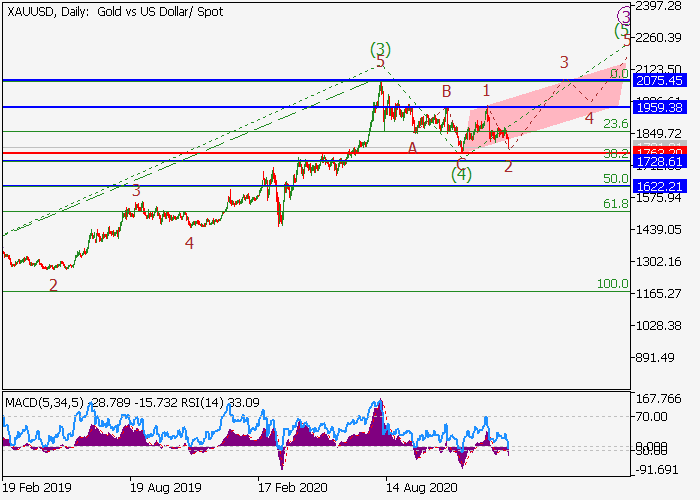

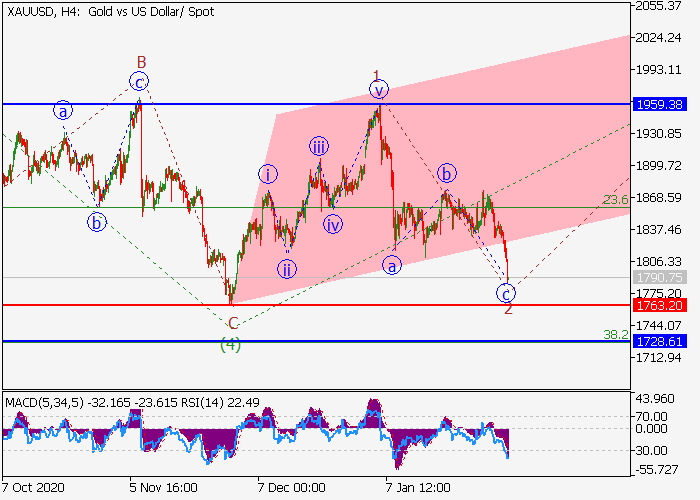

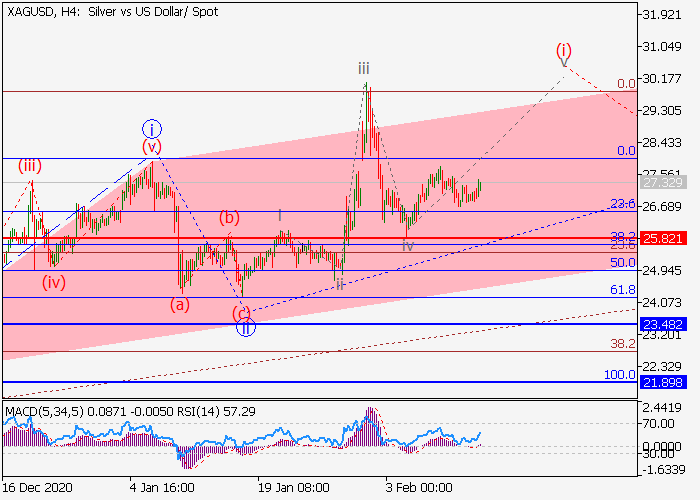

XAU/USD: wave analysis

The correction ends, the pair may grow.

On the daily chart, the third wave of the higher level (3) formed, a downward correction developed as the wave (4), and the wave (5) forms. Now, the first entry wave of the lower level 1 of (5) has formed, and a local correction is ending to develop as the wave 2 of (5), within which the wave c of 2 has formed. If the assumption is correct, the pair will grow to the levels of 1959.382075.45. In this scenario, critical stop loss level is 1763.20.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks