The Definitive Guide to Scalping, Part5: Scalping Ranges

Talking Points

- When markets are flat, scalpers can trade ranges.

- Traders should identify support & resistance before considering entries.

- Range trading can continue until price breaks.

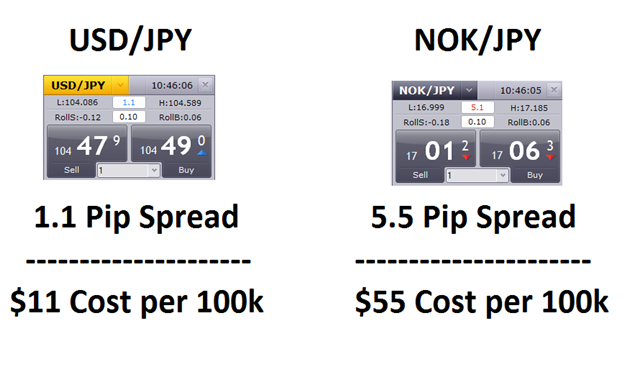

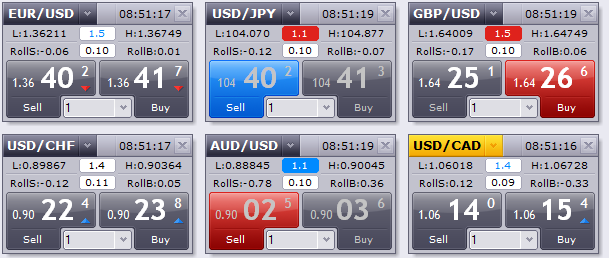

Scalpers have a variety of choices when it comes to an execution strategy. This decision should be decided after carefully evaluating current market conditions for the currency pair of their choosing.

For today’s scalping lesson, we will focus on ranges and how to trade them by planning entries between key levels of support and resistance.

Learn Forex – USDCHF Scalping Ranges with Cam Pivots

Trading the Range

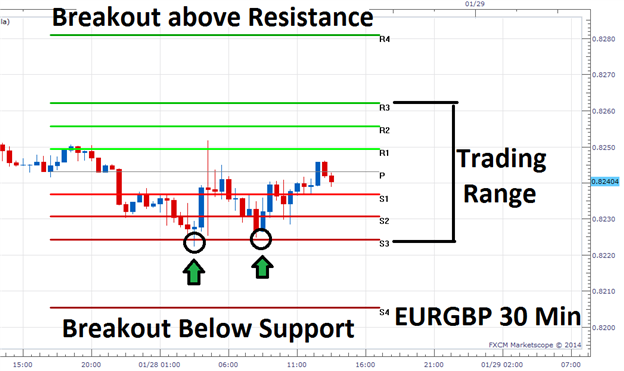

As a range trader our first task is to identify key levels of support and resistance. This can be done through a variety of methods mentioned in the 4th installment of the Definitive Guide to Forex Scalping. Once traders have found these points and price is confirmed to be traveling in a range, entries become very straight forward. Traders can set an entry order to sell levels of resistance and buy levels of support. From this point, scalpers must become patient and wait for the market to turn at one of these designated points.

In the example below, we can see this technique in action. Support and resistance have been found using Camarilla pivot points. Traders can set entry orders to sell the USDCHF back in the direction of the primary trend, near resistance at .9051. In the event that price touches these entries, they will be executed selling the USDCHF. Risk has been managed by placing a stop at the next line of resistance, designated as R4 at .9068. Taking profit should be done when price has reached the opposing point of the range. When selling a range, limit orders can be placed at support. Conversely in the event of buying range support, price targets can be set at range resistance.

Learn Forex – USDCHF Range Entries & Targets

Ranges with Oscillators

Traders can also choose to scalp market ranges

through the use of an oscillator. Again traders should wait for price to reach a key level of support and resistance prior to considering an entry. Once this occurs, traders can turn to an indicator such as MACD, CCI, or RSI to time their entry. In the event price touches resistance, as highlighted below, traders will enter the market on a return from an overbought level. This process can be replicated to buy levels of support when Oscillators cross back above an oversold value.

Trading with an oscillator can potentially help trader’s better find market momentum and even keep traders out of some bad positions. However, it should be noted that this does not give scalpers license to use sloppy risk management! Just as we would with our example using entry orders, traders can manage risk by placing a stop above the next line of resistance, while targeting range support to take profit using limit orders.

Learn Forex – USDCHF Range Entries with CCI

It should be noted that ranges can be traded as long as support and resistance remain intact! In the event the currency pair you are trading breaks or begins trending, it will be time to abandon the range and either switch to a new chart or a new strategy.

This concludes the 5thinstallment of The Definitive Guide to Scalping. If you missed one of the previous installments, don’t worry! You can catch up on all the action with the previous articles linked below.

---Written by Walker England, Trading Instructor

More...

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks