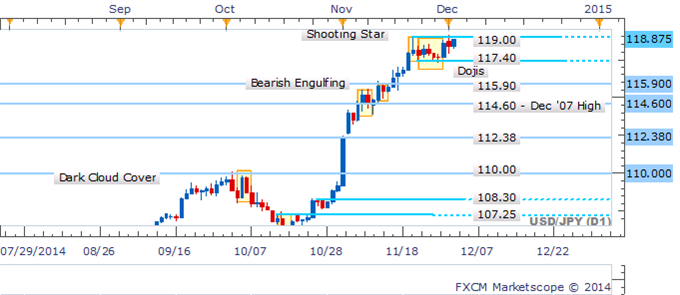

Pattern Technical Analysis for USDJPY: Dojis Indicated Reluctance From The Bears Near 117.40, Flat With Pending Long On Daily Close Above 119.00

by

, 12-03-2014 at 02:38 AM (1033 Views)

[/LIST]

USD/JPY has managed to regain some upward momentum after a string of Dojis suggested reluctance from the bears to lead the pair lower. With key reversal patterns lacking the prospect of a pullback is questionable. Amid a core uptrend a break of the nearby 119.00 ceiling may herald a push towards the next definitive resistance level at 119.80.

USD/JPY: Awaiting Breakout Amid Absence Of Bearish Signals

The four hour chart tells a similar story to the daily with an absence of key reversal signals near the 119.00 barrier. Yet the proximity of the pair to the key barrier suggests awaiting a breakout may offer a more attractive opportunity.

USD/JPY: Key Reversal Patterns Lacking Near 119.00 Barrier

By David de Ferranti, Currency Analyst, DailyFX

More...

Email Blog Entry

Email Blog Entry