Date : 2nd December 2022.

Market Update – December 2 – USD holds at lows & Stocks at Highs Ahead of NFP.

Trading Leveraged Products is risky

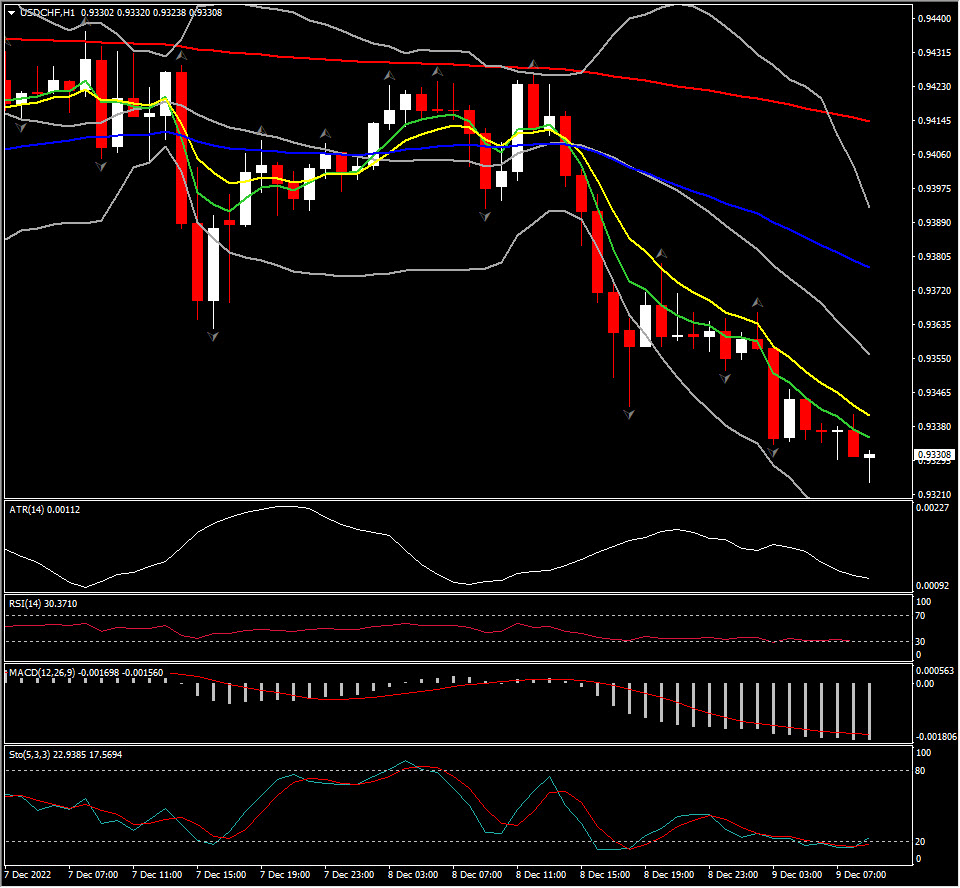

*The USD Index holds at lows not seen since August & June at 104.50 and significantly below the 200-day MA at 105.40. Weaker PCE inflation, lower JOLTS numbers, but tempered by a miss for Weekly Claims all added to pressure for yields too. 2/10 yr remains inverted by 71 bps. Stocks finished flat, Asian markets also flat except Nikkei (-1.59%) as JPY soars. All eyes on NFP; Consensus is a headline of 200k, less than 120k-150k and the USD could slip further, over 250-300k could lift the Greenback.

*EUR – broke over key psychological 1.0500 and holds at 5-mth highs at 1.0530 now.

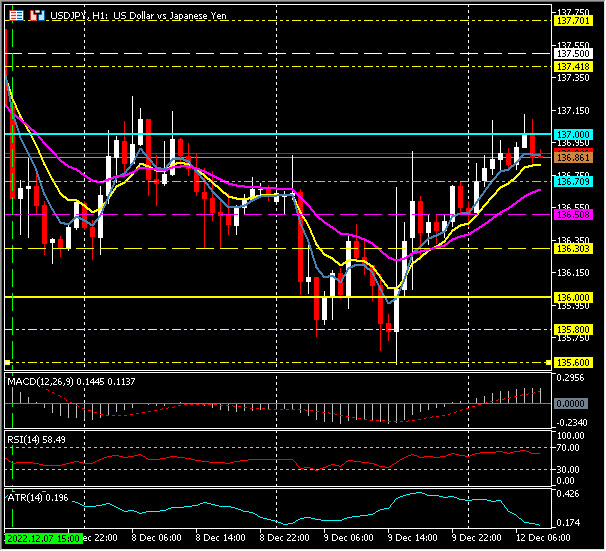

*JPY – collapsed to under 135.00 today and trades at 134.60 from 139.85 on Wednesday, hitting Japanese stocks.

*GBP – Sterling rallied again to breach 1.2300, briefly and post 5-month highs. Trades at 1.2260 now.

*Stocks – Wall Street held on to Wednesday’s gains closing flat – US500 -3.54 (-0.09%) 4076, Big movers included losses for CRM -8.27%, COST -6.56%, Blackstone -7.06%. FUTS trades at 4076 now too.

*USOil – Rallied again (4 consecutive days) to breach $83.00 before cooling to $81.25 now. OPEC meet over weekend and into Monday possibly

*Gold – Rallied to and broke the key $1800 and holds at $1802 now.

*BTC – Sentiment woes continue, but a weaker USD means it holds at 17k.

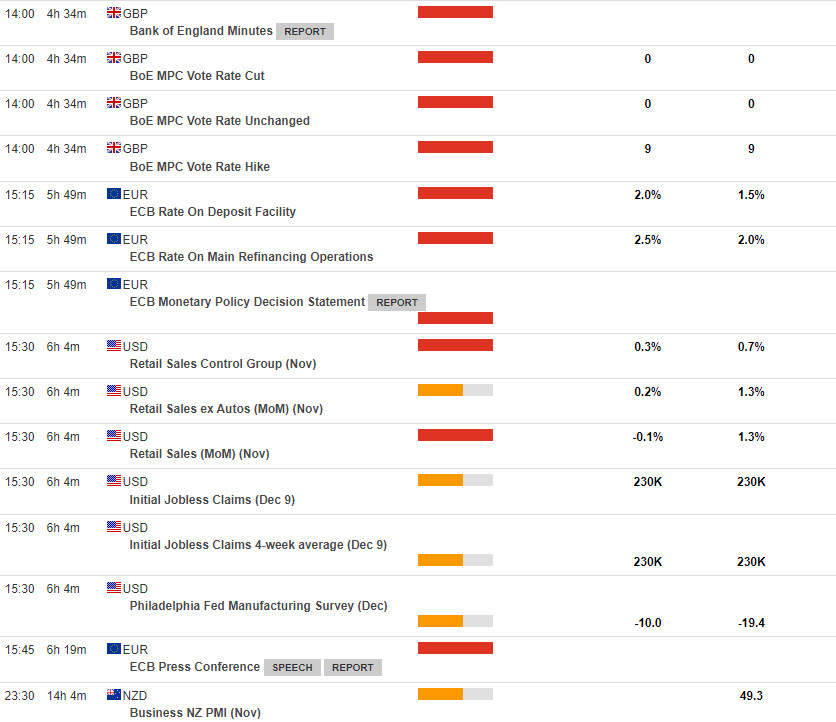

Today – US & Canadian Jobs Reports, EZ Producer Prices, Speeches from ECB’s Lagarde & de Guindos, Fed’s Barkin & Evans.

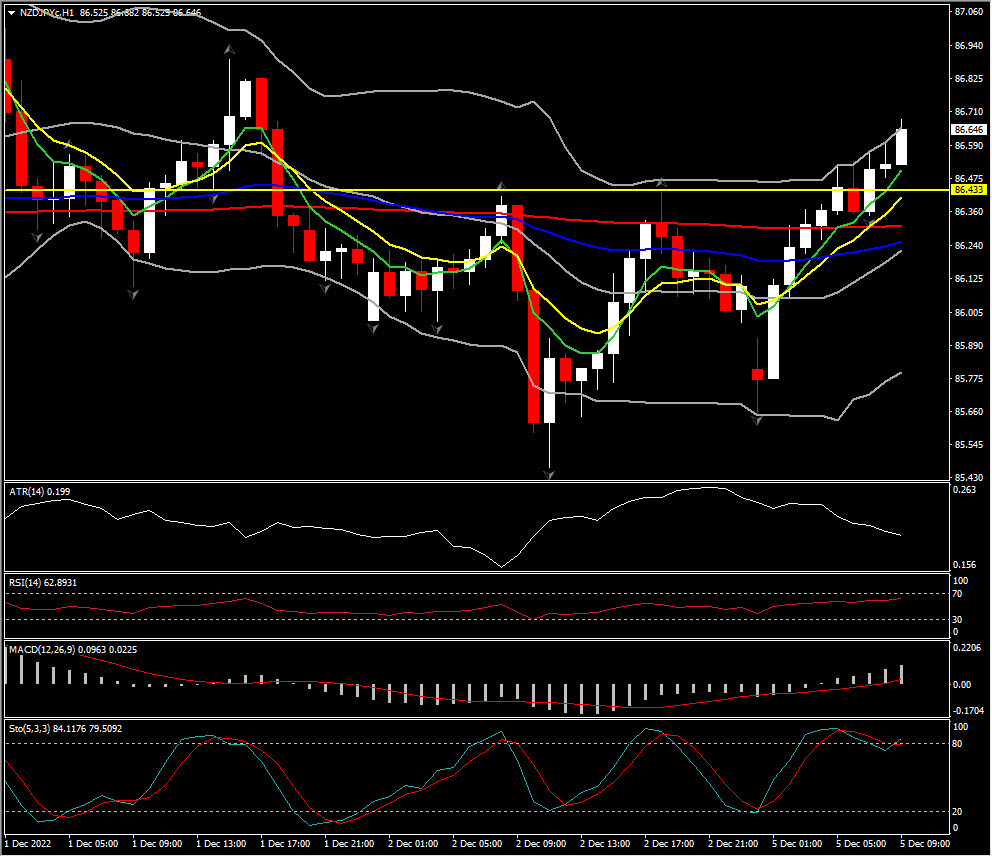

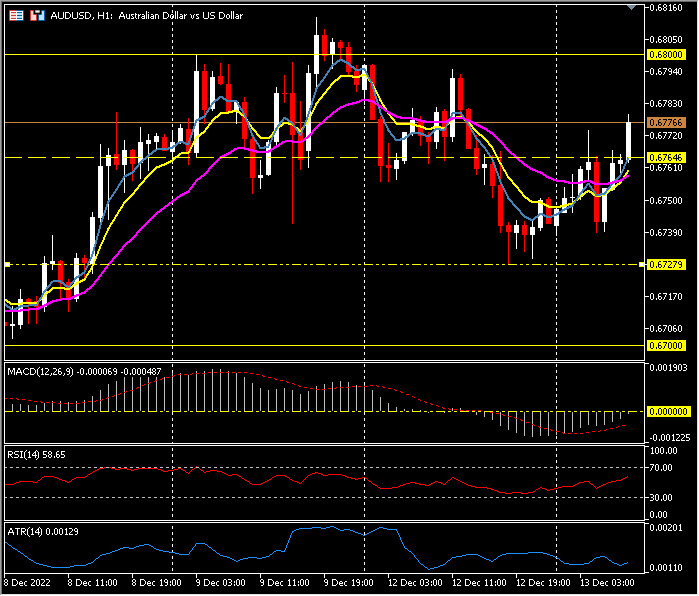

Biggest FX Mover @ (07:30 GMT) NZDUSD (+0.52%) rallied again to test 0.6400 today from 0.6300 yesterday and lows on Monday at 0.6150. MAs aligning higher, MACD histogram & signal line positive but falling, RSI 69.00 & rising, H1 ATR 0.00127, Daily ATR 0.0083.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

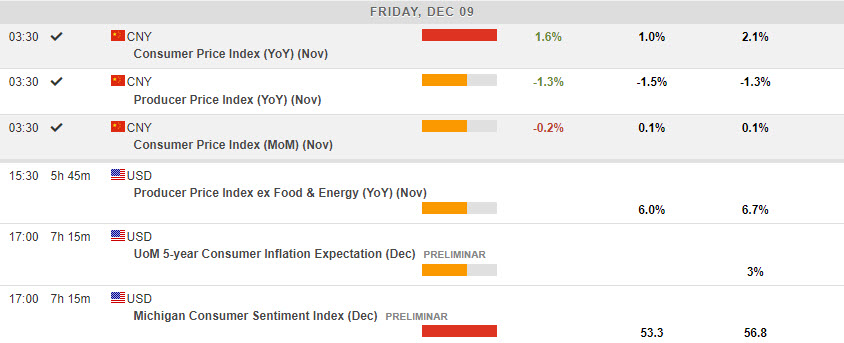

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks