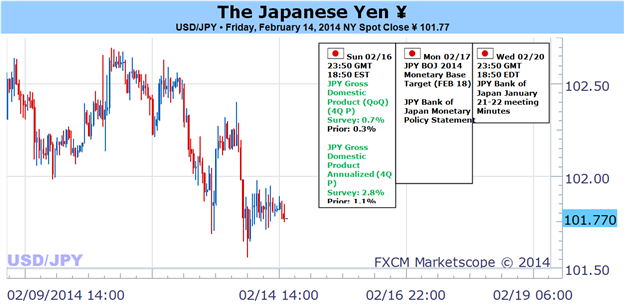

Japanese Yen to Swing from Quiet to Volatility on Risk, GDP and BoJ

Fundamental Forecast for Japanese Yen: Bullish

- Yen crosses and the Nikkei 225 have notably disconnected from the S&P 500 and Emerging Markets’ recovery

- The BoJ rate decision and Japan’s 4Q GDP release are key event risk to sustaining the yen-devaluation outlook

Given the incredible momentum behind the S&P 500 (as a risk gauge) and persistent tumble from the US Dollar (as a safe haven) this past week, we would assume that the Yen crosses would be hurtling higher on carry appetite. In reality, the FX market’s more ‘risk’ sensitive currency was virtually unmoved. The tepid progress from the exchange rates themselves matched volatility measures – both implied (expected) and realized. Does this lack of momentum reflect the quality of risk trends or is testament to a tempering of one of the market’s most impressive trades? Risk trends, 4Q Japanese GDP data and a BoJ rate decision this week will put this question to the test.

In the hierarchy of fundamental effectiveness; traditional measures such as growth, monetary policy, yield forecasting and other traditional pricing measures for currencies fall short of the more elemental ebb and flow of interest appetite (‘risk trends’). This is especially true for the Yen crosses. Though they may have retraced some of their gains, the pairs are still between 12 and 38 percent higher than where they were 18 months ago. We have not seen a recovery in carry, growth forecasts or volume to match this performance. Instead, we have seen investors take advantage of a period of low volatility and an effort at forcible yen devaluation push the crosses higher. Should that buoyancy vanish, this group will look exceptionally ‘overpriced’ and the fundamental reconciliation could be painful.

While a yen trader should always have their eye on risk trends, the theme will be particularly important over the coming week. Some benchmarks for sentiment have experienced an incredible surge this past week, but certain distortions are making for an uncertain outlook. Where the Emerging Markets have mounted an impressive recovery, the S&P 500 has returned to record high and volatility measures have deflated much of their recent swell in risk premiums; the fundamental backdrop hasn’t improved materially for investors. If the bound in ‘risk’ these past two week was simply a correction of the late January, market-wide stumble; it will come with natural limitations. Furthermore, it leaves the impression that these markets are prone to future bouts of deleveraging.

Even in the absence of a definitive tip in the greed-to-fear scale, the Yen is still looking at serious fundamental pressure in the week ahead. Just as important as the backdrop of a global yield grab to the currency has been the persistent belief that the Bank of Japan (BoJ) is committed to devaluing its currency. Whether the open-ended stimulus program can claim the effectiveness so many have attributed to it or not is irrelevant. It has inspired speculators to run the crosses alongside equities. That said, the impact of this program has been priced in well beyond the purchases made to this point. Considerable forward expectations for asset purchases and even an acceleration of the effort is no doubt reflected in the exchange rates we see now. What happens when reality falls short of expectations?

Mere months after the BoJ introduced its open-ended stimulus program back in April, it was the baseline assumption that the central bank would further upgrade its effort to reinforce its drive to end deflation and offset the ill-effects of a planned tax hike at the turn of the fiscal year (April). However, the verbal warnings and reassurances of more support have notably dropped off in recent months. Instead, we are seeing remarks of confidence that the economy is on its way to meeting its inflation target (2 percent by 2015) and concerns that wage growth is not keeping pace with inflation that is exacerbated by a falling currency.

Though this week’s BoJ meeting is not expected to result an actual change in monetary policy (if it did, the yen cross would be sharp), the market will be looking for telltale signs that the group is still supporting stimulus and the currency’s tumble. Furthermore, Monday morning’s 4Q GDP figure will calculate into officials’ and investors’ expectations for the need of more support. Things can get particularly dicey this week if risk trends take a turn for the worse and scheduled event risk doesn’t accommodate stimulus hopes.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks