Talking Points

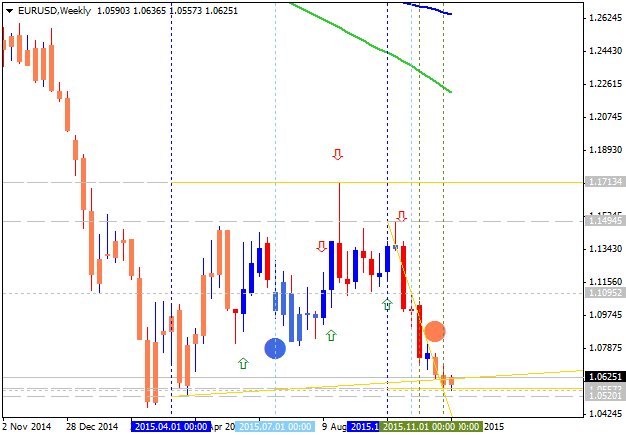

-Short term triangle keeps the larger triangle pattern in play

-An immediate move below 117.28 negates the short term triangle

-Look for resistance 119-120 to end wave D of a bullish triangle

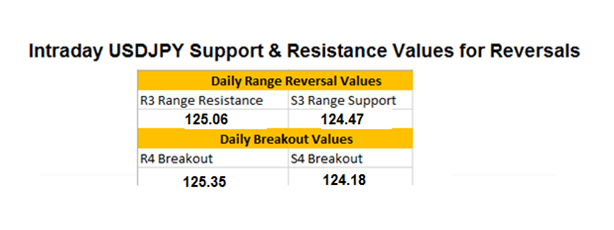

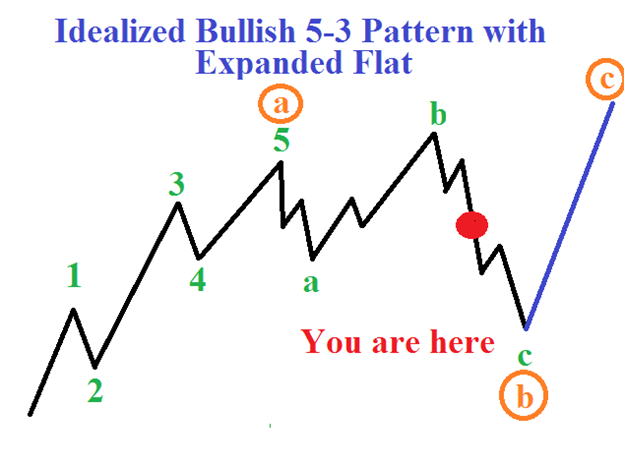

The USDJPY has been stuck in a sideways range since December and appears to be carving out a larger degree 4th wave triangle. That means that each of the 5 sub-waves of the triangle should shape up as a zig-zag, triangle, or combination between them.

Indeed, the price action for the past week appears to be carving out a smaller degree triangle. Triangles are one of my starting points in identifying a wave count because there are only certain places in the count where triangles form.

Therefore, this smaller degree triangle is in play so long as we are above 117.28. Use this level as risk for a revisit to the 119-120 handle.

USD/JPY 2 Hour Price Chart

More...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks