Deutsche Bank - "The European flow picture remains very negative"

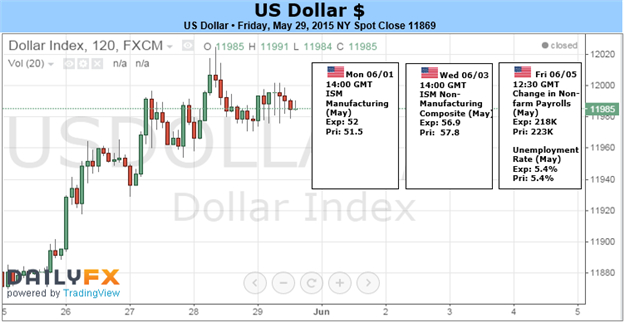

Cleaner positioning. "Equally, positioning metrics suggest that dollar longs have being pared back. A regression of currency manager index returns against the DXY now points to flat positioning, while the IMM shows a greater than 50% paring back in dollar longs," Deutsche Bank notes.

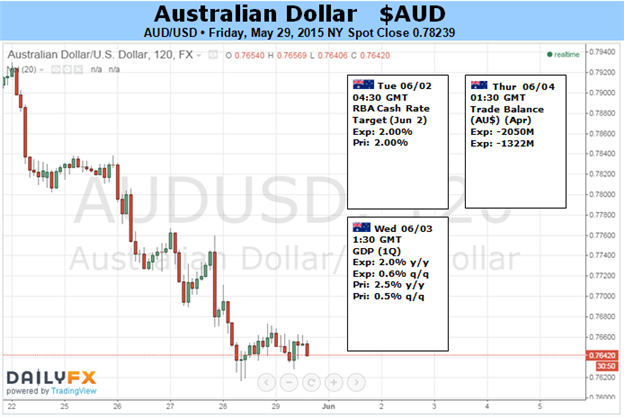

All about the Fed. "History has been all about the ECB, but the dominant driver of FX is now likely to be the Fed. On that front, monetary policy could come back in focus sooner than many expect," Deutsche Bank argues.

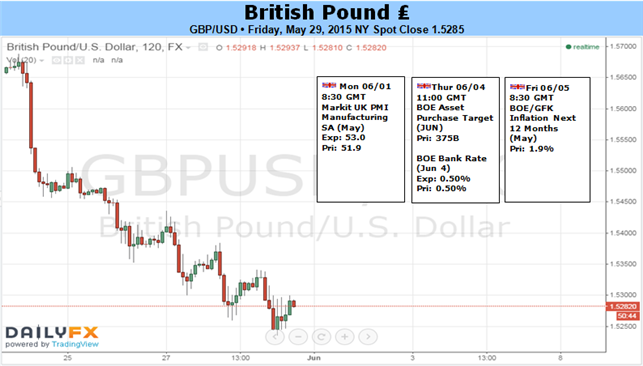

Euro still a good short. "While market focus is very likely to shift to the other side of the Atlantic, EUR/USD is still a good vehicle to express dollar longs. To start with, the euro is a consistent underperformer around Fed turning points," DB advises.

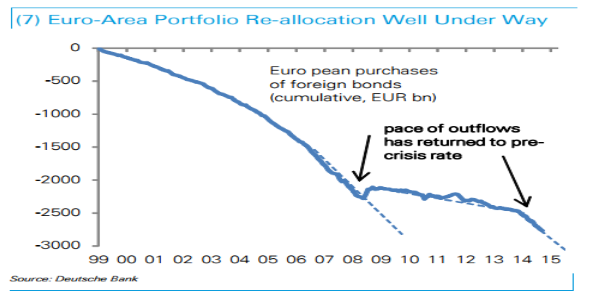

Negative euro flows. "Beyond that, the European flow picture remains very negative. The recent VaR shock in bund yields is likely to further discourage, rather than encourage fixed income inflows," Deutsche Bank adds.

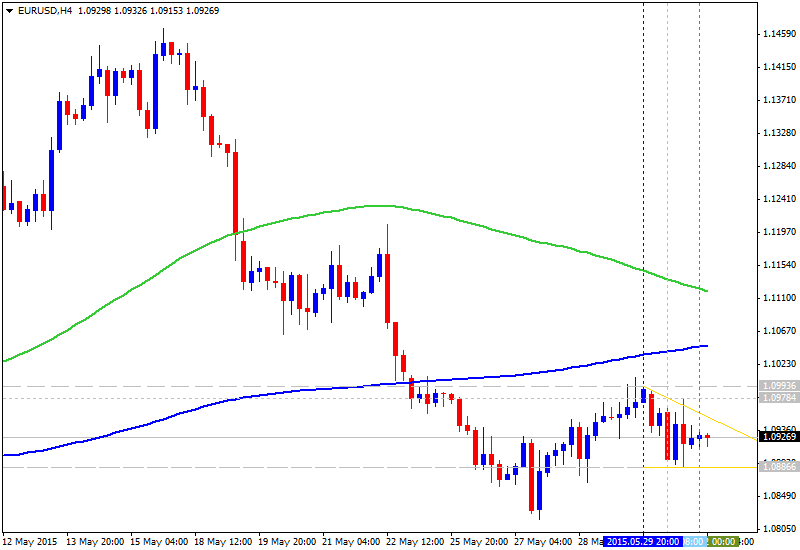

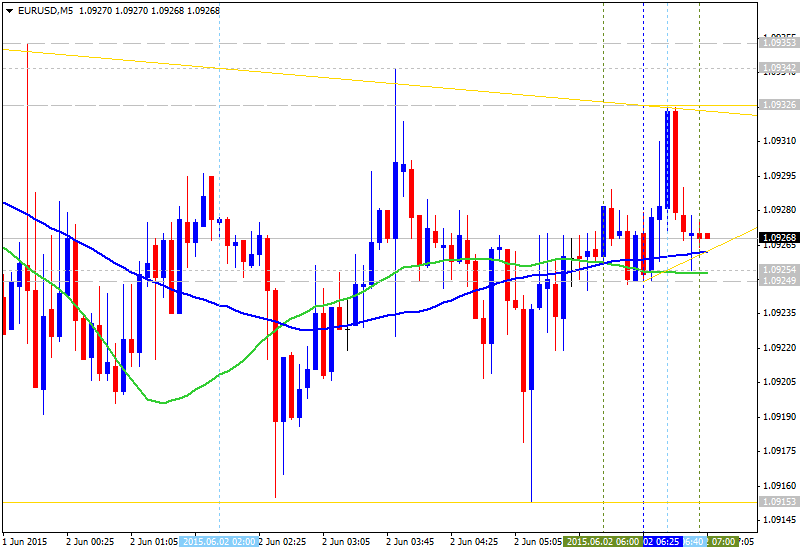

Target: "We continue to target a move down to 1.00 by the end of the year," Deutsche Bank says.

Conclusion. "The ingredients remain in place for a strong dollar trend this year. Given that focus is likely to shift to Fed tightening, rather than ECB easing, we like rotating positions away from the trade-weighted euro towards longs in the trade-weighted dollar. Still, EUR/USD should continue to be a primary casualty of broad dollar strength," Deutsche Bank concludes.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks