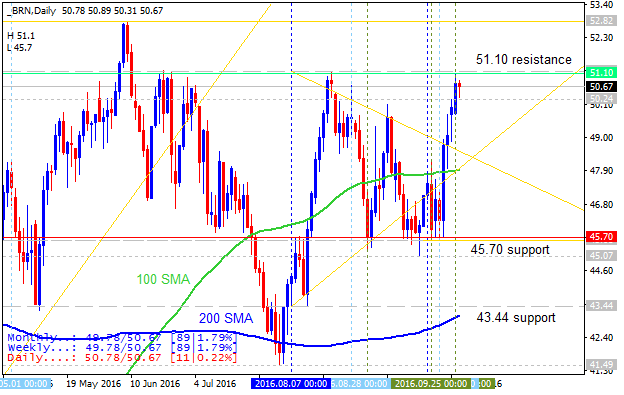

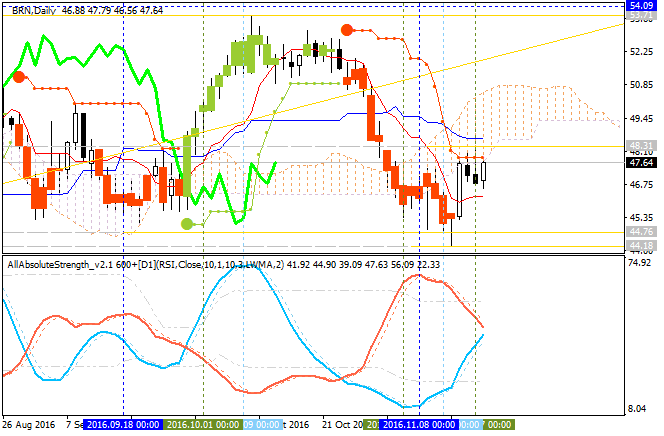

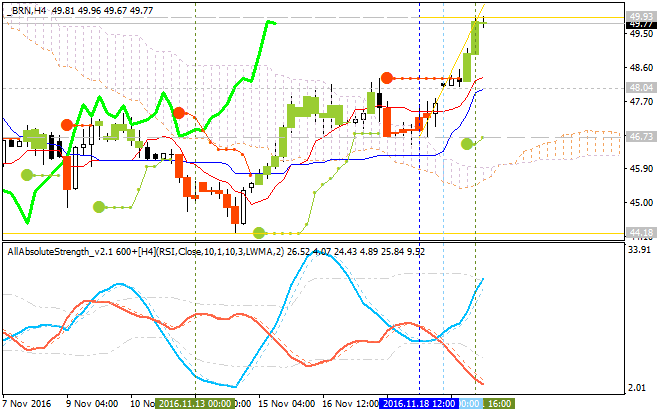

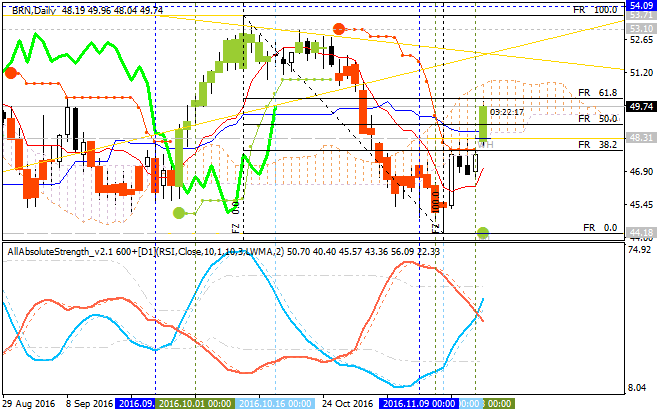

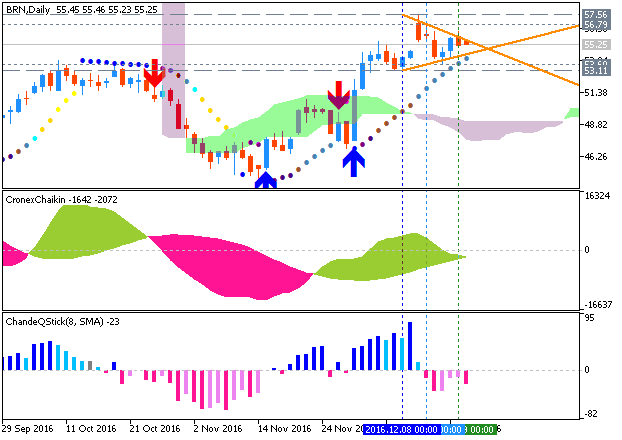

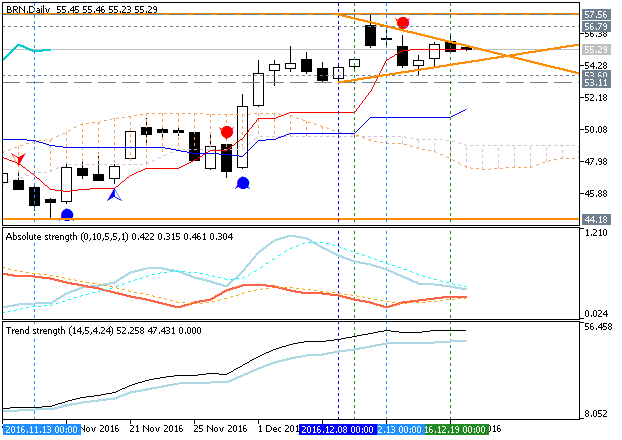

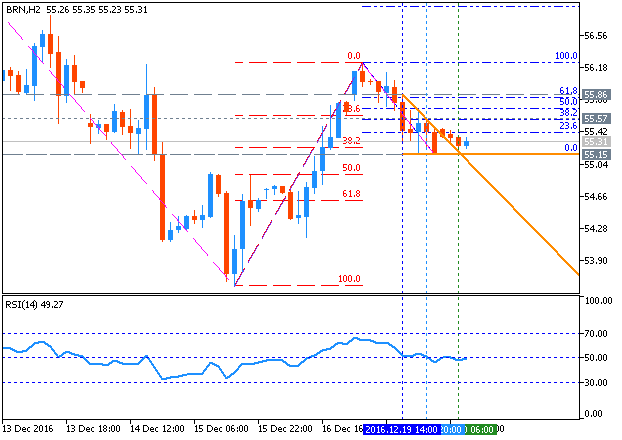

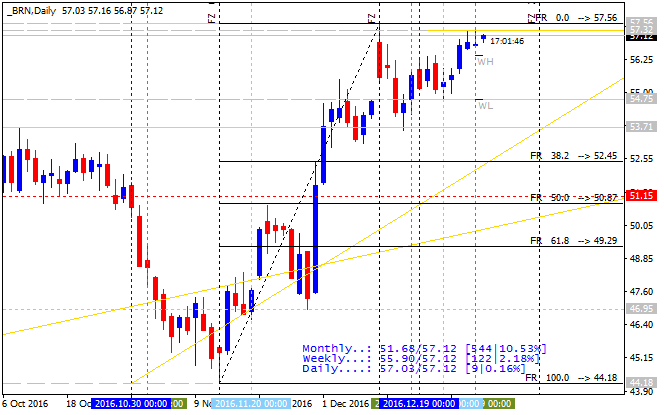

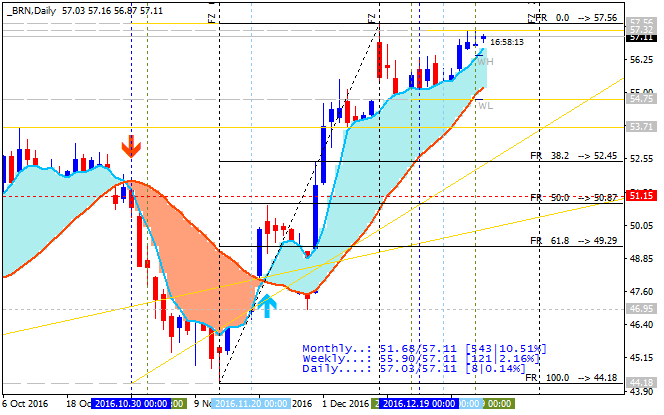

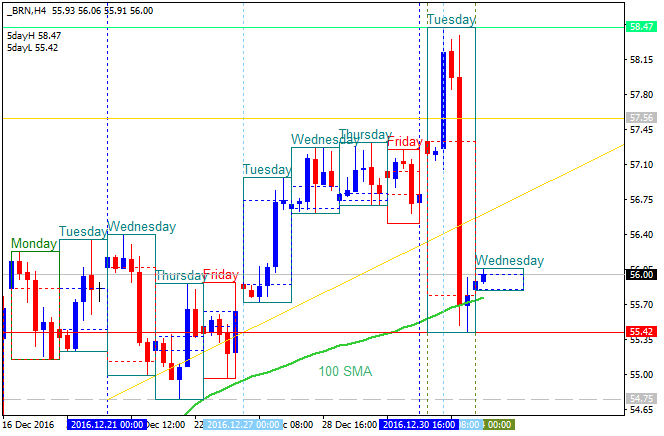

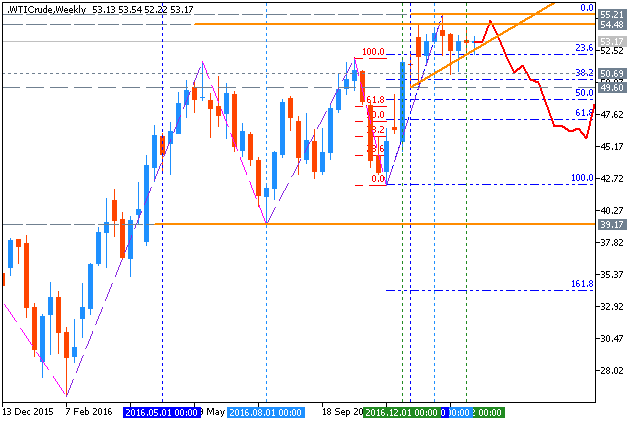

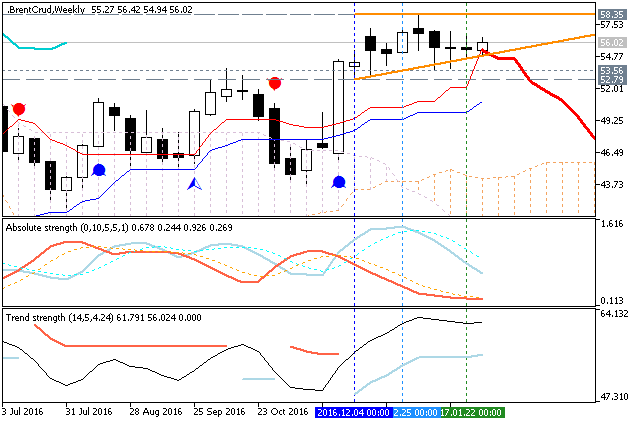

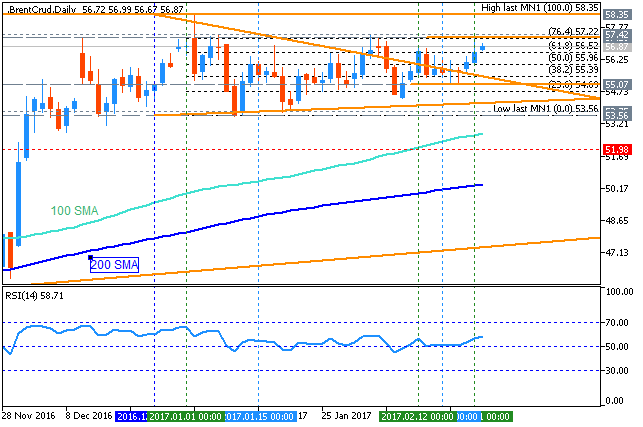

Oil Bulls continue to be rewarded by an OPEC Accord to curb production as the price of spot WTI trades at the highest levels since July. While the recent rise has been impressive following the post-Brexit announcement move down to $39.17, what is more impressive is the potential longer-term chart set-up for a Bull Run to the upside.

There is still cause for concern by some who think a USD Bull Market is in the making once the Fed decides to raise short-term interest rates or due to weakness elsewhere. Such a strengthening of the US Dollar could naturally put pressure on the price of Oil. However, if the USD fails to mature into an uptrend, we could be setting up for a favorable environment for further upside in the price of Crude Oil.

Another development in institutional positioning is the largest increase in long positions in WTI since January. This bullish positioning is an aggressive reversal from the bearish sentiment that had not been seen since September 2015 in recent CoT readings. The bullish sentiment comes in the forms of straight long positions via futures as well as options contracts that increased 8.1%. Such bullish exposure could see the market favor further upside on the charts.

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks