High-frequency trading gives players the edge on JSE. A FIFTH of the JSE’s equity activity came from high-frequency computerised trading earlier this week, CEO Nicky Newton-King says. When the JSE launched its co-location centre in May, it accounted for about 5% of equity activity. In the past month co-location activity had accounted for 18%-20% of the JSE’s equity trading, Ms Newton-King said.

SEC Likely Won’t Enact Stand-Alone High-Frequency Trading Rules.

For all the controversy over the problems associated with high frequency trading, regulators don’t seem like they’re in much of a rush to fix things.

The FOX Business Network learned the Securities and Exchange Commission has all but ruled out enacting a separate set of laws to combat improprieties involving high-frequency trading. Instead, Wall Street's top cop will likely enact a broader set of market reforms to deal with a myriad market-structure issues, including the high-speed trading, sometime next year.

“I think that the big banks are going to wake up and now in the era of billion dollar fines they’re going to find that the money they make from their dark pools is so small and the regulatory risk is so large, I think a lot of people are going to say it’s not worth it,” Seth Merrin, the chief executive of Liquidnet, a global institutional trading network said.

High Frequency, Fat Target - Michael Lewis misses the competitive benefits of computerized Wall Street trading.The book review.

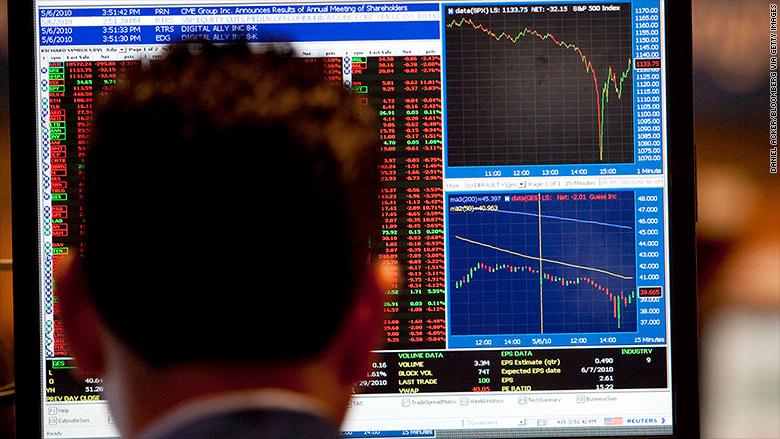

For the last five years, the press has been sounding alarms about high-frequency trading (HFT), a practice in which investors use fast computers driven by secret algorithms to rapidly trade securities. Time wondered in a 2012 headline whether the practice is "Wall Street's Doomsday Machine." Mother Jones in 2013 worried it could "set off a financial meltdown." In March of this year, 60 Minutes aired an infomercial-toned segment promoting the new Investor's Exchange (IEX) trading venue, which, according to IEX's website, is "dedicated to institutionalizing fairness in the markets" by slowing down trades.

Now we have Flash Boys, Michael Lewis' highly lauded attempt to explain the dark ways of Wall Street to the masses.

SEC announces first-ever market manipulation case against high-frequency trading firm.

On October 16, 2014, the US Securities and Exchange Commission (SEC) announced a settlement in the amount of US$1 million with Athena Capital Research LLC to resolve claims of market manipulation involving Athena’s use of complex trading algorithms to manipulate the closing prices of thousands of stocks by flooding the market with massive numbers of buy or sell orders during the final seconds of the trading day, a manipulative practice typically known as “banging the close.”1 This action represents the first-ever market manipulation case brought by the agency against a high-frequency trading (“HFT”).

Swiss Banks Letter, Canadian HFT Rules, Tesco Chair: Compliance. The article.

High Frequency Trading or Insider Trading? Is Michael Lewis just a disgruntled investor, or is there any merit to his claim? It would appear that more than just his harsh criticisms have moved federal agencies to dig deeper into the mystery.

What Is High Frequency Trading?

The Truth Behind High Frequency Trading And Its Impact On The Small Investo. The article.

TMX Group to install ‘speed bump’ to slow HFT traffic, ahead of Aequitas launch. Toronto Stock exchange owner TMX Group Inc. is introducing a “speed bump” to counter high-frequency traders.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks