Date 31st August 2023.

Market Update – August 31 – Markets sustain the “Bad News Is Good News” stance.

Trading Leveraged Products is risky

Asian stock markets traded mixed overnight, with mainland China bourses underperforming. Chinese manufacturing contracted in August for a 5th straight month, while Chinese property stocks fell after Country Garden, once the country’s largest developer by sales, reported record losses and China Vanke cancelled a share placement. China’s property sector is dealing with a renewed liquidity crisis. Country Garden on Wednesday reported a $7bn first-half loss, its worst ever. European stock futures are higher, also helped by upbeat reports from UBS. French inflation numbers were much higher than anticipated.

German retail sales disappointed again. Sales dropped -0.8% m/m in July. Expectations had been for a slight rise, after the two consecutive months of contraction. Consumer confidence also deteriorated again in data released yesterday, and high inflation and rising debt financing costs are still curtailing consumption.

*FX – USDIndex recovered to 103.25 from 102.84 lows, EURUSD turned to 1.0889 from 1.0949, GBPUSD steady at 1.2700 and USDJPY lifted to 146.30 with the Yen still close to the weakest level in over nine months as markets continue to test the resolve of officials to keep the currency underpinned.

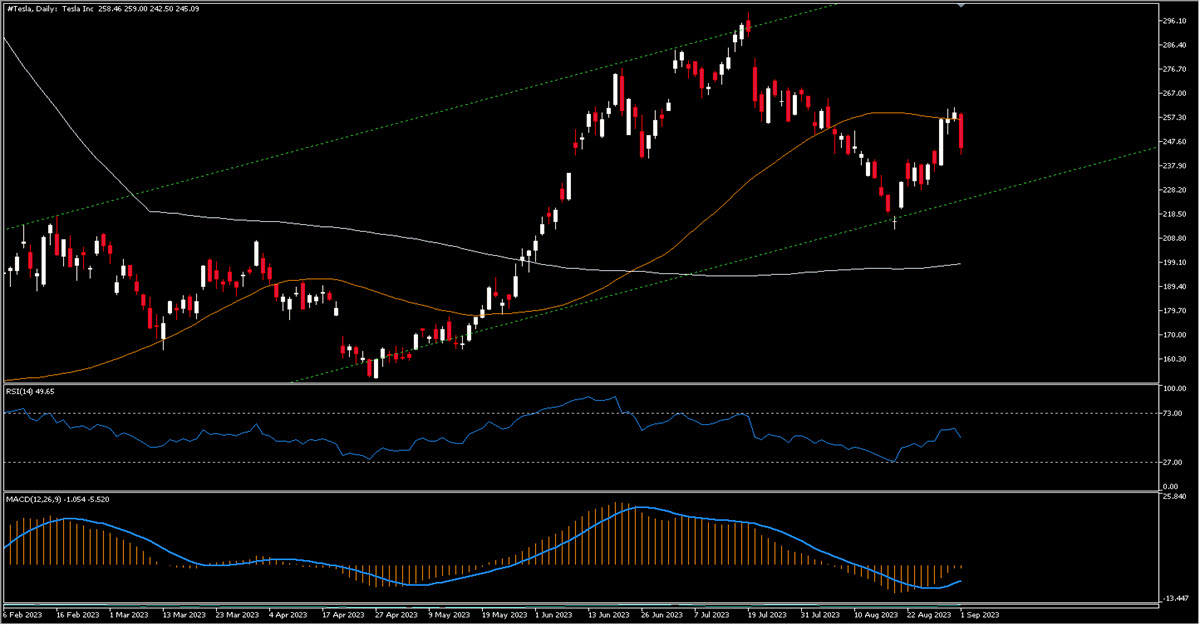

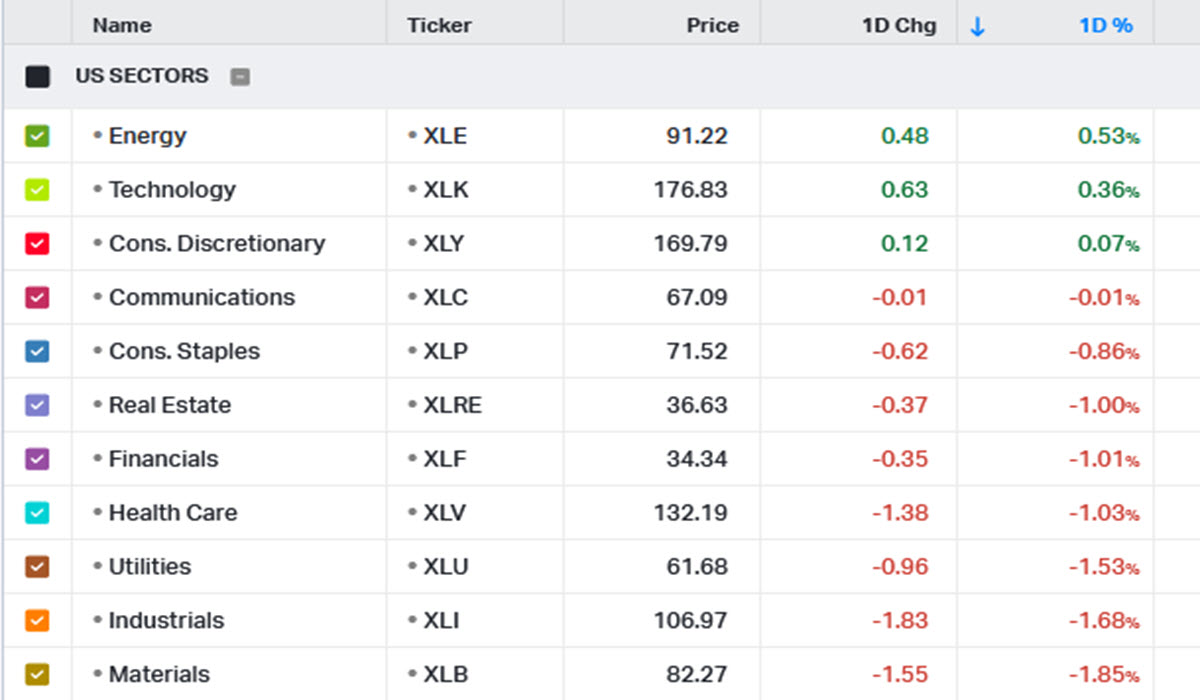

*Stocks – The US100 surged 1.74%, while the US500 advanced 1.45%, with the US30 up 0.85%. The US500 rose for a 4th straight session, the first time since the end of July. And it broke resistance at 4440 to extend the move to 4495. UBS reports huge 2Q profit skewed by Credit Suisse takeover, foresees $10B in cost cuts.

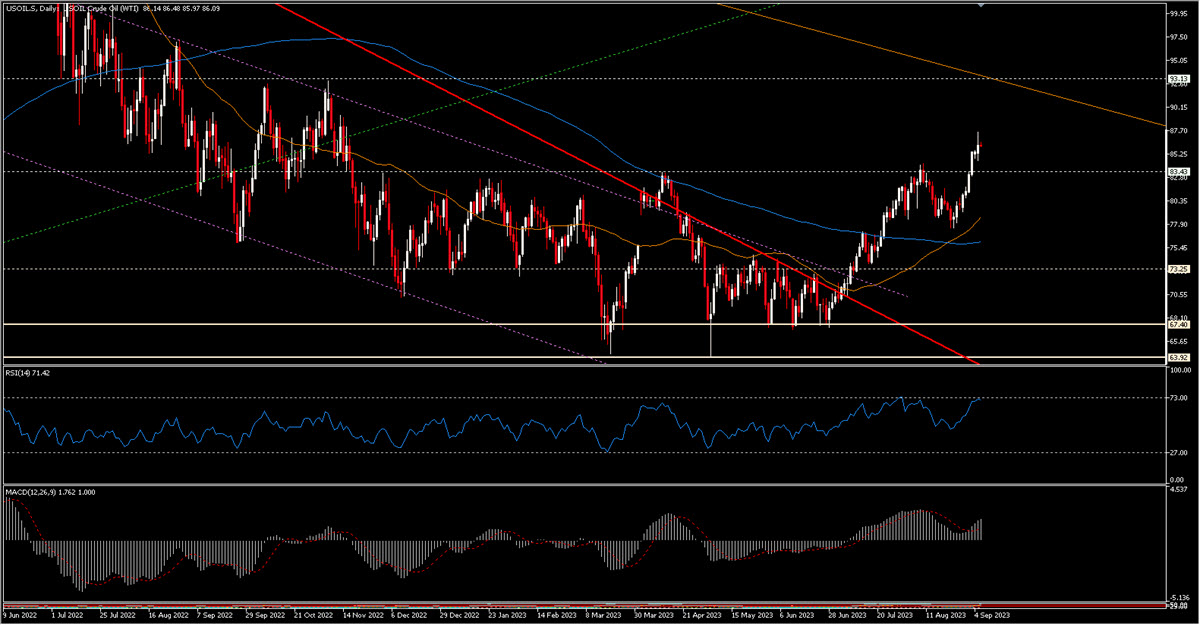

*Commodities – USOil sideways at 81.44 failing o break the 61.8% Fib. level from the August downleg.

*Gold – Spiked to $1,949.

Today: Eurozone CPI readings are likely to surprise on the upside, which will boost rate hike bets. Also the July income, consumption, and PCE deflator numbers will be scrutinized, along with weekly jobless claims.

Key Mover: XAUEUR (+0.51%) retests 2-month Supply Zone at 1785-1795.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks