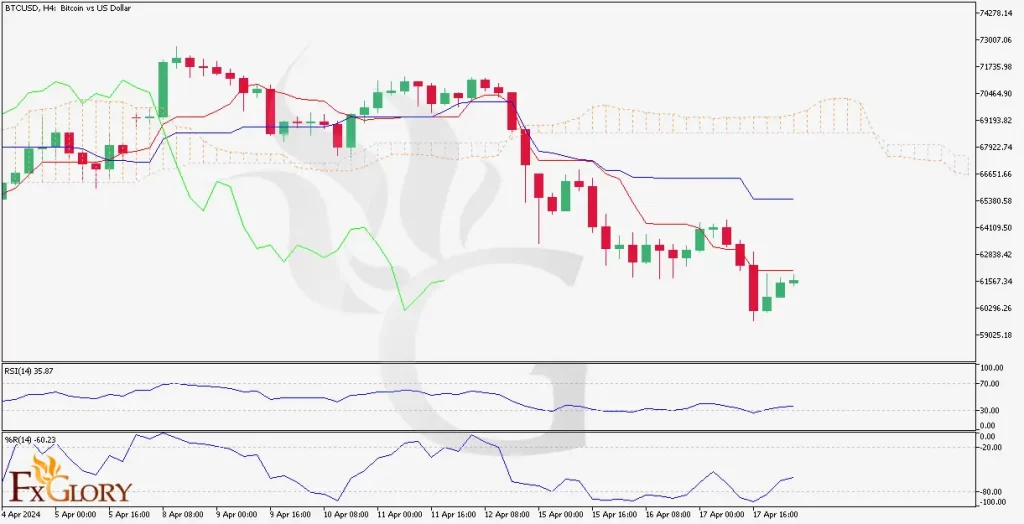

BTCUSD analysis for 18.04.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Bitcoin's valuation against the US Dollar is greatly influenced by a mix of market sentiment, technological developments, regulatory news, and macroeconomic trends. Global economic uncertainties and inflation rates are fundamental factors that can drive investors toward Bitcoin as a potential hedge. Additionally, changes in regulatory stances in key markets, such as recent legislation or enforcement actions, can significantly impact Bitcoin's price. The growing interest in decentralized finance (DeFi) and institutional investment in cryptocurrency also contribute to BTCUSD dynamics.

Price Action:

The H4 timeframe for BTCUSD shows a downtrend with the price moving below the Ichimoku cloud and key moving averages. The market has been forming lower highs and lower lows, which is indicative of a bearish sentiment in the short to medium term. There has been a slight recovery in the most recent price action, but the market remains under bearish pressure.

Key Technical Indicators:

Williams %R: The Williams Percentage is currently indicating oversold conditions, which could hint at a potential short-term reversal if buyers step in.

RSI (Relative Strength Index): The RSI is below the 50 threshold, which typically suggests bearish momentum, although it is not in the oversold territory, leaving room for potential downward movement.

Ichimoku Cloud: Price is trading below the Ichimoku cloud, indicating that the path of least resistance is to the downside and confirming the current bearish trend.

Support and Resistance:

Support: The nearest support is found at the recent low around $59,025, with a more substantial support zone near $58,000.

Resistance: Immediate resistance can be seen near the lower boundary of the Ichimoku cloud, followed by a stronger resistance at the $62,388 level, which aligns with the cloud's upper boundary.

Conclusion and Consideration:

The BTCUSD pair on the H4 chart is exhibiting bearish tendencies with the price action and technical indicators suggesting a continuation of the downtrend. The market could be ripe for a short-term bounce due to the oversold Williams %R indicator, but the overarching trend remains downward. Itís critical for traders to keep an eye on global economic indicators and crypto-specific news, which could abruptly influence the market. Implementing robust risk management strategies is vital, particularly given Bitcoinís historical volatility.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FxGlory

18.04.2024

4Likes

4Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks