Price Pattern Technical Analysis: SPX 500 Exposed to Deeper Losses, Aiming Below 2000 Mark

by

, 01-06-2015 at 10:24 PM (1160 Views)

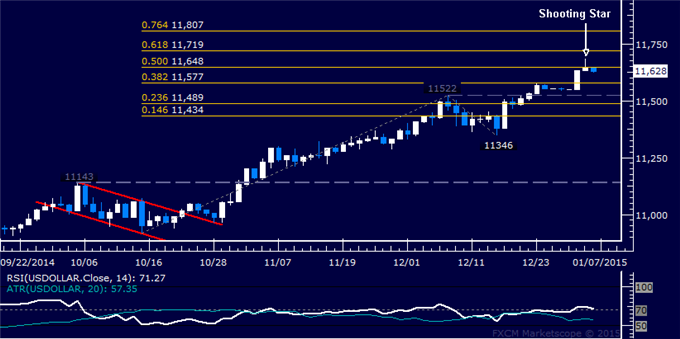

US DOLLAR TECHNICAL ANALYSIS – Prices may be readying to turn lower after prices put in a Shooting Star candlestick. Near-term support is at 11577, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis exposingthe 11489-522 area marked by the December 8 top and the 23.6% level. Alternatively, a turn above the 50% Fib at 11577 clears the way for a test of the 61.8% expansion at 11719.

S&P 500 TECHNICAL ANALYSIS – Prices declined as expected after producing a bearish Evening Star candlestick pattern. Sellers now aim to challenge the 38.2% Fibonacci retracement at 1988.00, with a break below that on a daily closing basis exposing the December 16 low at 1968.30 and the 50% level at 1955.80. Alternatively, a reversal back above the 23.6% Fib at 2028.00 aims for the 14.6% retracement at 2052.60.

GOLD TECHNICAL ANALYSIS – Prices continue to consolidate above the December 22 low at 1170.59. A break below that on a daily closing basis exposes the 38.2% Fibonacci expansion at 1156.00. Alternatively, a reversal above rising trend line support-turned-resistance at 1208.32 targets the December 9 high at 1238.13.

CRUDE OIL TECHNICAL ANALYSIS – Prices issued their largest daily decline in six weeks, with sellers now aiming to challenge the 50% Fibonacci expansion at 52.10. A break below that on a daily closing basis exposes the 61.8% level at 49.37. Alternatively, a turn above the 38.2% Fib at 54.83 targets the 23.6% expansion at 58.20.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

Email Blog Entry

Email Blog Entry