British companies sharply raised their marketing budgets in the first quarter, extending the trend to four-and-a-half years, as their financial prospects improved, results of a survey by IHS Markit showed Wednesday.

more...

This is a discussion on GBP News within the Analytics and News forums, part of the Trading Forum category; British companies sharply raised their marketing budgets in the first quarter, extending the trend to four-and-a-half years, as their financial ...

British companies sharply raised their marketing budgets in the first quarter, extending the trend to four-and-a-half years, as their financial prospects improved, results of a survey by IHS Markit showed Wednesday.

more...

UK retail sales logged their biggest quarterly decline in seven years as high inflation curbed consumer spending at the start of the year. The retail sales volume decreased 1.4 percent sequentially in the first quarter, the most since early 2010, data from the Office for National Statistics revealed Friday. Sales had increased 0.8 percent in the fourth quarter of 2016.

more...

The average asking price for houses in the United Kingdom was up 1.1 percent on month in April, property tracker Rightmove said on Monday - checking in at a record 313,655 pounds.

more...

British consumer confidence decreased in the three months ended March as rising price pressures damped consumer spending, results of a survey by the professional services firm Deloitte showed Monday.

more...

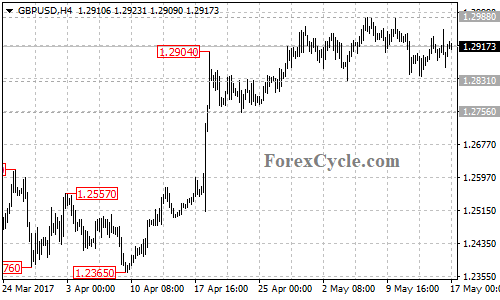

GBPUSD broke below 1.2864 support, indicating that the short term uptrend from 1.2756 had completed at 1.2965 already. Deeper decline could be seen in a couple of days, and next target would be at the bottom of the price channel on 4-hour chart. As long as the channel support holds, the fall from 1.2965 would possibly be consolidation of the longer term uptrend from 1.2365, and another rise towards 1.3100 could be expected after the consolidation. Key support is at 1.2756, only break below this level could signal completion of the uptrend from 1.2365.

-- ForexCycle.com --

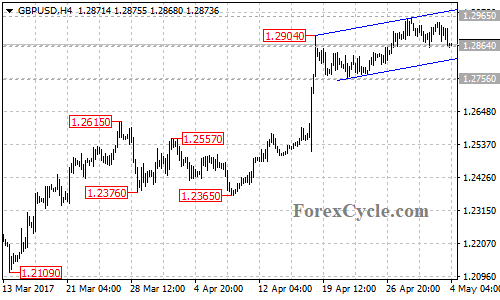

GBPUSD remains in uptrend from 1.2365, the fall from 1.2988 is likely consolidation of the uptrend. Near term support is at the bottom of the rising price channel on 4-hour chart. As long as the pair is in the channel, the uptrend could be expected to continue and next target would be at 1.3100 area. Key support is at 1.2831, only a breakdown below this level will indicate that the upward movement had completed at 1.2988 already, then the following downward movement could bring price to 1.2700 area.

-- ForexCycle.com --

British employers plan to raise basic pay the least in three-and-a-half years, thus confirming the trends revealed by the official labor market data that signaled a sharp slowing of wage growth, results of a survey by the Chartered Institute of Personnel and Development/CIPD showed Monday.

more...

GBPUSD continued its sideways movement in a range between 1.2831 and 1.2988. The sideways movement is likely consolidation of the uptrend from 1.2365. Further rise could be expected after the consolidation and a break of 1.2988 resistance could signal resumption of the uptrend. Support is at 1.2831, only a breakdown below this level will indicate that the upward movement had completed at 1.2988 already, then the following pullback could bring price back to 1.2700 zone.

-- ForexCycle.com --

British household finances are experiencing the most severe strain since the middle of 2014, amid subdued pay growth and as living costs rose at the fastest pace in nearly three years, survey data from IHS Markit and Ipsos Mori showed Wednesday.

more...

Bookmarks