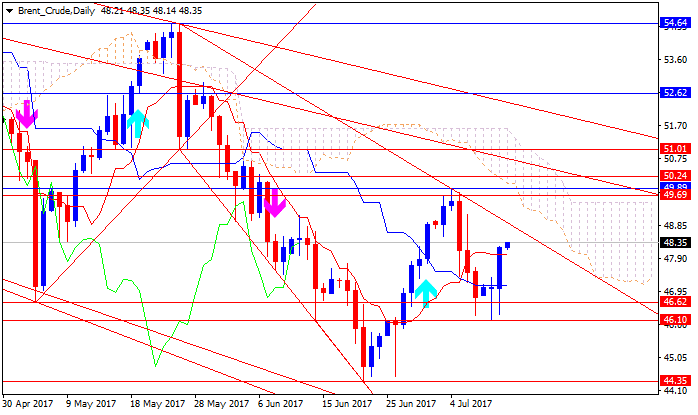

While OPEC may be winning in their battle to balance the global Oil market, it is not necessarily happening on the timeframe they would prefer. Naturally, it is not helpful that Shale production is at its highest levels since 2015. The U.S. Shale resurgence coupled with OPEC’s supply management continues to provide hope for Oil bulls. While Crude dropped ~3% on Wednesday, there is also likely to be volatility on expiration-position squaring is occurring as May WTI contract expires Thursday.

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks