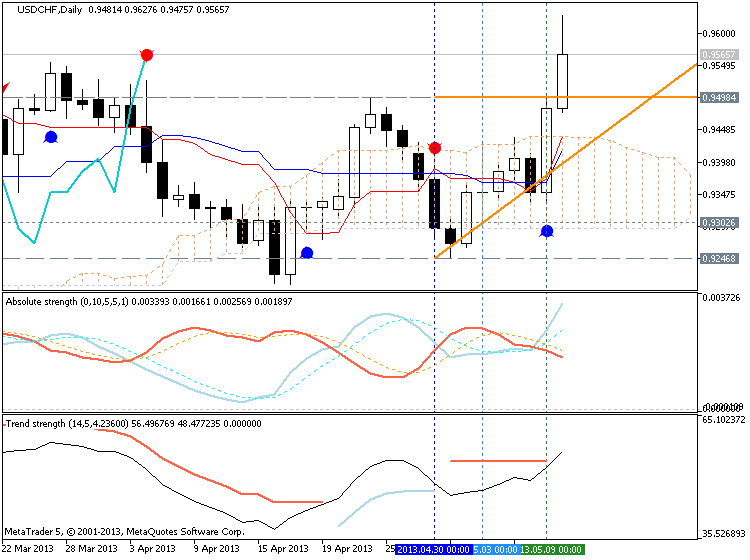

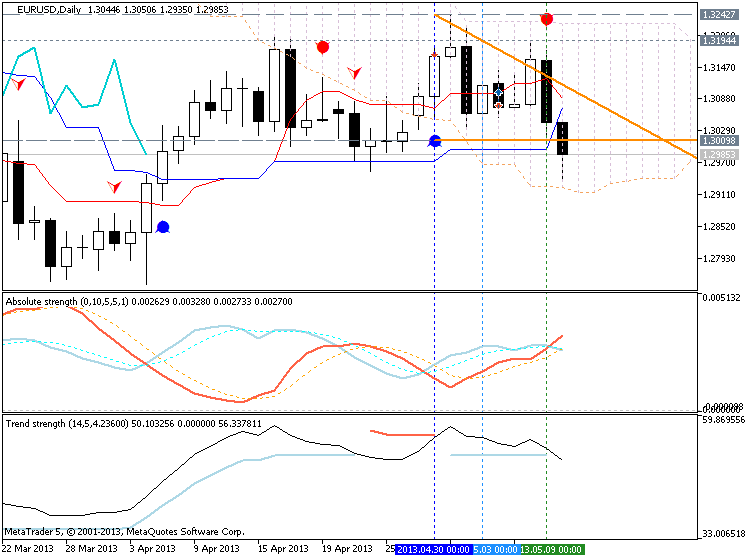

The other interesting situation is for USDCHF and EURUSD. We can see it here

this is USDCHF:

and it is EURUSD:

=============

So, as we see - it was breakout for USDCHF but still not yet for EURUSD. This pair (EURUSD) was crossed Sinkou Span B line and it is inside Ichimoku cloud trying to cross the other border of the cloud 9Sinkou Span A). So, USDCHF is already on primary bullish, EURUSD is on bearish (Sinkou Span B line is the "border" between bullish and bearish) but inside the cloud. It means: EURUSD is on ranging market condition.

But as USDCHF is leading pair with EURUSD/USDCHF combination (EURUSD is a little bit lagging with fast movement compare with USDCHF) - we can expect good breakdown for EURUSD for the next week.

5Likes

5Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks