Forex Analysis & Reviews: Forecast for GBP/USD on November 4, 2022

The Bank of England raised the rate to the expected 0.75% and warned of two points: in the future, the pace of the rate hike will slow down, from the 3rd quarter the UK economy will enter a recession and it will last until mid-2024 with an increase in unemployment until the end of the 25th year to 6.4%. The pound fell by 230 points. Data on British GDP for the 3rd quarter will be released on November 11, the forecast of economists is -0.2%, obviously, the forecast coincides with the calculations of the central bank.

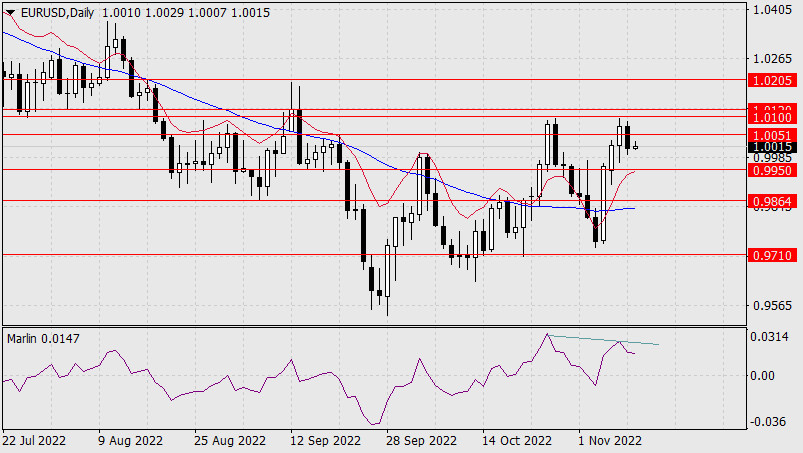

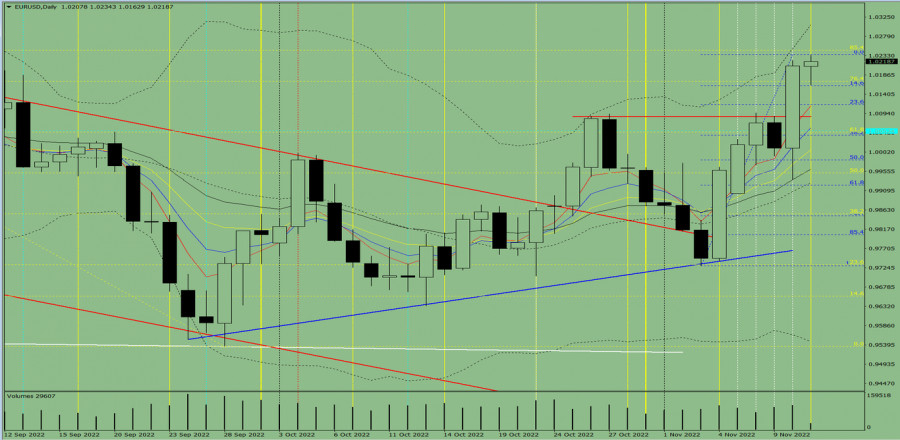

The decline continued to the target level of 1.1170 on the daily chart. The signal line of the Marlin Oscillator went below the zero line into the area of the downtrend. After the price settles under 1.1170, we are waiting for the pound to fall further to 1.0785 - to the line of the price channel of the higher timeframe.

On the four-hour chart, the price, together with the Marlin Oscillator, is turning into a slight correction. Perhaps the correction will last until the first noticeable resistance at 1.1260 - the former local support for October. After the end of the correction, we are waiting for a further fall towards the specified target.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

Read More https://ifxpr.com/3Nyw63c

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks