Talking Points:

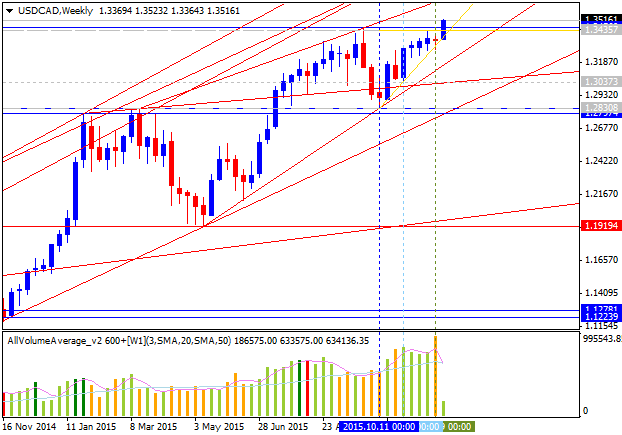

- USD/CAD Technical Strategy: Focus on Support at 1.2830

- Short-Term Resistance Sits near 1.3080-1.3150

- 38.2% Fibonacci Resistance Near1.31

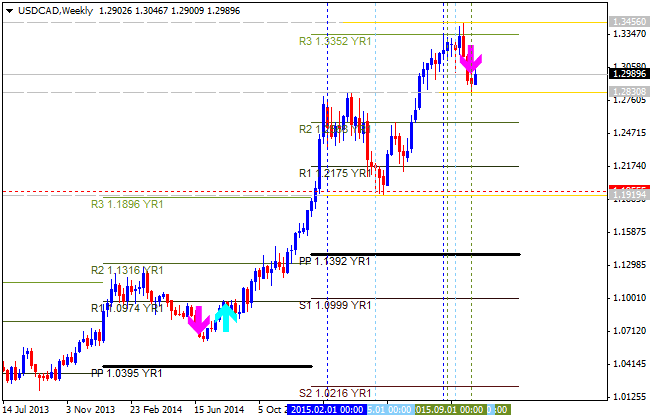

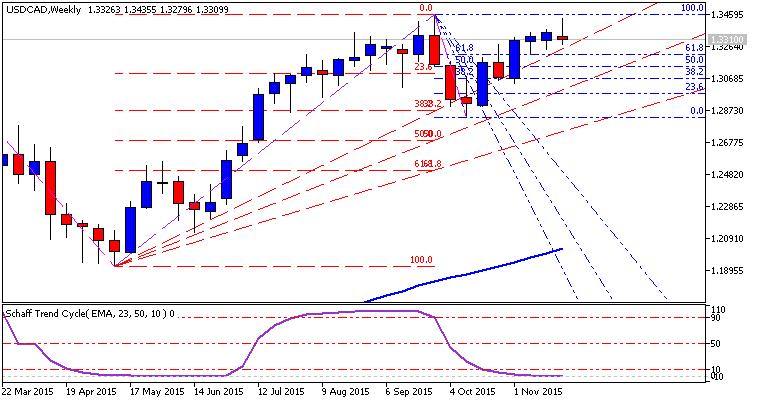

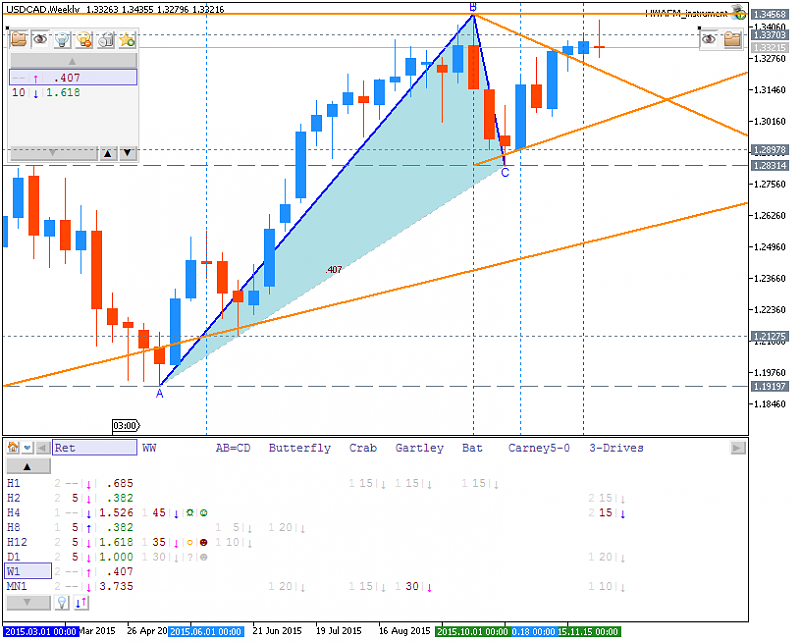

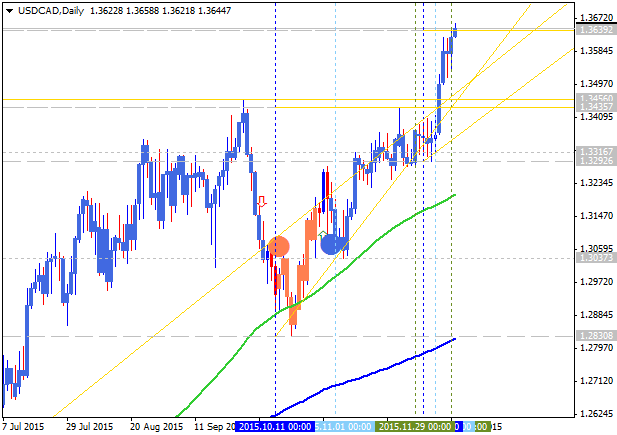

The Canadian Dollar broke out of its 4-month rising impulsive channel rather aggressively. This drop brought about a 600 pip decline from the late September high of 1.3457 to a current corrective low of 1.2833.

This is the lowest level since the Bank of Canada surprised markets with a rate cut and USDCAD went from ~1.21 to 1.3450 in short order. Since then, Oil has regained some footing and if you remove the 8-most volatile components of Canadian CPI, we’re over 2%. Additionally, we’ll have the Bank of Canada and PM elections that will likely spark volatility in the Loonie.

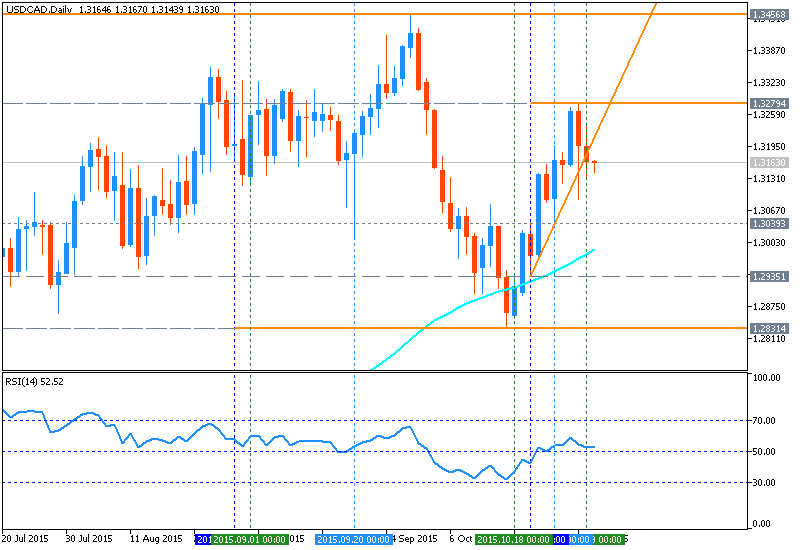

While we are moving higher off the recent 1.2832 low, resistance is near. Short-Term resistance is setting up around the 38.2% Fibonacci Resistance around 1.31 from the decline that started at 1.3457. Because price broke below 1.2950, the confidence of the longer-term uptrend is quickly waning. Price action around resistance will be imperative to grabbing the feel for this pair during this data heavy week.

Two complementary markets to USD/CAD is the WTI / US Oil and the US Dollar. A higher US Dollar favors a higher USD/CAD while higher US Oil favors lower USD/CAD. To get a feel for the next hundred pip move on USDCAD, looking to these markets would be helpful. First, if US DOLLAR holds recent Bearish Key Day Resistance of 11,970 and US Oil can hold support of $43 before moving higher, then the breakdown from the 4-month rising wedge is likely just getting underway. On the other hand, if Oil is about to take another leg lower, (not the author’s view) we could be setting up for another test of the 11-year high at 1.3457. T.Y.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks