Brent declines moderately following a surge to 81.00 USD

Brent prices surged to 81.00 USD amid increasing tensions in the Middle East. Growth may continue after a minor correction. Find out more in our Brent analysis for today, 8 October 2024.

Brent forecast: key trading points

- US data: the market awaits the API crude oil stock report today

- Current trend: correcting as part of the uptrend

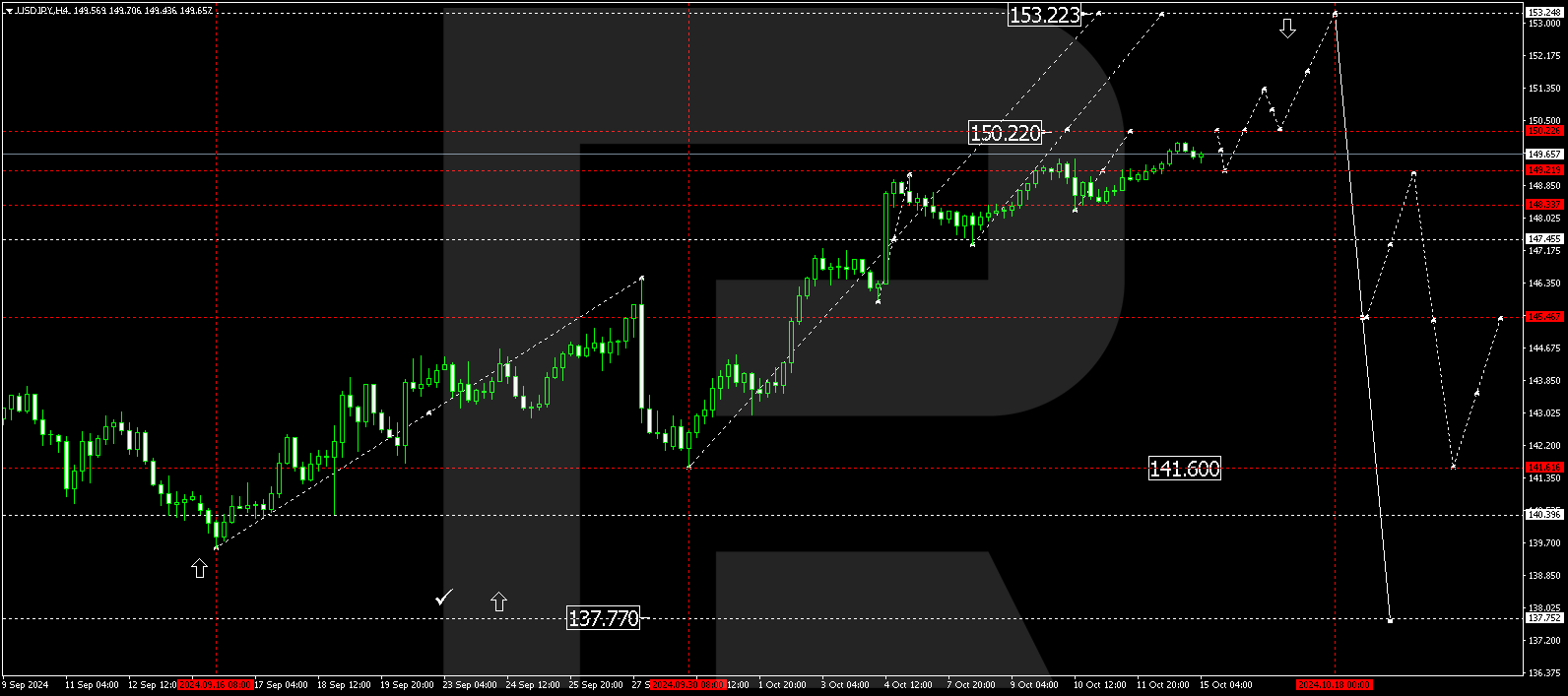

- Brent forecast for 8 October 2024: 81.00 and 77.00

Fundamental analysis

Brent quotes are experiencing a strong upward rally (rising by about 10% in a week) following escalating geopolitical tensions in the Middle East. The American Petroleum Institute (API) is set to release US crude oil stock data today. A decline in inventories may support Brent prices, while an increase may conversely push the asset price down.

The market is also awaiting US inflation statistics this week, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) due on Thursday and Friday. Oil will likely react to the US stock marketís response to inflation data. A rise will propel Brentís price, while a decrease will push it down.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks