S&P500: long positions are still relevant

20/02/2020

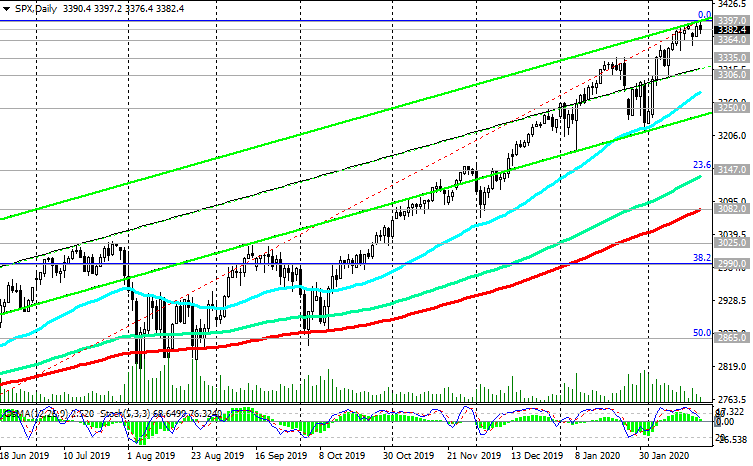

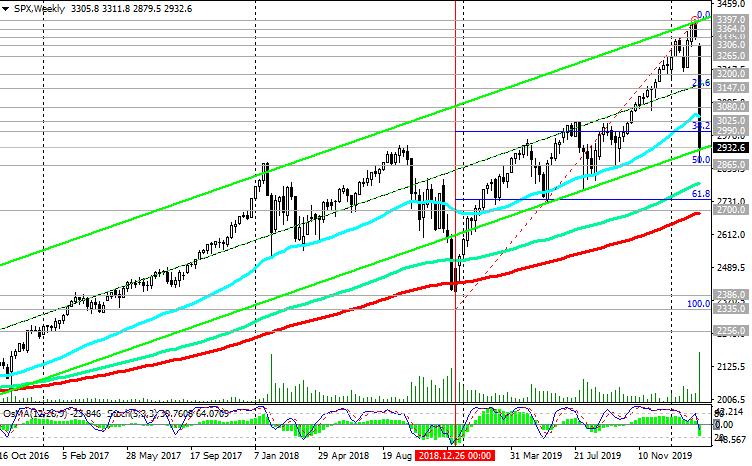

During today's Asian session, the S&P500 updated another record high near 3397.0 mark. Demand for US assets remains. In the current situation of the spread of coronavirus and the slowdown of the Chinese and global economies, the US economy looks most stable. During the January meeting, the Fed signaled increased optimism about the US economy. According to the minutes published Wednesday, Fed leaders "saw an improvement in the balance of risks for economic prospects compared to the previous meeting".

Demand for US assets is growing. So, according to data released last Tuesday, net purchases of US long-term securities by foreign investors in December amounted to $ 85.6 billion, which is $ 60 billion higher than forecast. Economists believe that in the second half of the year the results of American companies will improve.

This, along with expectations of a softer monetary policy by the Fed, creates the prerequisites for further growth of US stock indices.

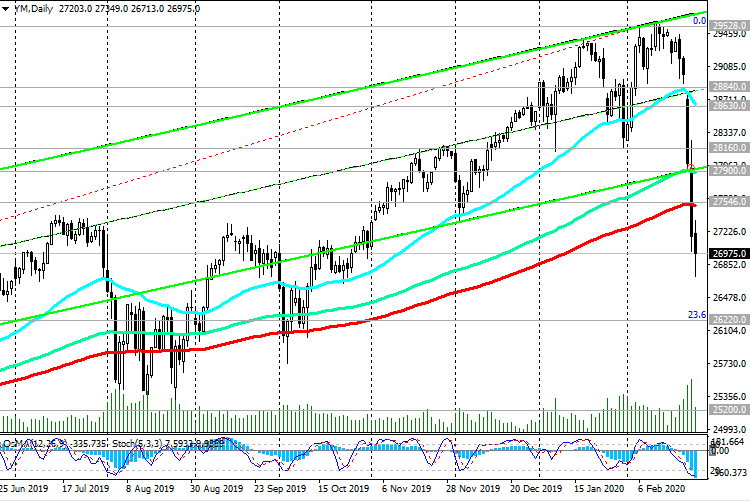

So, the Dow Jones Industrial Average on Wednesday trades increased by 0.4% to 29348.00 points, the S&P 500 grew by 0.5%, to a new record high of 3386.00 points, the Nasdaq Composite jumped 0.9% to 9817.00, also a new record high.

In the event of a breakdown of the local resistance level 3397.0, the S&P500 growth is likely to continue.

In an alternative scenario and after the breakdown of short-term support levels of 3364.0 (ЕМА200 on the 1-hour chart), 3306.0 (ЕМА200 on the 4-hour chart), the S&P500 correctional decline may continue to the support level 3250.0 (the lower border of the ascending channel on the daily chart and the highs of 2019). However, only a breakdown of support levels 3025.0 and 2990.0 (Fibonacci level 38.2%) will increase the risks of breaking the bullish trend of S&P500.

Today, investors will pay attention to the publication (at 13:30 GMT) of weekly data on the number of initial applications for unemployment benefits and the Conference Board index for January (at 15:00 GMT). This index represents the combined value of 10 economic indicators related to employment, new orders, consumer confidence, housing, stock market prices, lending trends and interest spreads. According to the forecast, the index is expected to grow by +0.4%, which is also a positive factor for US stock indices and the dollar.

The S&P500 index maintains a long-term positive trend. Above the support levels 3364.0, 3335.0, long positions are preferred.

Support Levels: 3364.0, 3335.0, 3306.0, 3250.0, 3147.0, 3082.0, 3025.0, 2990.0

Resistance Levels: 3397.0, 3400.0

Trading Recommendations

Sell Stop 3347.0. Stop-Loss 3398.0. Targets 3335.0, 3306.0, 3250.0, 3147.0

Buy Stop 3398.0. Stop-Loss 3347.0. Goals 3450.0, 3490.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks