Thanks, Igor.

it is unusual but functional. you have mixed two algorythms.Very good.

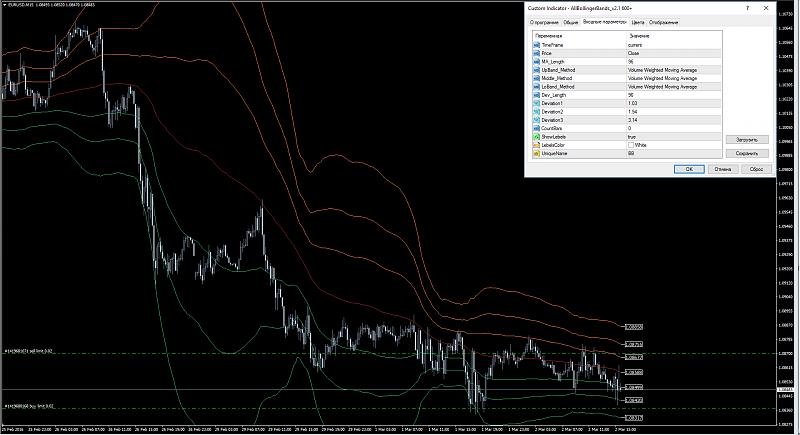

Below there is a chart that represents prices quite well. Look at it.

Below I have shown VWMA with bands (I published the indicator at this thread as well). The lines are dotted.

Look, they are almost the same and validate each other. Perfect !

Best

D.P.

79Likes

79Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote.gif)

Bookmarks