Talking Points

- NFP Is a Highly Anticipated News Event

- Expectations are Set at 230k

- Traders Will Track the USD Based on Results

The release of the monthly Non-Farm Payroll figures is a highly anticipated moment for Forex traders. This is with good cause as the Non-Farm Payrolls, also known as NFP, has been historically known to produce volatility in the market place. As with other news releases on the economic calendar, traders will use this data to determine the strength or weakness of the underlying economy. NFP specifically looks at whether the US economy is expanding or contracting through new jobs being added to the labor force. With NFP set to be released this Friday at 8:30am ET,let’s take a momentto preview this week’s upcoming event.

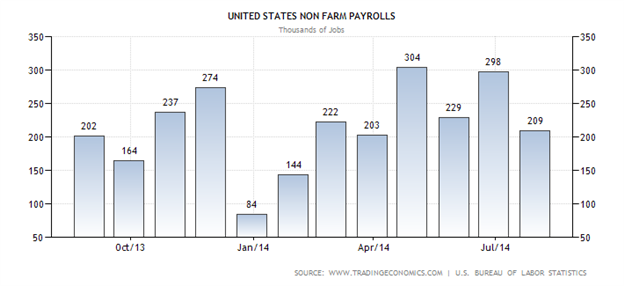

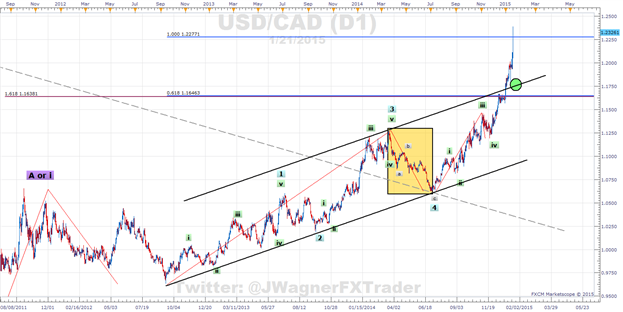

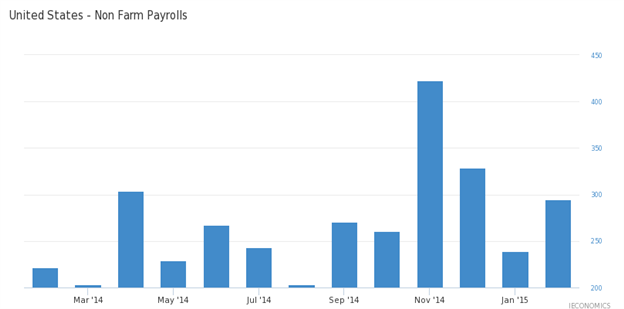

First, NFP looks specifically at net changes in employment as jobs are created or subtracted in an economy in any given month. The term Non-Farm is used since farm / agricultural workers are not included in the employment count. The decision to not include agricultural jobs lies in these jobs being largely seasonal that could possibly produce small temporary shifts in labor reporting. Below we can see a composite of past NFP events from September 2012 through last month’s release. Through graphing we can see that employment figures have gradually been getting higher, after bottoming with the 2014 low of Just 84k new jobs reported in January.

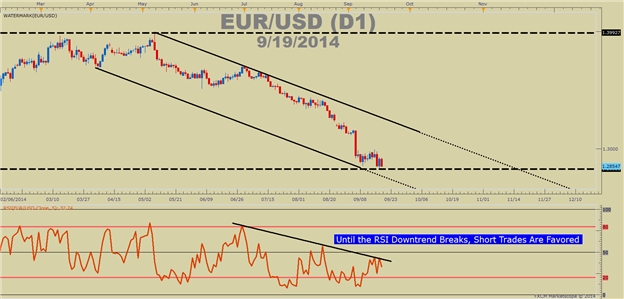

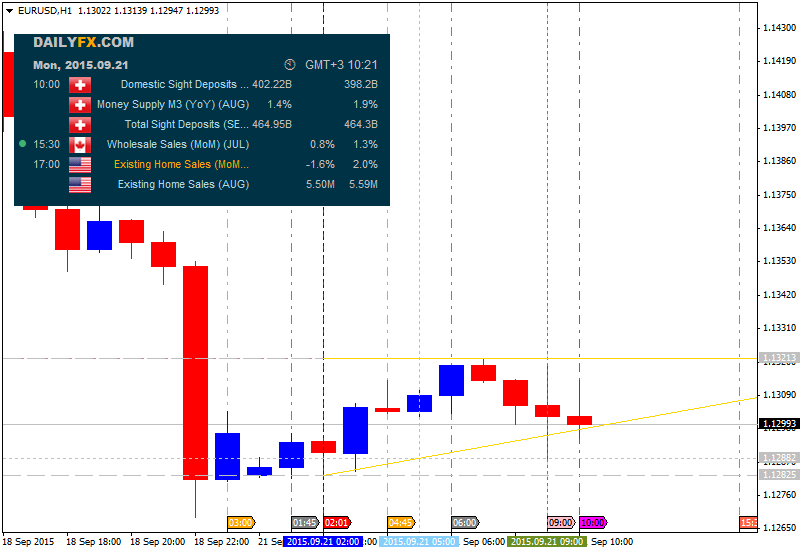

To get an idea of what may be in store for this week’s NFP announcement, we can take a moment and review last month’s event. Below we can see a EURUSD 5 minute chart tracking price during the NFP news release. NFP numbers were expected to be released at 230k, meaning analysts expected 230,000 new jobs to be added to the economy. However, at the time of release the NFP number was issued lower than expected at 209k. Traders were left to react to this lower number with the market immediately reacting by selling off the US Dollar. After a few hours price action settled with the EURUSD increasing in value as much as 58 pips from the event low at 1.3189.

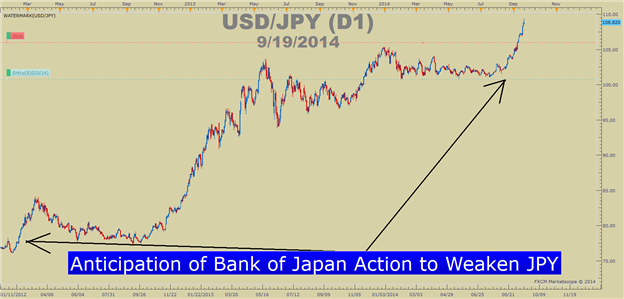

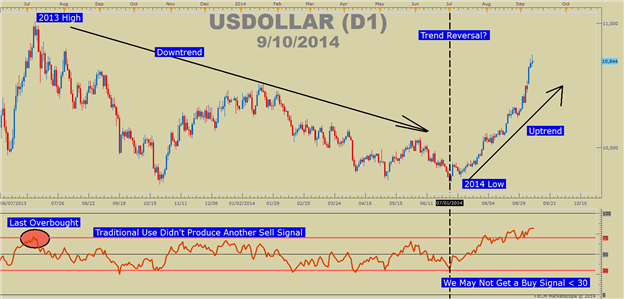

It should be noted that even though the news print was slightly lower than expected, traders generally took this data as USD positive. The August 1st high at 1.344, proved to be the monthly high for the EURUSD, with the USD rallying as much as 333 pips against the EUR through yesterday’s price action.

EURUSD August 2014 NFP Release

So what should traders look for this month, with NFP totals again being released on Friday the 5th? Expectations are set for 216k new jobs to be created. Taking a cue from last month’s report, if expectations are missed this could again lead to a selloff of the US Dollar across multiple currency pairs. However if NFP numbers are better than expected, or if the number is a narrow miss, traders may take this as a positive sign and look for the US Dollar to rally. Once a direction is established traders can then trade the news using the strategy of their choosing.

---Written by Walker England, Trading Instructor

More...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks