Date: 16th January 2024.

Dollar Demand Rises and Global Stocks Tumble, Find Out Why!

*Investors price in 6 rate cuts in 2024, but all Fed members remain hawkish. Economists advise investors are getting ahead of themselves and the Fed is only likely to cut 3 times.

*Finance giants gather in Davos and advise markets rate cuts are premature and the risk of inflation still remains.

*Trump beats Ron DeSantis in Iowa and is on track to represent the Republicans in the 2024 US elections.

*The UK’s employment sector remains resilient, but salaries again see a considerable slow-down. The salary slowdown pushes the Pound lower.

GBPUSD – UK Salaries Decline And Dollar Demand Rises

The GBPUSD is trading at its lowest level since January 5th after being pushed lower by Dollar strength and UK data. The US Dollar Index has been increasing in value for 3 consecutive days due to higher inflation data and hawkish comments from global banking leaders. Another indication that interest rates are likely to remain high is this week’s bond yields. During this morning’s Asian session, the US 10-Year Bond Yields rose 0.055% and again rose above 4.00%. Higher bond yields are known to be Dollar bullish, but investors will monitor if bond yields can hold onto gains. This is something yields were not able to achieve last week.

The Pound this morning is declining against all currencies which provides traders with clear opportunities within the GBPUSD. However, the data from the UK is not “all bad” for the Pound. The UK’s Claimant Count Change read 11,700, lower than previous expectations and lower than the previous 3 months. Strong employment means higher consumer demand and means a trickier fight against inflation. However, the lower earnings do help regulators fight against inflation. As a result, investors are ditching the Pound in favor of the Dollar.

According to analysts, investors today have preferred the Dollar where there is already confirmation that inflation rose. Nonetheless, the Pound may correct if tomorrow’s UK inflation data is higher than the 3.8% expectations. Though, if inflation does read 3.8% or lower, the Pound may witness further downward momentum.

When evaluating indicators and technical analysis, the GBPUSD exchange rate is currently witnessing potential sell signals. The price is trading below trend-lines, average price movements and below the neutral on most oscillators. The price is also trading below the regression channel and the regression channel is also widening while declining. All the above indicates downward price movement, however, if the price rises above 1.27127, these signals can potentially change.

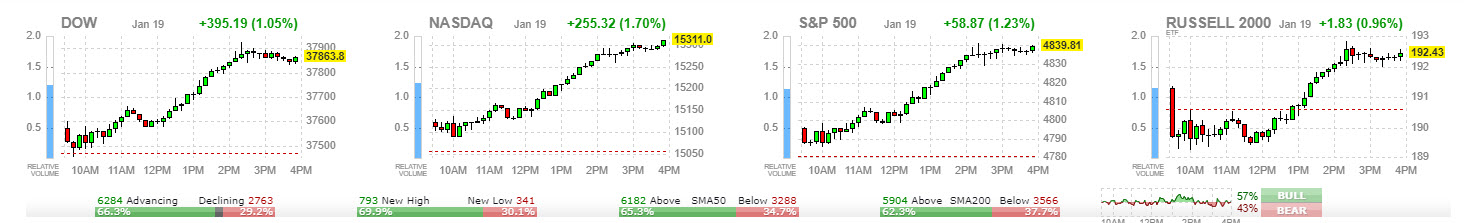

US30 – Global Sentiment Towards Stocks Declines. Eyes on Goldman Sachs Earnings!

The US30 is experiencing a decline during this morning’s Asian session, similar to all other US indices. The US30 was pressured by negative earnings data from the banking sector on Friday as well as the possibility of less rate cuts this year. However, technical analysts remind investors that the price has declined to a previous support level which the asset has not been able to break on the past 3 occasions. Traders monitor the price action as the asset tests this support level.

The next vital announcement for the asset will be Goldman Sach’s earnings report which will be made public before the US Session opens. Analysts expect the banking giant to see a 23% drop in earnings per share and a slight decline in revenue. Though, if the data is lower than expected, the stock price can decline. Goldman Sachs is the third most influential stock within the Dow Jones and holds 6.63% of the index.

Lastly, another negative for the USA30 is the stock market performance today globally; UK, EU and Asian indices are trading lower. The poor sentiment within the stock market is largely due to hawkish comments from the Fed and finance ministers in Davos. Analysts advise investors are pricing in up to 6-7 rate cuts in 2024, but banks are predicting 3-4.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks