Brent rebounds slightly, but the sell-off is not over yet

Brent oil has recovered to 61.17 USD. The sharp two-day drop has paused. Discover more in our analysis for 6 May 2025.

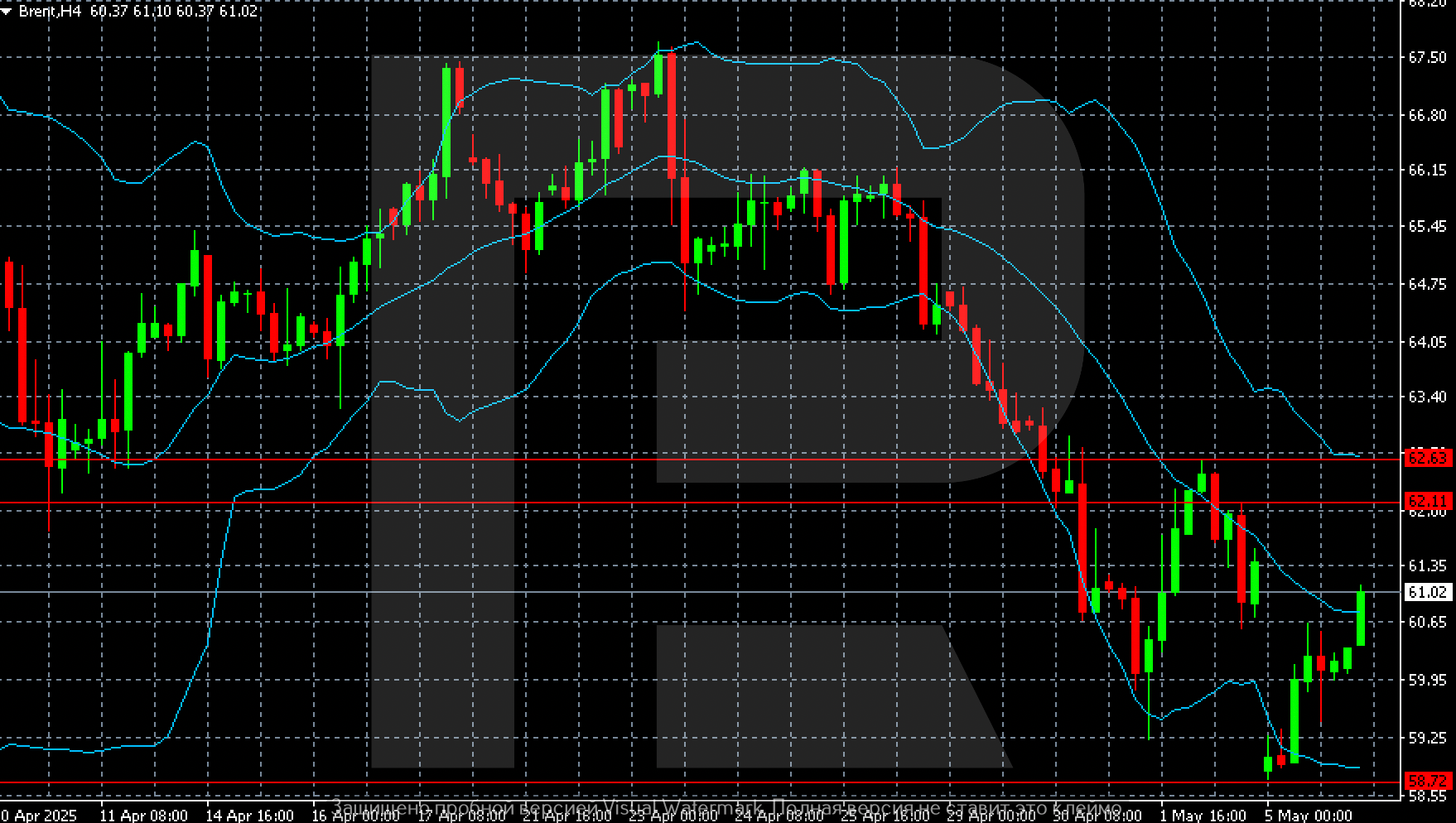

Brent technical analysis

On the H4 chart, Brent prices have rebounded from a local low of 58.72 and moved up towards 61.00. For the bounce to transition into a sustained reversal, prices must consolidate above 62.11. This would pave the way for further gains towards 62.63.

Brent prices have recovered after a steep drop, but still trade near four-year lows.

Read more - Brent Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks