Forex Weekly Outlook June 16-20

The dollar and the euro were on the back foot in the past week. The focus is now on the Fed decision and the UK inflation data. In addition, the Philly Fed Manufacturing Index and inflation figures will be of interest. Here are the main events on our FX calendar. Here is an outlook on the market-movers for the coming week. A jump in US job openings underpinned the US dollar. While this figure is lagging, it closely watched by the Federal Reserve. However, other figures from the US, such as retail sales, were mediocre. The UK enjoyed encouraging employment figures that lift the prospects of an early rate hike, and Carney indeed explicitly said that a rate hike make come sooner than later, sending the pound jumping up.. In Europe, the lower bond yields and the implementation of the negative deposit rate weighed on the common currency. Another currency that stood out is the kiwi that leaped up: the RBNZ hiked the rate and did not signal a pause.

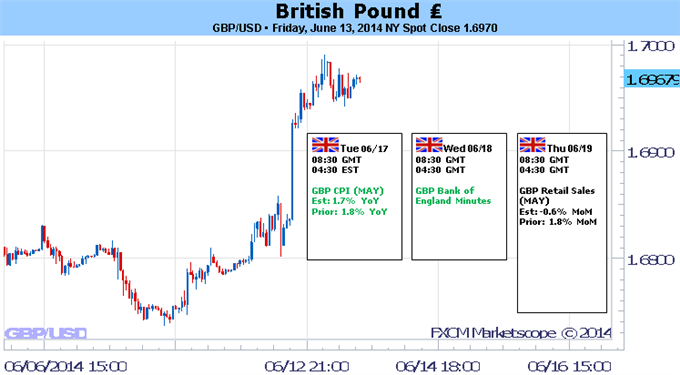

- UK inflation data: Tuesday, 8:30. Annual inflation in the UK edged up to 1.8% in April, rising for the first time in almost a year, following 1.6% in the previous month. The main cause for this rise was higher travel and energy prices. Analysts expected a smaller climb of 0.1%. However rising inflation ignites new fears that the standard of living will decline due to falling wages. CPI is expected to slide to an annual level of 1.7%. The RPI is predicted to remain at 2.5% and Core CPI to slide to 1.7%.

- German ZEW Economic Sentiment: Tuesday, 9:00. German economic sentiment plunged in May by 10.1 points, to 33.1, hitting the lowest level since January 2013. The Ukraine crisis was the probable cause for this fall starting effect economic activity, especially in the eastern part of the country. Economists expected a 2.2 points fall to 41.3 in May. A rise to 35.2 points is expected now. The all-European figure is also expected to advance to 59.6 points.

- US Building Permits: Tuesday, 12:30. U.S. building permits soared in April to their highest level in nearly six years, reaching 1.08 million-unit pace. The sharp rise offered hope that the recent sluggishness in the housing market may be over. The 90,000 rise surprised analysts expecting a 1.01 million-unit pace. A similar level of 1.07 million is estimated now. Housing starts carry expectations of dropping from 1.07 to 1.04 million.

- US inflation data: Tuesday, 12:30. U.S. Consumer Price Index increased 0.3% in April after posting a 0.2% gain in March, as food prices edged up for a fourth consecutive month and the cost of gasoline climbed. The reading was consistent with analysts’ forecast. In the 12 months through April, CPI gained 2.0% after a 1.5% rise in March, the biggest increase since July last year. Meanwhile, core inflation, excluding food and energy prices, rose 0.2% above predictions of a 0.1% rise and following a 0.2% rate in the previous month. US inflation remains in Goldilocks territory. Both CPI and Core CPI are expected to rise 0.2% m/m.

- UK MPC Meeting Minutes: Wednesday, 8:30. After Carney lifted the pound with his rate hike comment, it will be very interesting to see if one or more members already voted for a rate hike in June’s no-change decision. Up to now, Carney enjoyed unanimous support behind his policy, and that is what is expected now. A non-unanimous vote could push the pound even higher.

- US rate decision: Wednesday, 18:00, press conference at 18:30. The Fed is expected to taper bond buys for the 5th time, to $35 billion / month. Recent data from the US has been positive and showed growth in jobs as well as in other sectors after the terrible first quarter. Markets will likely focus on the fresh economic projections, especially those concerning the potential date of a rate hike. The previous decision was not accompanied by a press conference, and it passed quite quietly. This was not the case in March, when Yellen said that a rate hike could come within 6 months of the end of QE and stirred markets. Was it a slip in her first appearance or did she sow the initial seed for a rate hike in early 2015? Every word she says now will be scrutinized and could cause a significant market stir. Given the recent improvement, we can expect a more hawkish approach. If the hints are subtle, a full response to the FOMC statement and the press conference can only be expected in the following sessions. Contrary to April’s decision, this one could have a long lasting impact on markets.

- NZ GDP: Wednesday, 22:45. Economic growth in New Zealand continued to grow in the last quarter of 2013, rising 0.9% from a 1.2% expansion in the third quarter. Analysts expected a higher rise of 1.0% in the 4th quarter. Manufacturing and wholesale trade were the main contributors to the rise in output. On an annualized rate, GDP expanded 3.1% in the December quarter, in line with forecasts. A growth rate of 1.2% is expected now.

- Switzerland rate decision: Thursday, 7:30. The Swiss National Bank kept rates unchanged at 0.25% but was more optimistic on future growth prospects. The bank reiterated its commitment to defend the 1.20 per euro limit with unlimited interventions and stood ready to take further measures if necessary. The SNB said economic activity in Switzerland should improve from the first quarter of 2014 confirming a 2.0% growth this year.

- US Unemployment Claims: Thursday, 12:30. Recent trends in jobless claims have been positive, with a gradual convergence towards the 300K level. While the drops have never been steady, the US job market seems to be going in the right direction. A figure of under 300K will certainly be dollar positive, but after the recent rise to 317K, a similar value of 316K is predicted.

- US Philly Fed Manufacturing Index: Thursday, 14:00. US manufacturing barometer in the Philadelphia area declined less than expected in April, reaching 15.4 after rising to 16.6 points in March. The Philly Fed’s general conditions index reaching 15.4 in May was nearly as strong as April’s 16.6. This report, together with Empire State, reaffirms the strength of the US manufacturing sector. A small slide to 14.3 points is on the cards.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks