Date: 31st January 2024.

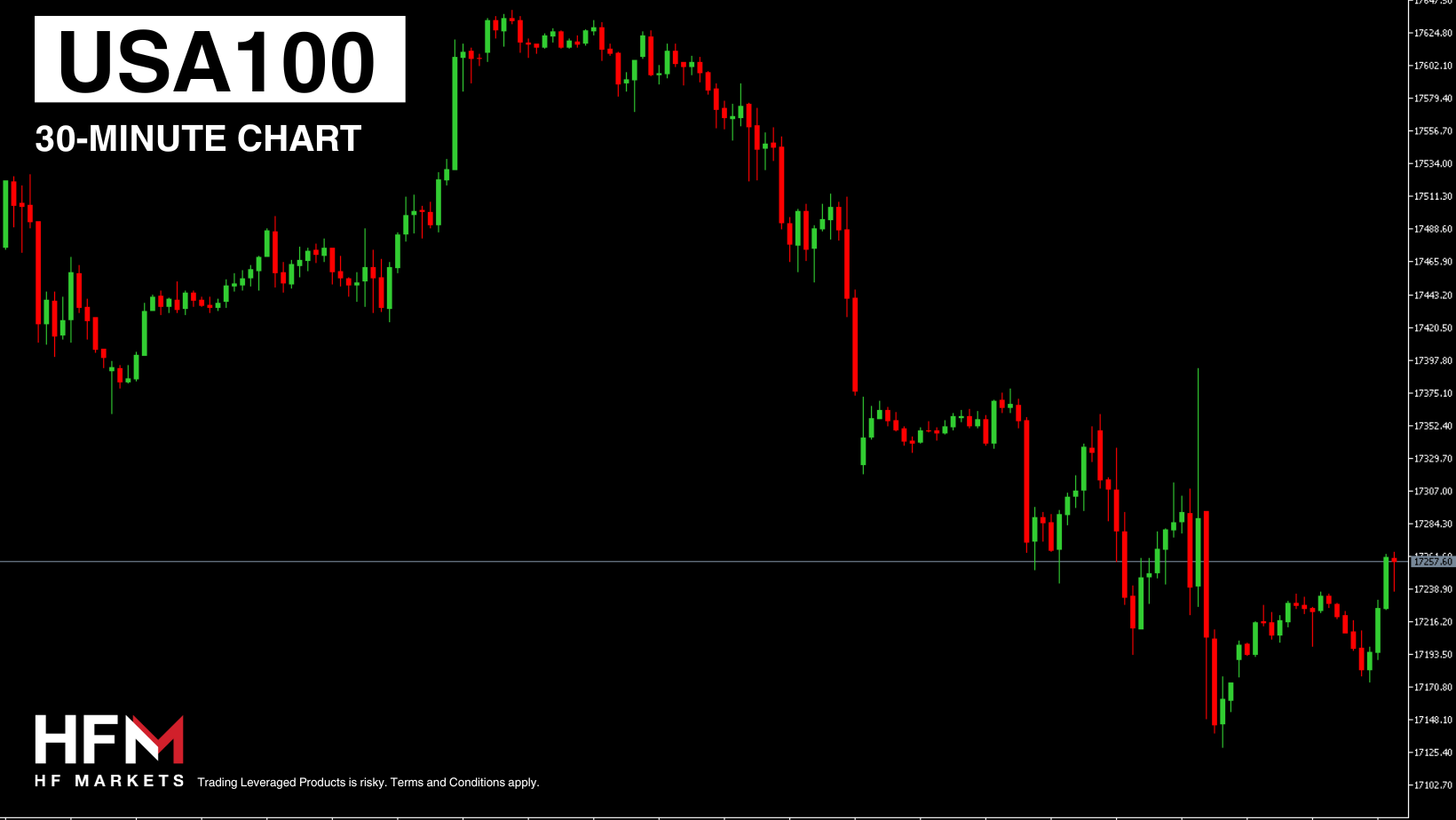

US Technology Stocks Decline Ahead of the Fed’s Press Conference.

* US Technology Stocks decline ahead of the Fed’s interest rate decision and press conference. Only the Dow Jones witnessed bullish price movement during the US session.

* Both Microsoft and Alphabet beat earnings and revenue expectations, but stocks declined. Find out why below.

* The Euro rose in value against all currencies on Tuesday, but the region’s Gross Domestic Product continues to indicate stagnation and a risk of a recession.

* The US Dollar Index trades higher but US Bond yields fall to weekly lows.

USA500

The SNP500 fell 0.33% during yesterday’s trading session and formed a 0.10% bearish gap during this morning’s Asian session. The price has since formed a price range which traders can use as a breakout level at $4,909.11 and $4,901.40. The decline in the index was largely triggered by the upcoming Federal Reserve Press Conference and “profit taking”, according to analysts.

Overnight the market focused on the quarterly earnings reports from Microsoft and Alphabet. Microsoft is the most influential stock and holds a weight of 7.31%. Microsoft stocks fell by 0.28% before the announcement and a further 0.25% after the announcement. Volatility levels were relatively low and according to analysts, the upcoming Fed announcement may potentially be the reason why. In addition to this, Microsoft did not add anything particular to their forward guidance which disappointed investors.

Microsoft Earnings beat expectations by 5.80% and Revenue by 1.45%. In addition to this, investors are also cautious about the fact that growth is largely being witnessed in the Azure and cloud services. Whereas the other 7 sectors are seeing relatively lower growth. Bloomberg advises the company earnings are solid and do not indicate a need for a selloff or significant decline. However, neither do we have any indications of upward price movement.

Alphabet stocks on the other hand saw a larger decline after their earnings report was published. The earnings per share figure was 2.50% higher than expectations and revenue only 1%. Even though the earnings were higher than expectations, shareholders were still largely disappointed. The previous 4 quarters saw earnings beat between 7% and 10%. According to analysts, investors took this as an opportunity to cash in profits and so there was no need to hold onto positions for the time being.

Of the USA500’s most influential 10 stocks, only 2 ended the day higher and from the 50 most influential stocks 28 rose in value. Here we can see that the individual stocks and components are not giving a clear picture and most likely tonight’s Fed comments will determine the price movement over the next 24-48 hours.

EURUSD

The Euro saw moderate increases against all currencies during the European session but lost momentum once the US session opened. However, the price this morning is showing much stronger volatility in favor of the Dollar. In addition to this the US Dollar Index is rising in value during this morning’s Asian Session. So, are investors increasing their exposure to the Dollar ahead of tonight’s Federal Reserve decision, statement, and press conference? Traders will monitor if this will be the pattern for the day.

The Dollar is once again being supported by considerably stronger than expected economic data. JOLTS Job Openings rose from 8.93 million to 9.03 million, higher than the previous 2 months and higher than expectations. In addition to this the CB Consumer Confidence also rose to its highest level since December 2021. If the Federal Reserve Chairman, Jerome Powell, gives a more hawkish press conference compared to recent ones, the Dollar can indeed potentially rise further. For example, if the Fed advises the FOMC will not vote for rate cuts in the first 2 quarters for the year.

When monitoring technical analysis, the price of the exchange is below trend lines, in the sell zone of oscillators and trading below the regression channels. All factors currently indicate Dollar dominance.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks