This might be one of the worst days in the history of cryptocurrency trading, where every top coin gave its investors a cold sweat. While the leading digital currency Bitcoin fell to the session’s lowest figures, altcoins like Litecoin, Dogecoin and Darkcoin also crashed by huge margins.

This is a clear case of panic sell, which might have originated from the Bitcoin’s poor performance in last two weeks. In our previous articles, we speculated low demands and higher supply and dumping rate to be one of the major reasons for the constant decline in Bitcoin value. Reports from other websites also provided multiple speculations in the name of increasing merchant adoptions, market manipulation by short-term traders, etc. But no one could actually predict Bitcoin to fall over 14% within the span of 24 hours.

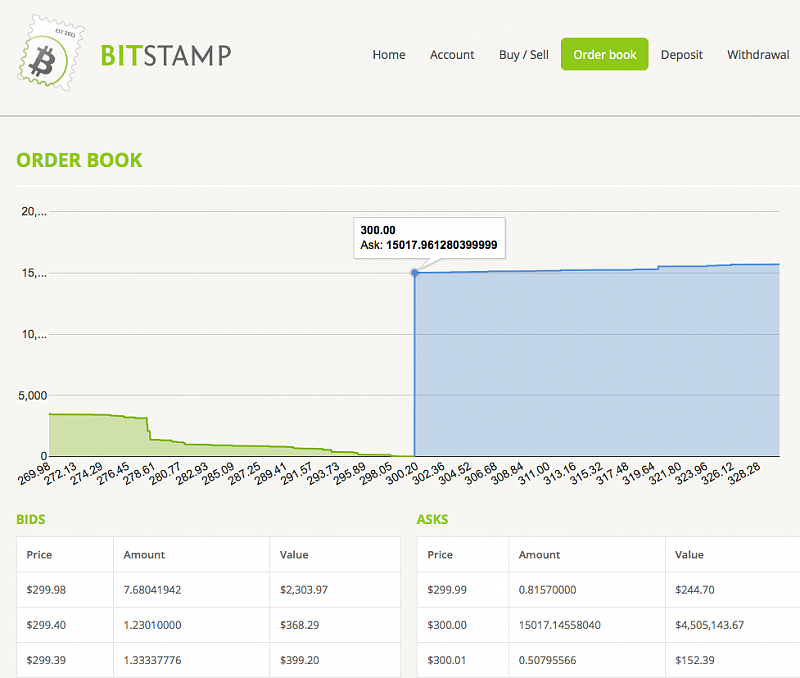

There is a huge chance that early adopters are giving up on the coin, and are selling it at low to recover whatever they can save, or make. A rumor is also coming to the wires, saying that one single investor has sold over 30,000 BTC on BitStamp, only at $300. More would be discussed later upon the conformation of the event.

But is it influencing the altcoins as well? Somewhere yes, as every topo cryptocurrency other than Bitcoin is also facing the speculations of a sell-off – be it Litecoin, which has fallen by 11% in US markets, Dogecoin by 13%, or NXT which has dipped by more than 12% in last 24 hours. Bear whale has struck the market indeed.

BTC/USD

The BTC/USD opened at 345 during the 10/4 trading session, from where it continued on its downtrend. There were however certain expectations that the pair will rebound upon reaching the 300-dollar wall. The slow decline was indicating the fear of small-term traders, leaving the market over the ongoing FUD. At one point of time though, the BTC/USD stepped upward, finding the first support level at 330. It however was short-lived, and started to fall back after touching the 338 mark. Once again there was a resistance-less decline, which ultimately brought the pair to the closing value of 316.

The real trouble surfaced during the 10/5 trading sessions when the Bitcoin’s value fell instantly within seconds, probably because of the aforementioned sell-off of 30,000 BTC. At this time, we cannot exactly predict whether the market will be bearish or bullish. But for long run, it might retrace its steps back once the buying pressure takes over the market.

Just in 14 hours the sell wall has shrunk by more than 50%.

Who’s Behind the Bitcoin Sell Wall?

More...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks