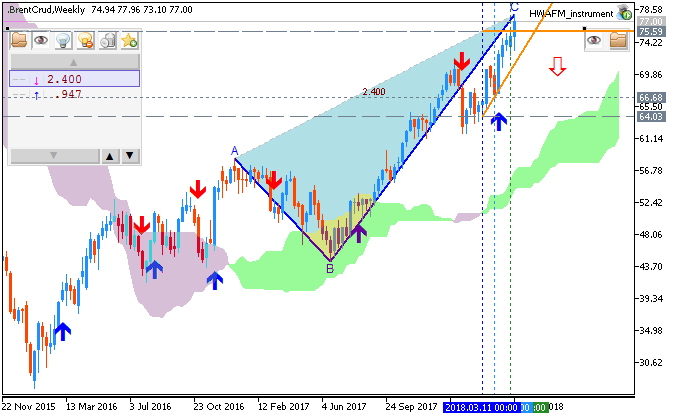

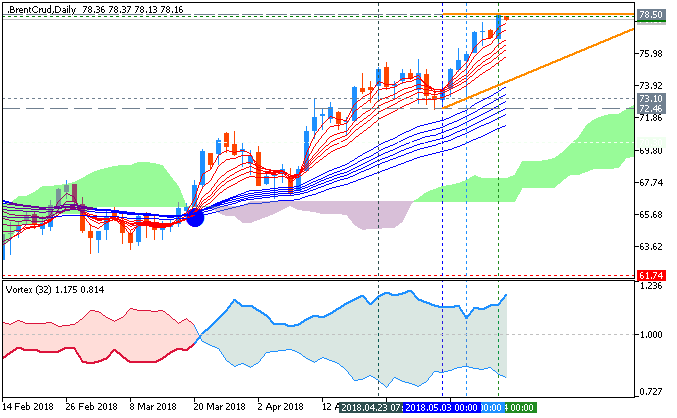

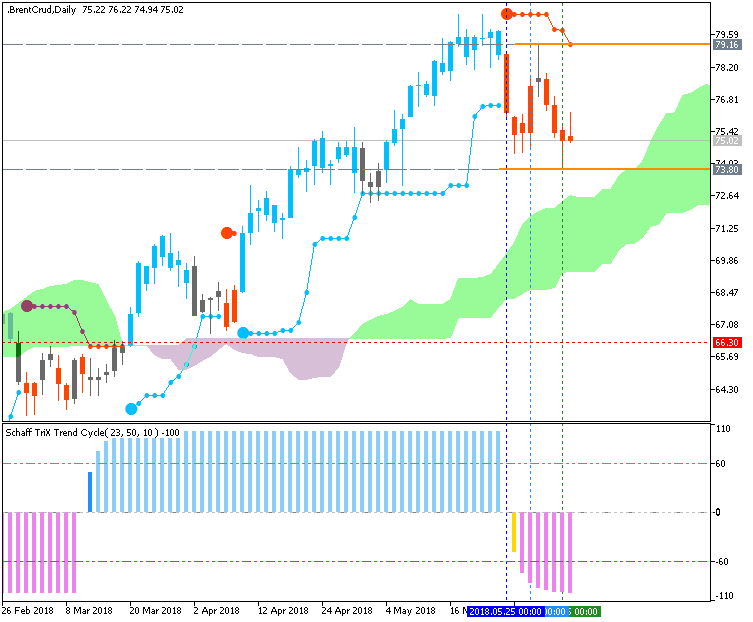

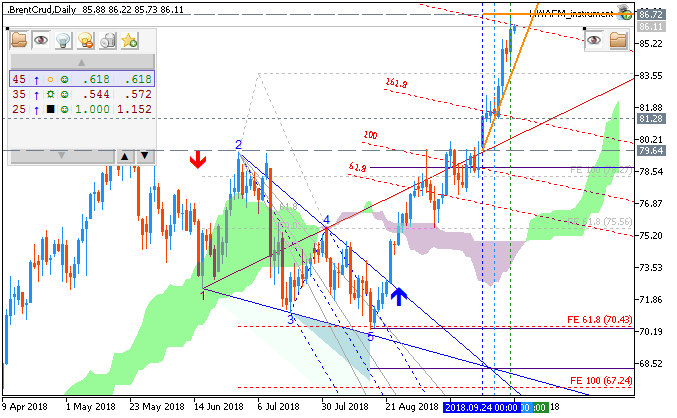

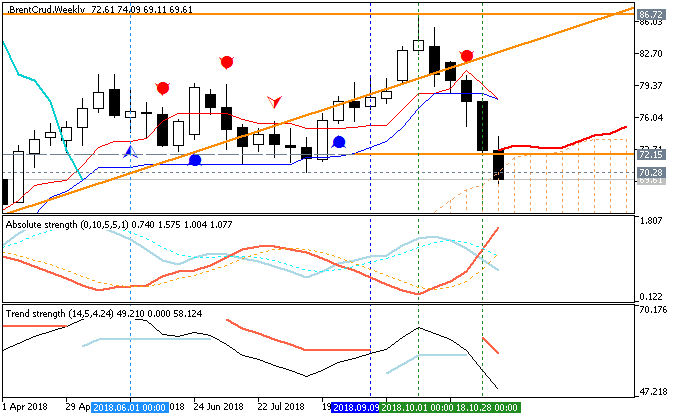

OPEC and the United States seem to be sending Bullish signals to the Crude Oil market. OPEC and Russia appear to be setting the stage to keep oil cuts going despite a vanishing glut that caused them to engage the production curbs in the first place. Second, shrinking US Oil stockpiles are showing a tighter physical market per the EIA report on Wednesday that puts pressure on physical buyers to buy now and hold as the benefits of carrying the physical exceed the costs as evidenced by backwardation.

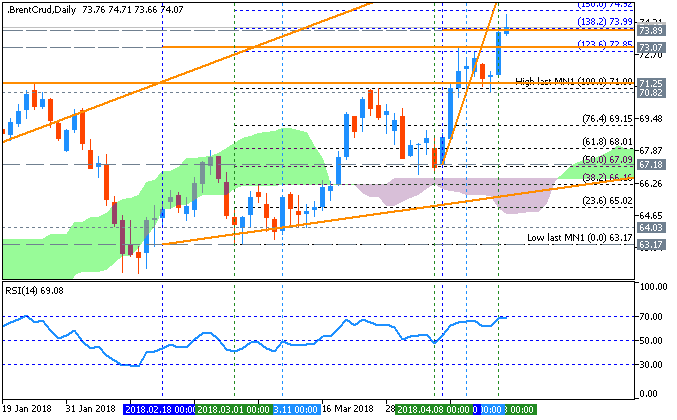

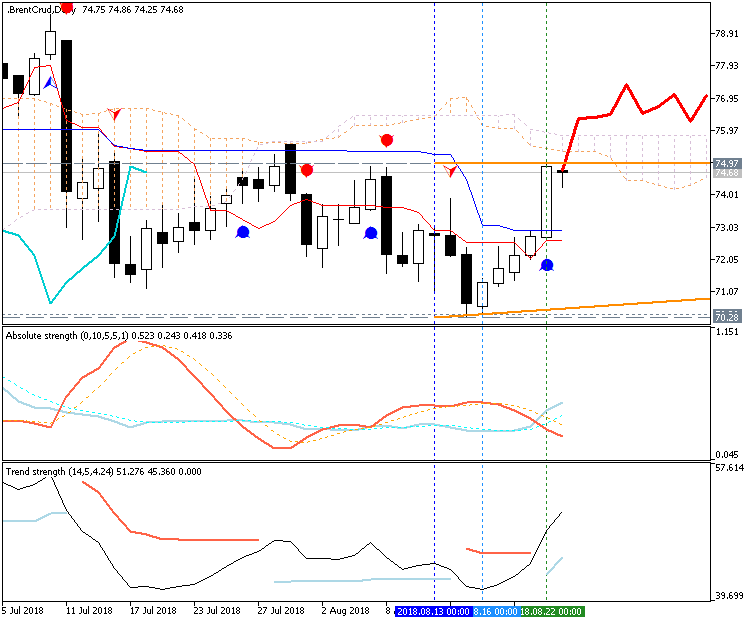

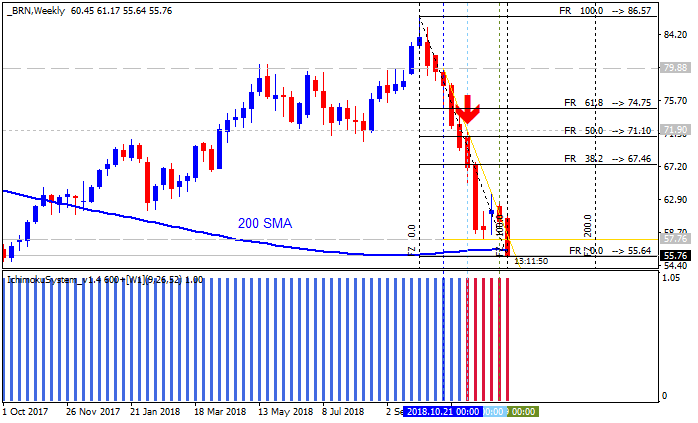

These developments have led to Crude futures surging nearly 3% in New York with the price pushing closer to the $70/bbl mark for WTI and $75/bbl on Brent for June settlement. For the former, there remains a confluence of technical resistance from Fibonacci levels near the $70/bbl mark that could be seen as a place for buyers to take profits should the fundamental data develop fault lines.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks