Canadian Dollar Rate Forecast

by

, 05-11-2018 at 07:27 AM (922 Views)

A strong Candian Dollar is emerging on the back of elevated crude oil prices and a weakening US Dollar on a soft CPI print for April. Now, the focus will turn to the US/CA 2Yr yield differentials to see if the CAD can make up even more ground. The key risk to further CAD strength appears to be overconfidence on a successful outcome to NAFTA talks and potentially rich pricing in of a May rate hike.

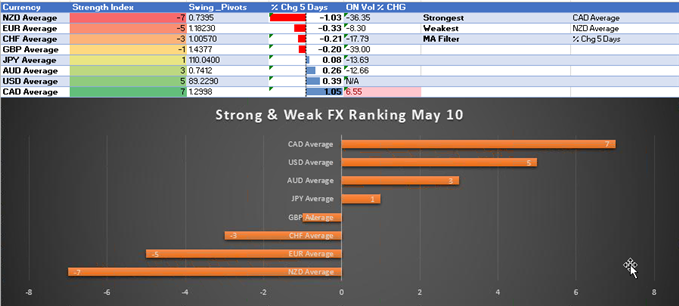

May 10 Strong/Weak G8 FX Dashboard

The strong/weak table above that I also share on FX closing bell helps to visualize where there is broad strength in the FX market. Currently, the strongest currency is the Canadian dollar based on an equally weighted 5-day % change with the US Dollar as a close second. The weakest currency after the RBNZ and their new Governor Orr provided a message of patience is the New Zealand Dollar.

Price had appeared wedged between clean support at C$1.2803 and resistance at C$1.29 per USD. However, a swift move higher to C$1.2999 that was reversed provides swing traders with a strong resistance point to build a CAD long bias from. However, the US Dollar remains strong, so if CAD strength persists, GBP/CAD or EUR/CAD may be better plays.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short (emphasis mine.)

more...

Email Blog Entry

Email Blog Entry