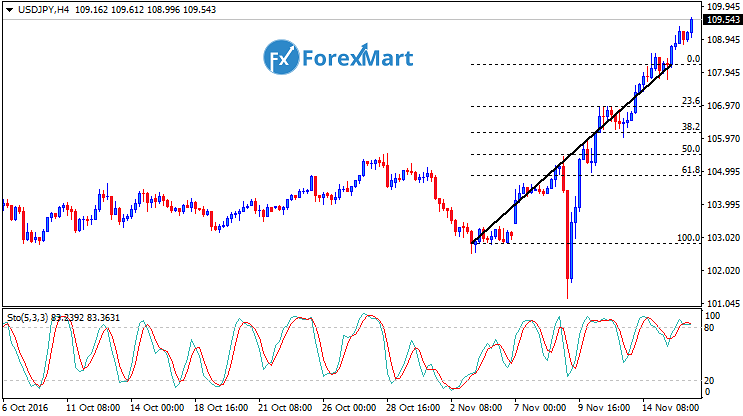

The USD continued to rise against the JPY as investor reaction caused the USD/JPY to reach its highest levels since June 2016. This has caused the market to reach its striking distance range since May at 111.44 points. The USD/JPY pair finished off the previous session at 109.181 points after increasing by 0.760 or +0.70%.

This recent rally was mainly caused by a sharp increase in US Treasury yields following the bullish report for the US retail sales data. The US Commerce Department has reported that retail sales data went up by 0.8% for the previous month, with September retail sales data revised to have increased by 1.0%. The retail sales data for both months were the highest data release since 2014, with retail sales data increasing by 4.3% as compared to last year.

Traders also reacted to an increase in import prices from 0.2% to 0.5%, a signal that inflation rates are now steadily increasing. The USD/JPY is expected to continue increasing towards 111.444 as US Treasury yields are still expected to increase further. Meanwhile, Japanese Government Bonds are still at the bottom range while US Treasury 30-year Bonds are steadily rising. Investors are waiting for the release of the Produce Price Index which is expected to maintain its previous reading of 0.3%. The data for the Capacity Utilization Rate is also expected to remain at 75.5%, while Industrial Production data could possibly show a slight increase from 0.1% to 0.2%.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks