Price Pattern Technical Analysis: Gold Stalls After Breakdown, Crude Oil in Digestion Mode

by

, 12-24-2014 at 11:03 PM (1424 Views)

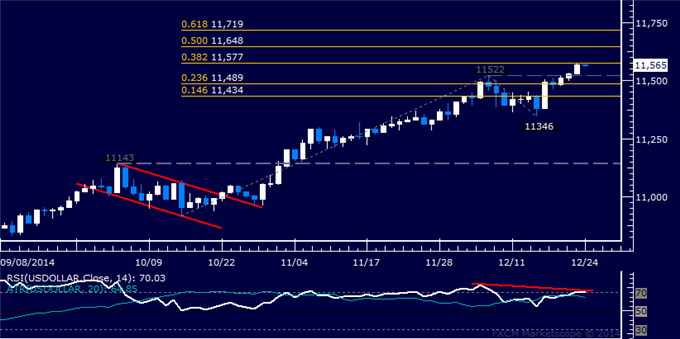

US DOLLAR TECHNICAL ANALYSIS – Prices pushed higher for a third consecutive day but negative RSI divergence casts doubt on follow-through. A daily close above the 38.2% Fibonacci expansionat 11577 exposes the 50% level at 11648. Alternatively, a reversal below the 11489-522 area marked by the December 8 top and the 23.6% Fib opens the door for a challenge of the 14.6% expansion at 11434.

S&P 500 TECHNICAL ANALYSIS – Prices edged above the December 5 high at 2079.60, exposing the 50% Fibonacci expansion at 2098.60. A daily close above this barrier exposes the 61.8% level at 2129.40. Negative RSI divergence warns of ebbing upside momentum and hints a turn lower may be looming. A turn back below 2079.60 sees initially support at 2067.90, the 38.2% Fib.

D

GOLD TECHNICAL ANALYSIS – Prices resumed downward momentum, with sellers now aiming to challenge the 38.2% Fibonacci expansion at 1156.00. A break below this boundary on a daily closing basis exposes the 50% level at 1130.64. Alternatively, a reversal above the 23.6% Fib at 1187.39 targets the 14.6% expansion at 1206.74.

CRUDE OIL TECHNICAL ANALYSIS – Prices are in consolidation mode above the $58.00/barrel figure. A break below the 23.6% Fibonacci expansion at 58.20 exposes the 38.2% level at 54.83. Alternatively, a bounce above the 23.6% Fib retracement at 63.94 targets the 38.2% threshold at 67.31.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

Email Blog Entry

Email Blog Entry