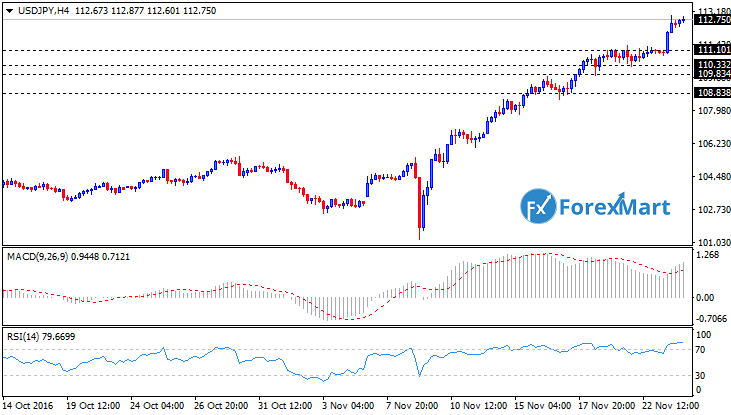

The Japanese yen exhibited significant losses during Monday’s session following the release of a negative-leaning Merchandise Trade Balance data. Meanwhile, the USD has been subject to buying interests due to increasing expectations of an eventual Fed rate hike in December.

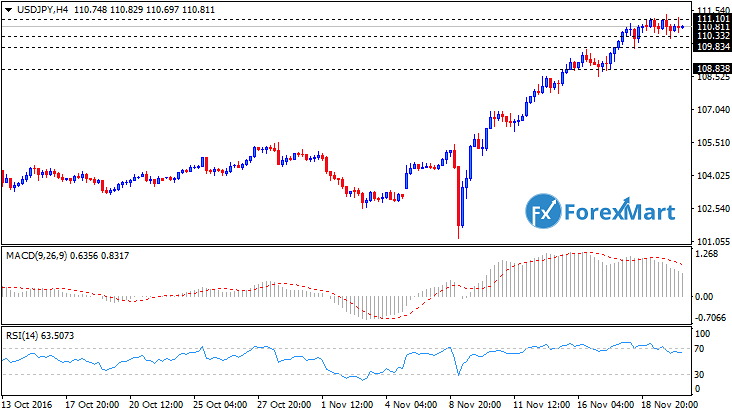

Although the USD/JPY pair was unable to increase further and reverted immediately after testing the 111.00 trading range, the currency pair was able to remain in the positive territory during the last trading session. As of now, the pair’s value is still in an upward direction and has somewhat shifted from its previous limit. The pair’s price went slightly higher in the USD/JPY’s 4-hour chart. Resistance levels for the currency pair can be found at 111.00 points, while support levels are expected to be at 110.00 points.

The MACD indicator for USD/JPY dropped, indicating a decrease in buyer positions. The MACD also exhibited a bearish stance for its hourly chart, while the RSI indicator for the pair was able to remain within its overbought readings. If the USD/JPY pair fails to go beyond 111.00, then this could cause the USD to drop in value and plummet to 110.00 points. If the pair breaches the 110.00 range, then this could lead to further decreases up to 109.00 points.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks