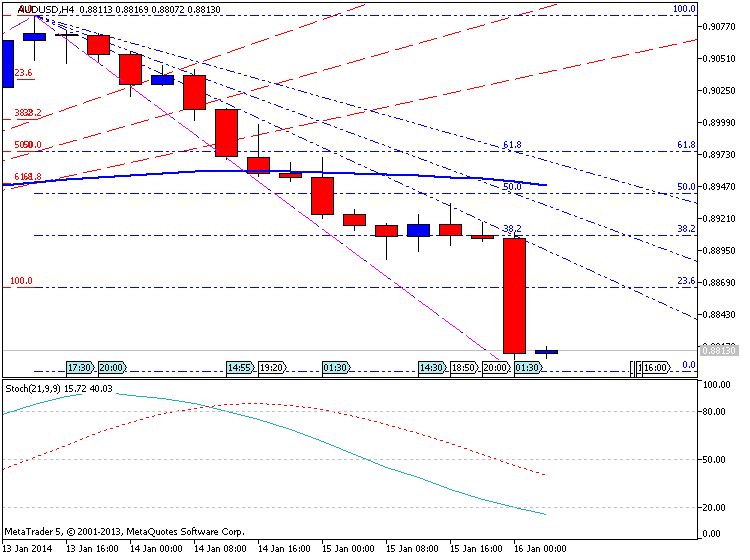

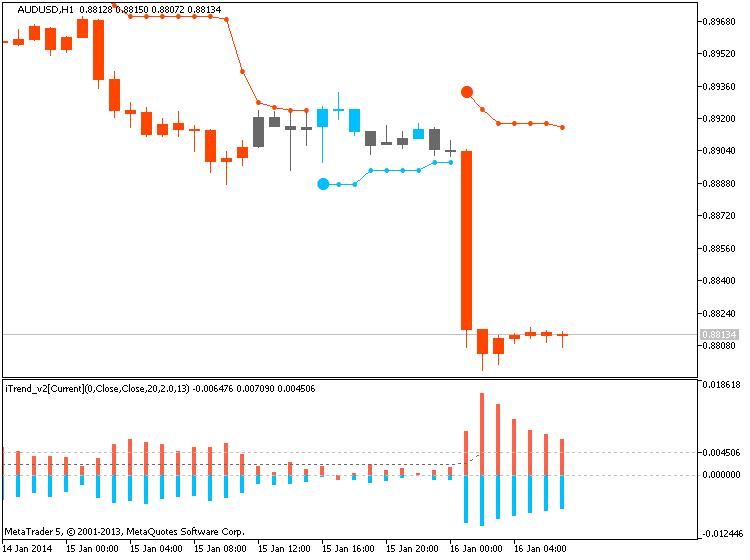

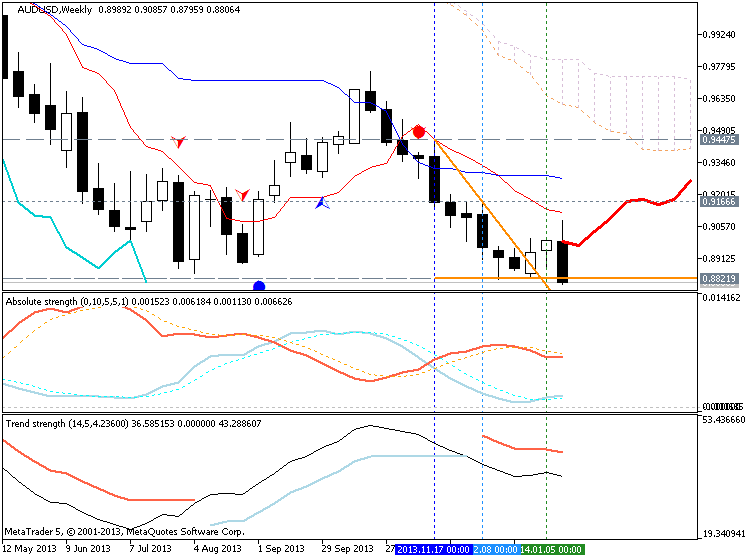

Australia posted a seasonally adjusted unemployment rate of 5.8 percent in December, the Australian Bureau of Statistics said on Thursday. That was in line with expectations and unchanged from the November reading. But the Australian economy lost 22,600 jobs last month to 11,629,500 versus expectations for an increase of 10,000 jobs following the addition of 21,000 jobs a month earlier.

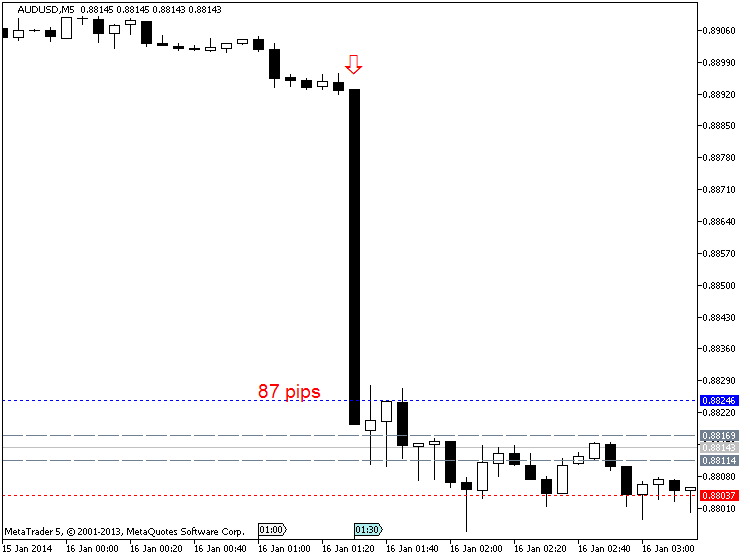

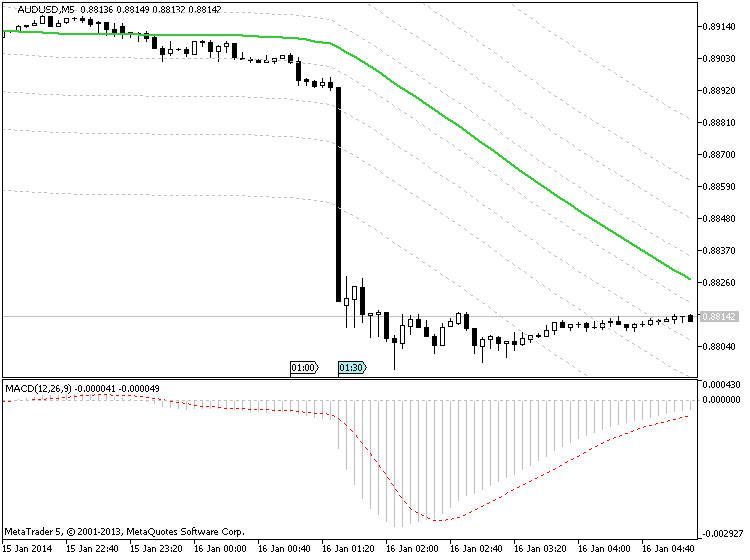

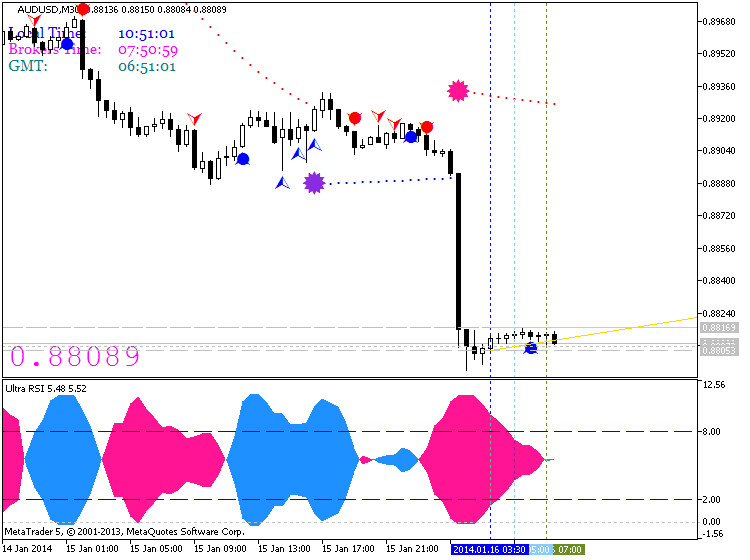

AUDUSD M5 : 87 pips price movement by AUD - Employment Change news event :

More...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks