Brent declines as US crude oil inventories rise

Brent prices dropped to around 64.00 USD following the release of US crude oil inventory data from the EIA. Discover more in our analysis for 22 May 2025.

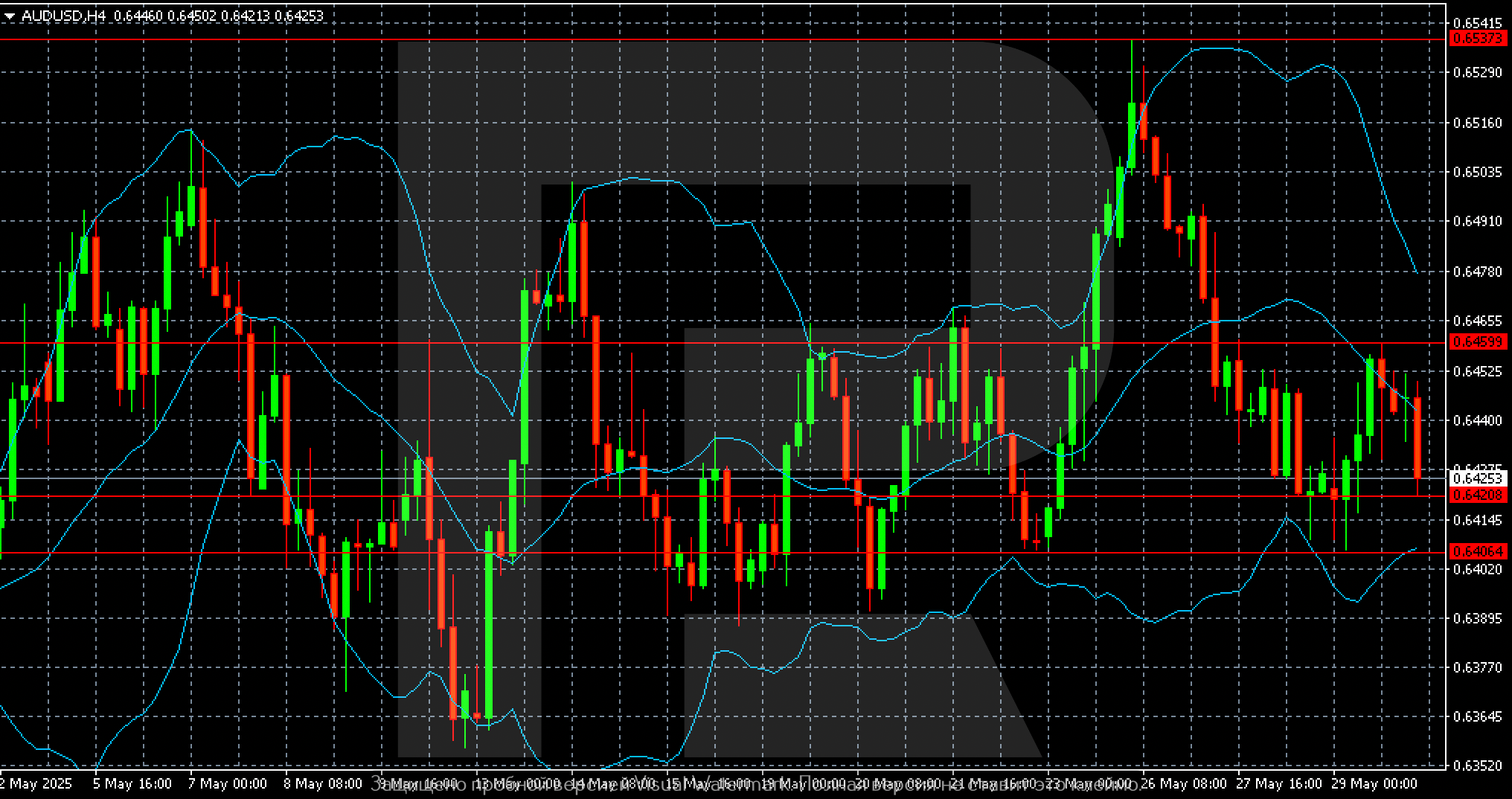

Brent technical analysis

On the H4 chart, Brent shows a downward correction following its recent rise. Prices are currently trading within a broad sideways range between 63.00 and 66.00 USD. The breakout direction from this range will determine the assetís next move.

Brent quotes are falling following the EIAís report of a 1.328 million barrel rise in US oil inventories.

Read more - Brent Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks