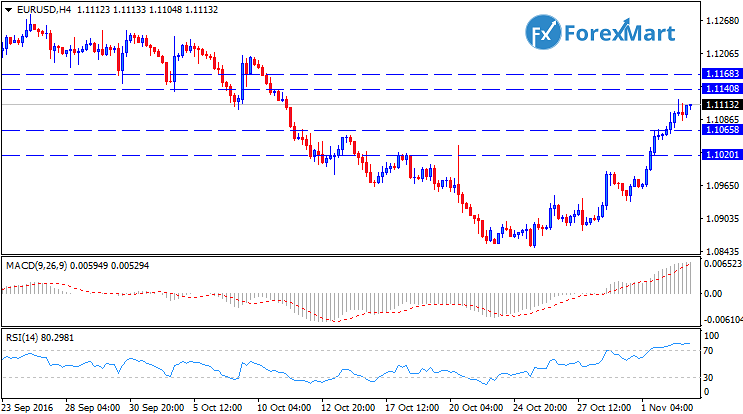

The EUR/USD pair increased up to 1.1068, its highest level reached in 3 weeks after the dollar traded significantly lower after the results of the US Presidential poll showed that Trump went one point higher than Clinton with regards to voters’ intentions. Meanwhile, US macroeconomic releases came out on a positive note after the Markit PMI data for October came out at 53.4, its highest data release for 2016.

In spite of positive US data which strengthens the possibility of an interest rate hike in December, the USD is still in danger of dropping in value during the Tokyo session due to the negative market sentiment with regards to the US dollar. The 4-hour chart for the currency pair exhibits high overbought rates for the technical indicators even though the EUR/USD had a bare minimum of additional 100 pips on a daily basis, which is also an indicator that there is a possibility that the EUR/USD could gain more profit.

The EUR/USD will have to go above its daily highs in order to incur more gains since this is the 50% retracements of its most recent drop in value. The movement of the EUR/USD is expected to slow down during the Tokyo session prior to the FOMC meeting which will determine whether the USD will be able to sustain its current bearish stance.

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks