Date: 18th October 2023.

Market Update – October 18 – Data Fuels Higher-for-Longer Bets.

Trading Leveraged Products is risky

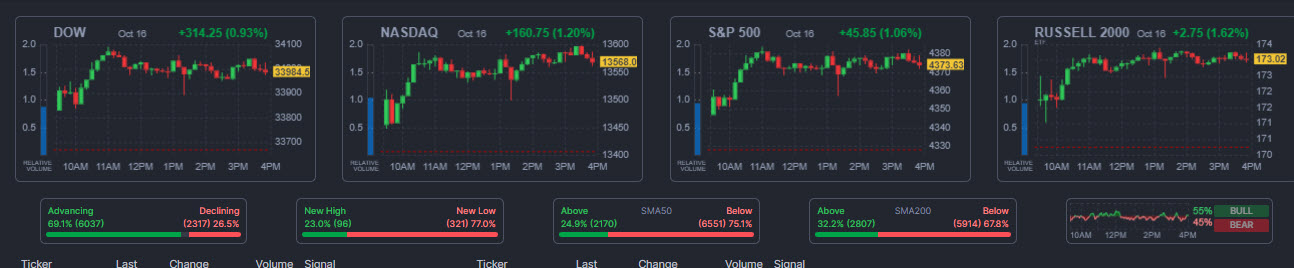

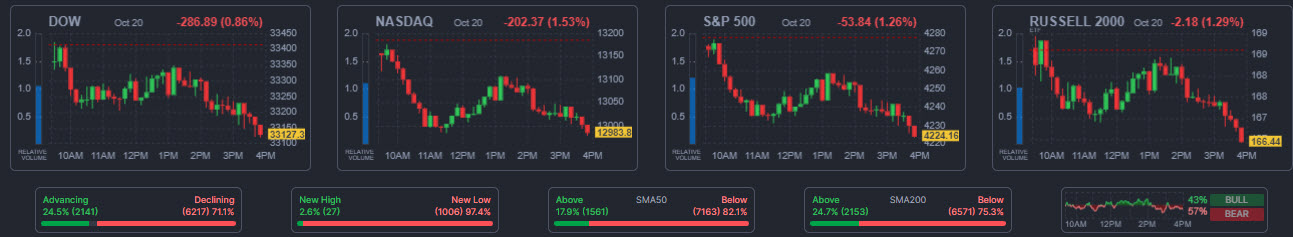

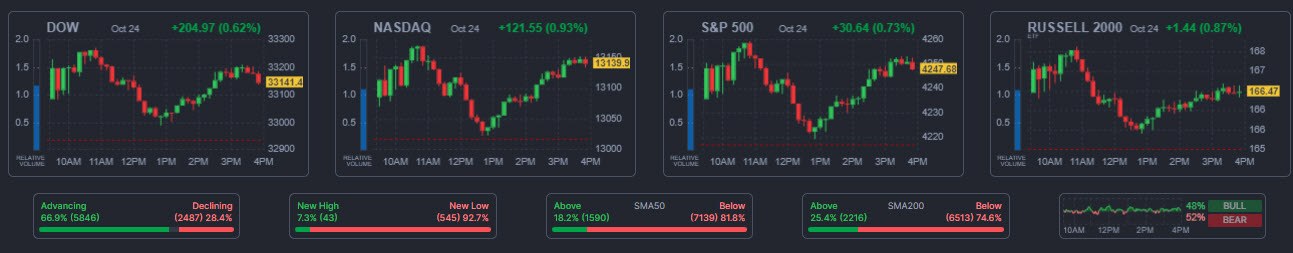

Asian equities followed US stocks lower after strong retail data. Treasury yields continued to shoot higher, reaching new cycle peaks. Data revived fear of an even higher Fed rate stance for an even longer period of time. Implied Fed funds futures climbed and priced in a 53% chance for a hike by the end of January. However, the market still shows only a small, less than 20% chance, for a move on November 1 since many policymakers have advocated a wait-and-see stance for now. China’s economy grew 4.9% in the third quarter. A largely positive report that confirms that China’s economy has bottomed out, even if the recovery may not be quite as strong as some had hoped.

UK inflation was higher than anticipated, against expectations for a slight deceleration in the annual rate. Core inflation decelerated to 6.1% y/y, the lowest rate since January, but still a tad higher than markets had expected.

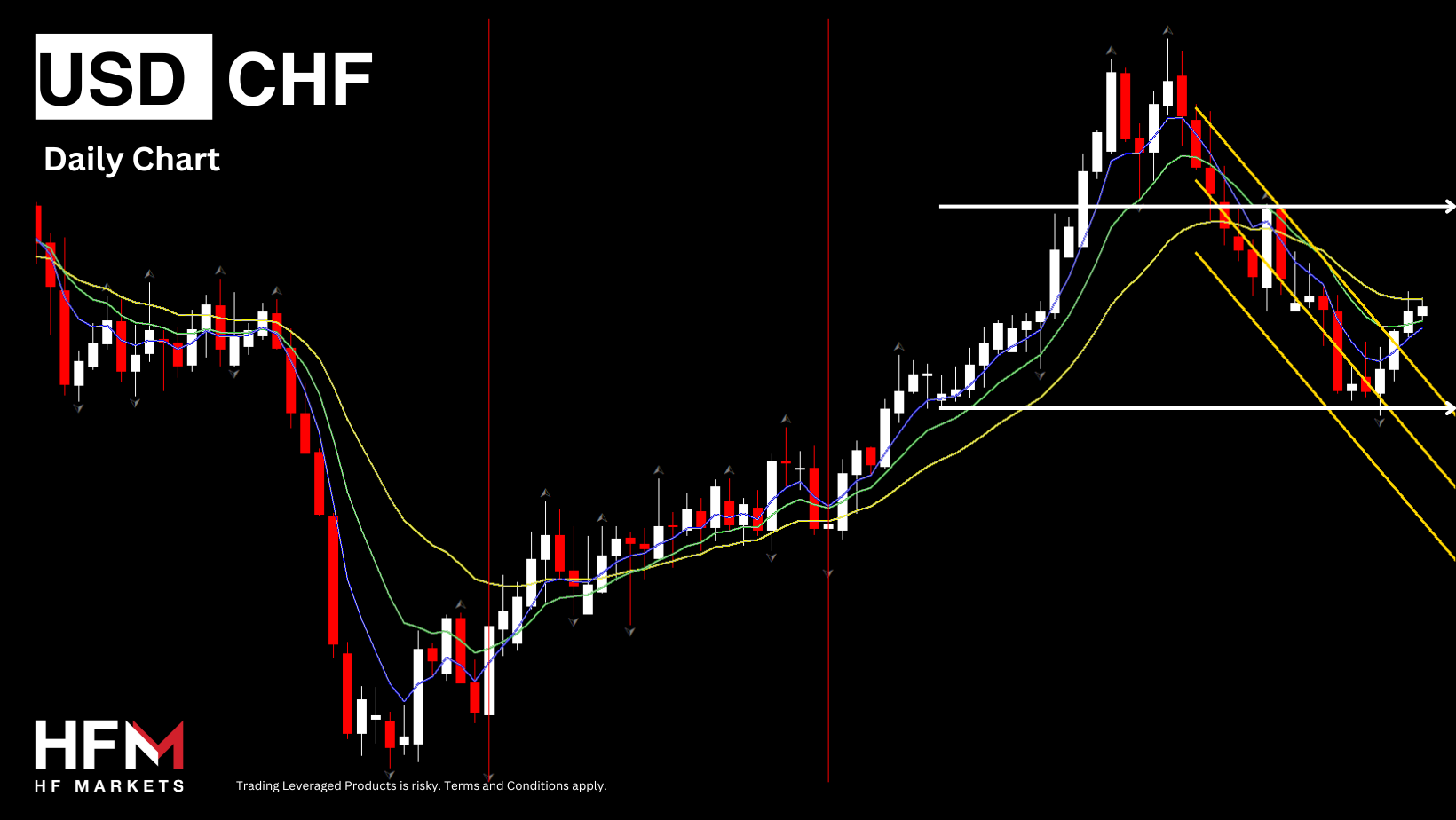

*USDIndex has nudged down to 105.75 from a session high of 106.32.

*Stocks: NVIDIA closed at -4.68%, as the US is restricting the sale of chips that Nvidia designed specifically for the Chinese market, part of sweeping new updates to export curbs. Asian semiconductor stocks declined.

*USOIL broke $87 on renewed concerns in Middle East conflict.

*Gold rises to 4-week high, at 1942.70, as Israel-Hamas conflict drives demand for safe-haven assets. Israel’s military has bombarded Gaza with air strikes in anticipation of a widely expected ground invasion against Hamas.

*Today: US Building Permits & FOMC Waller & Harker Speeches.

Interesting Mover: UK100 retests the neckline of a possible inverse head and shoulder formation, at 7715-7740. A breakout could turn attention to the 7800 area.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks