Elliott Wave Theory – Plenty of people will freely offer you advice on how to spend or invest your money. “Buy low and sell high,” they’ll tell you, “that’s really all there is to it!” And while there is a core truth to the statement, the real secret is in knowing how to spot the highs and lows, and thus, when to do your buying and selling. Sadly, that’s the part of the equation that most of the advice givers you’ll run across are content to leave you in the dark about.

The reality is that no matter how many times you are told differently, there is no ‘magic bullet.’ There is no plan, no series of steps you can follow that will, with absolute certainty, bring you wealth. If you happen across anyone who says otherwise, you can rely on the fact that he or she has an agenda, and that at least part of that agenda involves convincing you to open your wallet.

In the place of a surefire way to make profits, what is there? Where can you turn, and what kinds of things should you be looking for?

The answers to those questions aren’t as glamorous sounding as the promises made by those who just want to take your money, but they are much more effective. Things like careful, meticulous research. Market trend analysis. Paying close attention to extrinsic factors that could impact whatever industry you’re planning to invest in, and of course, Elliott wave theory. If you’ve never heard of the Elliott wave, you owe it to yourself to learn more about it.

Postulated by Ralph Nelson Elliott in the late 1930’s, it is essentially a psychological approach to investing that identifies specific stimuli that large groups tend to respond to in the same way. By identifying these stimuli, it then becomes possible to predict which direction the market will likely move, and as he outlined in his book “The Wave Principle,” market prices tend to unfold in specific patterns or ‘waves.’

The fact that many of the most successful Wall Street investors and portfolio managers use this type of trend analysis in their own decision making process should be compelling evidence that you should consider doing the same. No, it’s not perfect, and it is certainly not a guarantee, but it provides a strong framework of probability that, when combined with other research and analysis, can lead to consistently good decisions, and at the end of the day, that’s what investing is all about. Consistently good decision making.

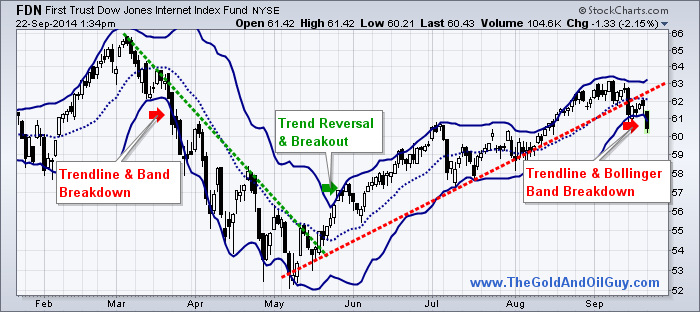

We use Elliott Wave Theory in real time by looking at the larger patterns of the SP 500 index for example. We deploy Fibonacci math analysis to prior up and down legs in the markets to determine where we are in an Elliott Wave pattern. This helps us decide if to be aggressive when the markets correct, go short the market, or to do nothing for example. It also prevents us from making panic type decisions, whether that be in chasing a hot stock too higher or selling something too low before a reversal. We also can use Elliott Wave Theory to help us determine when to be aggressive in selling or buying, on either side of a trade.

For many, its not practical to employ Elliott Wave analysis with individual stocks and trading, but it can be done with experience. We instead use a combination of big picture views like weekly charts, Wave patterns within those weekly views, and then zoom in to shorter term technical to determine ultimate timing for entry and exit. This type of big picture view coupled with micro analysis of the charts gives us more clarity and better results.

One of our favorite patterns for example is the “ABC” pattern. Partially taken from Elliott Wave Theory, we mix in a few of our own ingredients to help with timing entries and exits. This is where you have an initial massive rally or the “A” wave pattern. Say a stock like TSLA goes from $30 to $180 per share, which it did. The B wave is what you wait for and using Fibonacci analysis and Elliott Wave Theory we can calculate a good entry point on the B wave correction. TSLA dropped from $180 to about $ 120, retracing roughly 38% (Fibonacci retracement) of the rally $30 to $180. The B wave bottomed out as everyone was negative on the stock and sentiment was bearish. That is when you get long for the “C” wave. The C wave is when the stock regains momentum, good news starts to unfold, and sentiment turns bullish. We can often calculate the B wave as it relates often to the A wave amplitude. Example is the TSLA “A” wave was 150 points, so the C wave will be about the same or more.

When TSLA recently ran up to about $270 per share, we were in uber bullish “C” wave mode, and we had run up $150 (Same as the A wave) from $120 to $270. That is when you know it’s a good time to start peeling off shares. Often though, the C wave will be 150-161% of A wave, so TSLA may not have completed it’s run just yet.

Knowing when to enter and exit a position whether your time frame is short, intermediate, or longer… can often be identified with good Elliott Wave Theory practices. Your results and your portfolio will appreciate it, just look at our ATP track record from April 1 2013 to March 3rd 2014 inclusive of all closed out swing positions.

We incorporated Elliott Wave Theory into our stock picking starting last April and you can see the results:

See more here.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks