Technical Analkysis for EURUSD, USDJPY and S&P 500

by

, 08-21-2014 at 02:51 AM (1434 Views)

Talking Points

- EUR/USD touched multi-month low

- SPX nearing key resistance zone

- USD/JPY overcomes key pivot

Price & Time Analysis: EUR/USD

- EUR/USD has come under further pressure to touch its lowest level since late September

- Our near-term trend bias is lower in the euro while below 1.3430

- The 6th square root relationship of the yearís high at 1.3280 is a key pivot with a daily close below needed to confirm that a new leg lower is underway

- A cycle turn window is eyed on Thursday

- A move over 1.3430 would turn us positive on the euro

EUR/USD Strategy: We like holding only reduced short positions while below 1.3430.

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 EUR/USD 1.3240 *1.3280 1.3280 1.3335 *1.3340

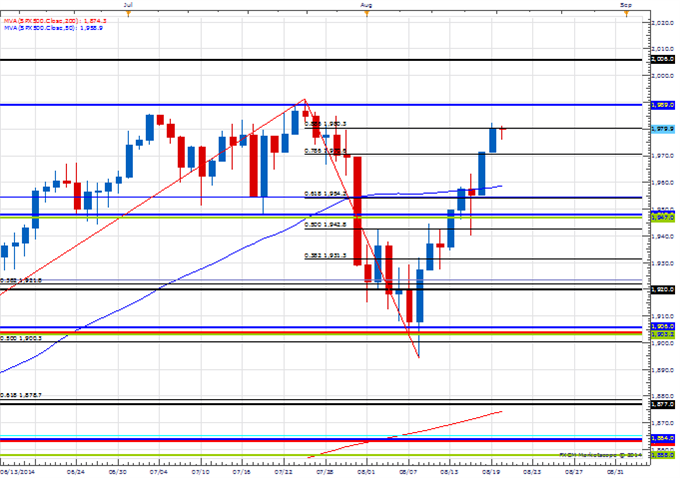

Price & Time Analysis: S&P 500

- S&P 500 has moved steadily higher since rebounding off the 2nd square root relationship of the all-time high near 1900

- Our near-term trend bias is negative on the index while under 1991

- A move under 1940 is really needed to instill any sort of downside momentum

- A cycle turn window is seen around the end of the month

- A daily close over 1991 will turn us positive again on the index

S&P 500 Strategy: Square

Instrument Support 2 Support 1 Spot Resistance 1 Resistance 2 S&P 500 *1940 1970 1978 1980 *1991

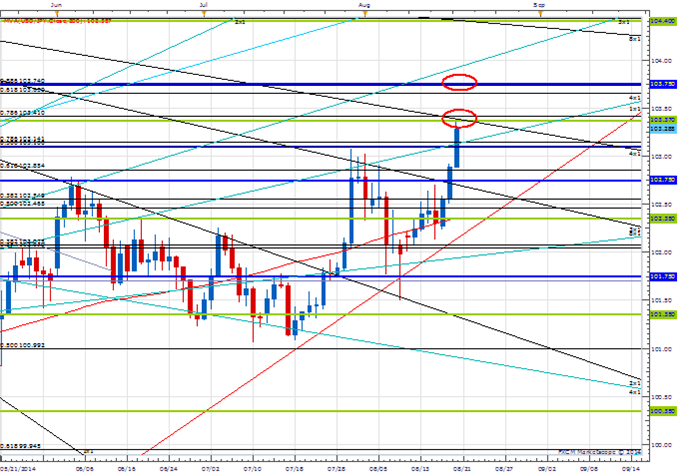

Focus Chart of the Day: USD/JPY

Our bullish view on USD/JPY is finally starting to pay off. On Tuesday the exchange rate managed to close above the 101.75/85 resistance zone which has proven rather sticky for quite some time. The real question though is this the start of a bona fide run higher or just another false start like in early April? Given the compression in the exchange rate since over the past four months we favor the former as we view a long consolidation like that much like a tightly coiled spring. When it releases it tends to do so explosively. How USD/JPY reacts near 103.40 and 103.90 over the next day or so should clue us in to which scenario is unfolding as an easy push through these important resistance levels would indicate a clear change in the marketís behavior and give us more confidence that a trend is indeed developing. Failure to easily breach these levels, on the other hand, could mark the top of a range.

More...

Email Blog Entry

Email Blog Entry