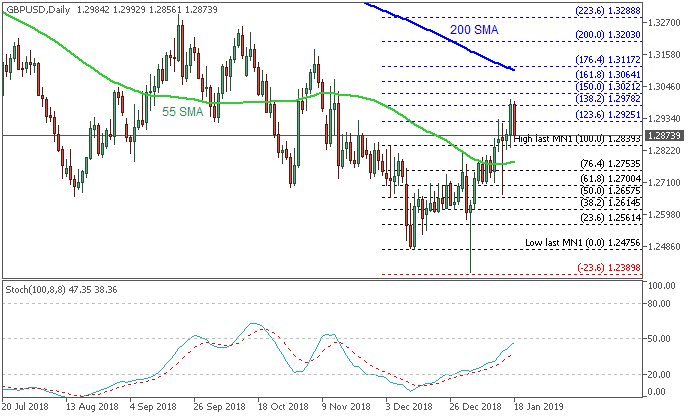

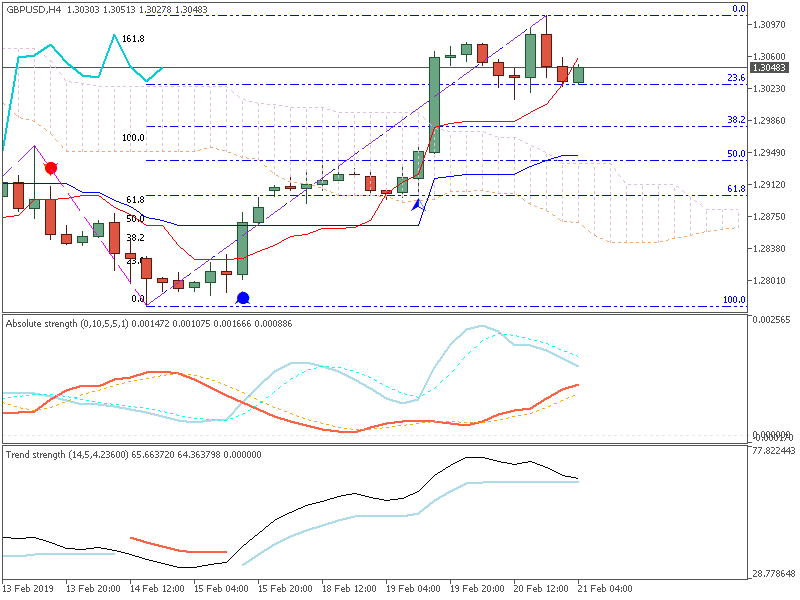

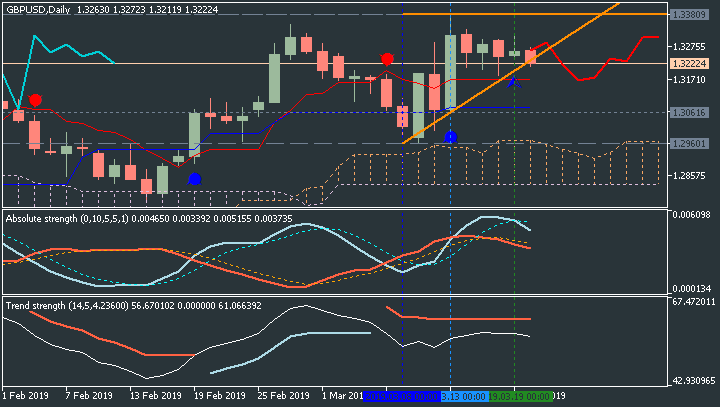

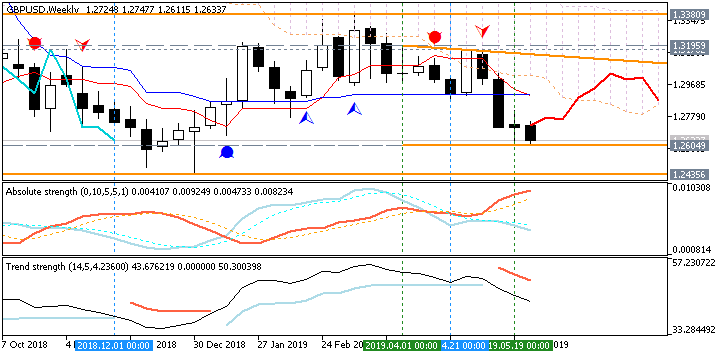

GBPUSD has enjoyed a strong run in 2019, picking itself up from a 1.2435 low to touch the 1.3000 level on an improving fundamental backdrop. This year’s mini-rally now sees GBPUSD touching the 200-day moving average and Cable has failed at its first attempt to break and close above here. Another attempt is expected shortly and if successful, the 38.2% Fibonacci retracement level at 1.3177 becomes the next target. This level also coincides with the November 7 high. If this level is closed above, the recent series of lower highs will be broken, adding an additional bullish nudge for the pair. GBPUSD have also made four higher lows in a row, so if 1.2832 – Thursday’s low - remains intact, the chart set-up for GBPUSD remains constructive.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks