Brent gains momentum: China and OPEC+ are changing the rules of the oil market

Brent crude prices are recovering after a decline, with quotes testing the 65.40 USD level. Discover more in our analysis for 7 October 2025.

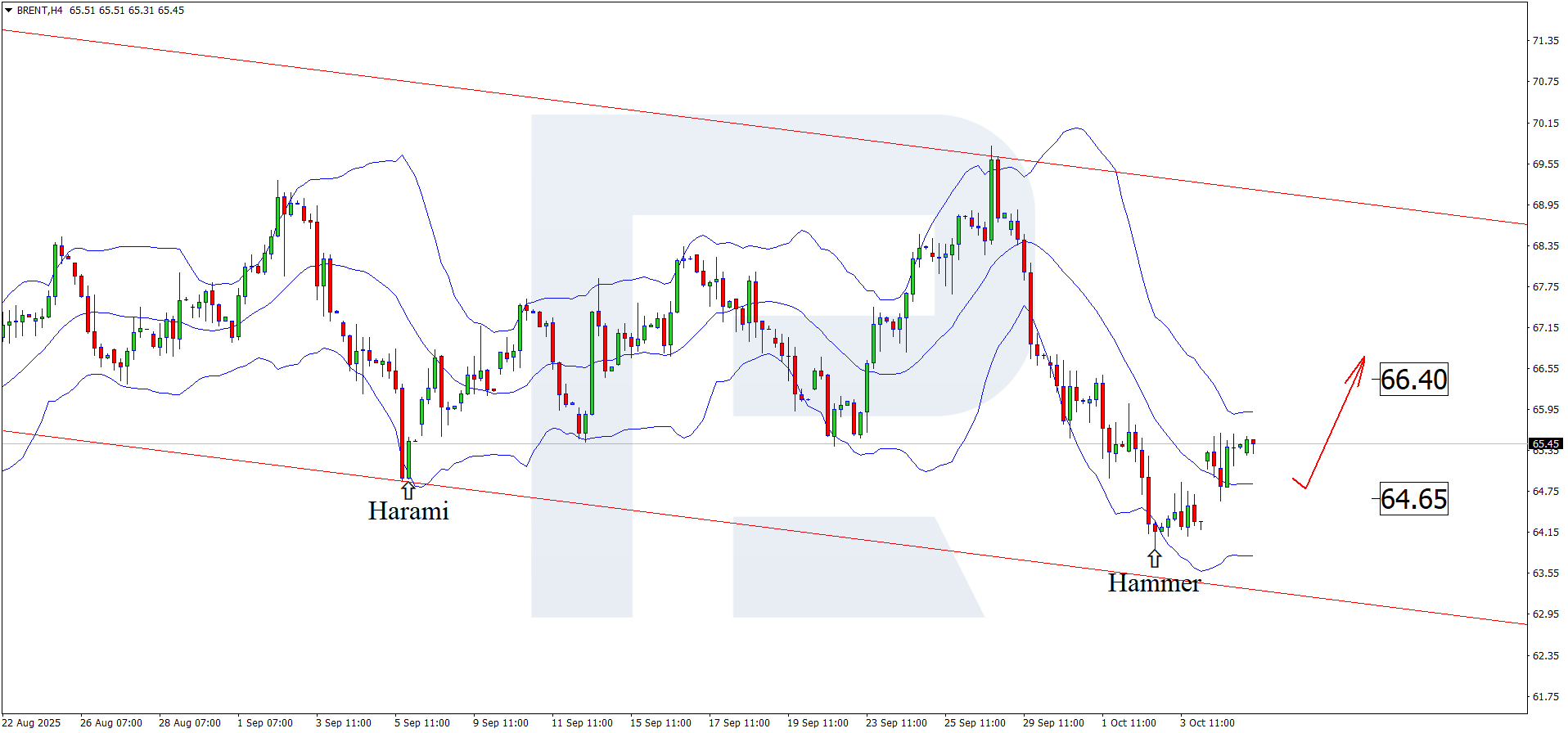

Brent technical analysis

Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. At this stage, the market is developing a growth wave following this signal.

Overall, Brent crude dynamics on 7 October 2025 remain moderately positive.

Read more - Brent Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks