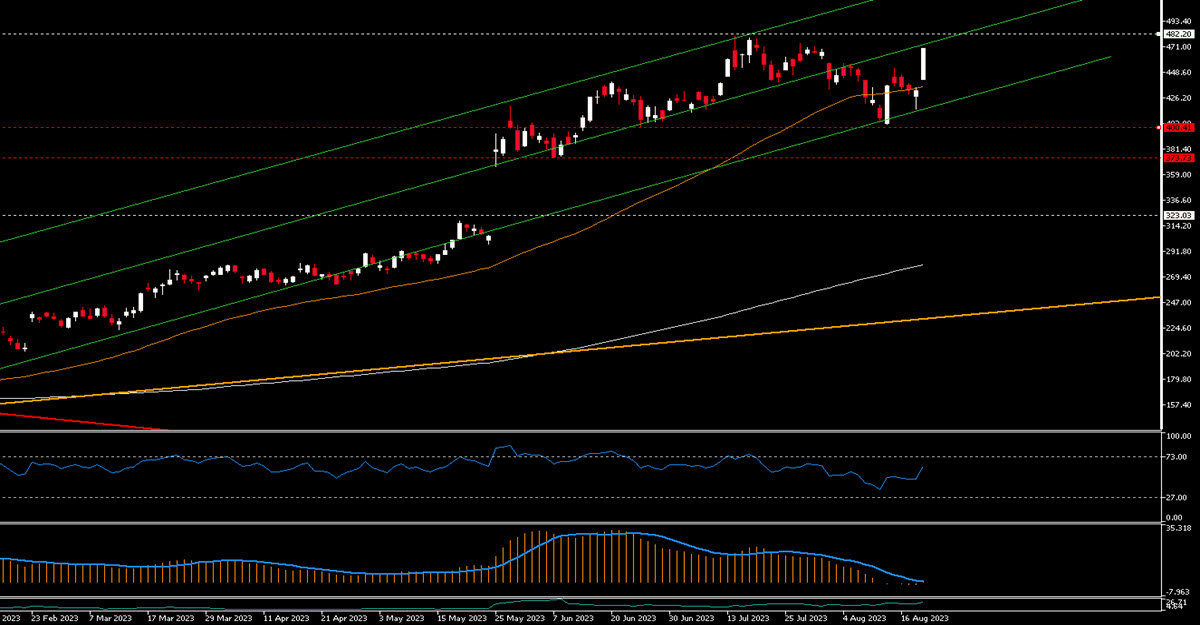

Interesting Mover: US100 (0.15%) is trading below its 50MA and have broken the first steepest (yellow) trendline. 14935 area is now a weak static support.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Marco Turatti

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks